Question No 30 Chapter No 5

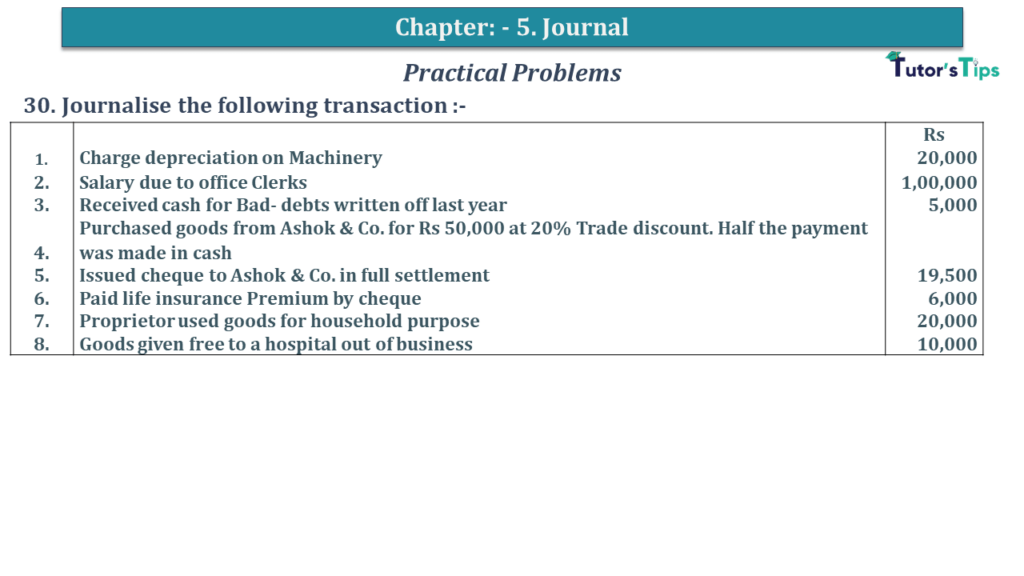

30. Journalise the following transaction:-

| Rs | ||

| 1 | Charge depreciation on Machinery | 20,000 |

| 2 | Salary due to office Clerks | 1,00,000 |

| 3 | Received cash for Bad- debts written off last year | 5,000 |

| 4 | Purchased goods from Ashok & Co. for Rs 50,000 at 20% Trade discount. Half the payment was made in cash | |

| 5 | Issued cheque to Ashok & Co. in full settlement | 19,500 |

| 6 | Paid life insurance Premium by cheque | 6,000 |

| 7 | Proprietor used goods for household purpose | 20,000 |

| 8 | Goods given free to a hospital out of business | 10,000 |

The solution of Question No 30 Chapter No 5: –

| In the Books of Radhika Traders |

|||||

| Date | Particulars |

L.F. | Debit | Credit | |

| 2019 | |||||

| 1 | Depreciation A/c | Dr. | 20,000 | ||

| To Machinery A/c | 20,000 | ||||

| (Being Depreciation charged on machinery) | |||||

| 2 | Salary A/c | Dr. | 1,00,000 | ||

| To Outstanding Salary A/c | 1,00,000 | ||||

| (Being Salary due to office clerks) | |||||

| 3 | Cash A/c | Dr. | 5,000 | ||

| To Bad Debts Recovered A/c | 5,000 | ||||

| (Being Bad debts recovered) | |||||

| 4 | Purchases A/c | Dr. | 40,000 | ||

| To Ashok & Co | 20,000 | ||||

| To Cash A/c | 20,000 | ||||

| (Being goods purchased) | |||||

| 5 | Ashok & Co. | Dr. | 20,000 | ||

| To Bank A/c | 19,500 | ||||

| To Discount Received A/c | 500 | ||||

| (Being Payment made to Ashok & Co. in full settlement) | |||||

| 6 | Drawings A/c | Dr. | 6,000 | ||

| To Cash A/c | 6,000 | ||||

| (Being Payment made for life insurance premium) | |||||

| 7 | Drawings A/c | Dr. | 20,000 | ||

| To Purchases A/c | 20,000 | ||||

| (Being Goods used for household purposes) | |||||

| 8. | Charity A/c | Dr. | 10,000 | ||

| To Purchases A/c | 10,000 | ||||

| (Being Goods given away as a charity) | |||||

https://tutorstips.com/journal-entries/

Thanks, Please Like and share with your friends

Advertisement

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

Chapter 1 Evolution of Accounting & Basic Accounting Terms

Chapter 2 Accounting Equations

Chapter 3 Meaning and Objectives of Accounting

Advertisement

Chapter 5 Books of Original Entry – Journal

Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

Chapter 7 Books of Original Entry – Cash Book (Coming soon)

Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

Chapter 9 Ledger (Coming soon)

Chapter 10 Trial Balance and Errors (Coming soon)

Advertisement

Chapter 11 Bank Reconciliation Statement (Coming soon)

Chapter 12 Depreciation (Coming soon)

Chapter 13 Bills of Exchange (Coming soon)

Chapter 14 Generally Accepted Accounting Principles(GAAP)

Chapter 15 Bases of Accounting

Advertisement

Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

Chapter 17 Capital and Revenue

Chapter 18 Provisions and Reserves

Advertisement

Chapter 19 Final Accounts (Coming soon)

Chapter 20 Final Accounts – With Adjustments (Coming soon)

Chapter 21 Errors and their Rectification (Coming soon)

Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

Chapter 24 Computerised Accounting System (Coming soon)

Chapter 25 Introduction to Accounting Information System (Coming soon)