Question No 30 Chapter No 11

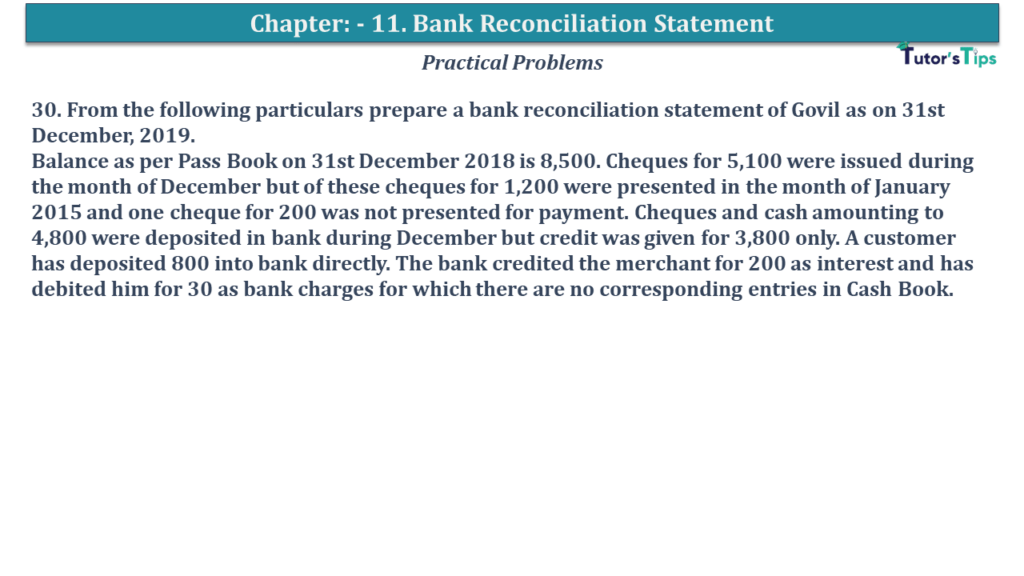

30. From the following particulars prepare a bank reconciliation statement of Govil as of 31st December 2019.

Balance as per Pass Book on 31st December 2018 is 8,500. Cheques for 5,100 were issued during the month of December but of these cheques for 1,200 were presented in the month of January 2015 and one cheque for 200 was not presented for payment. Cheques and cash amounting to 4,800 were deposited in the bank during December but credit was given for 3,800 only. A customer has deposited 800 into the bank directly. The bank credited the merchant for 200 as interest and has debited him for 30 as bank charges for which there are no corresponding entries in Cash Book.

The solution of Question No 30 Chapter No 11: –

| Bank Reconciliation Statement |

||

| Particular | Plus Items (Rs) |

Minus Items(Rs) |

| Credit Balance as per Pass Book | 8,500 | |

| Add: Cheque deposited but not credited (4,800 – 3,800) | 1,000 | |

| Bank charges | 30 | |

| Less: Cheque issued but not presented (1,200 + 200) | 1,400 | |

| Amount directly deposited by customer | 800 | |

| Interest allowed by bank | 200 | |

| Debit Balance as per Pass Book | 7,130 | |

| 9,530 | 9,530 | |

https://tutorstips.com/bank-reconciliation-statement/

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

Advertisement

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.