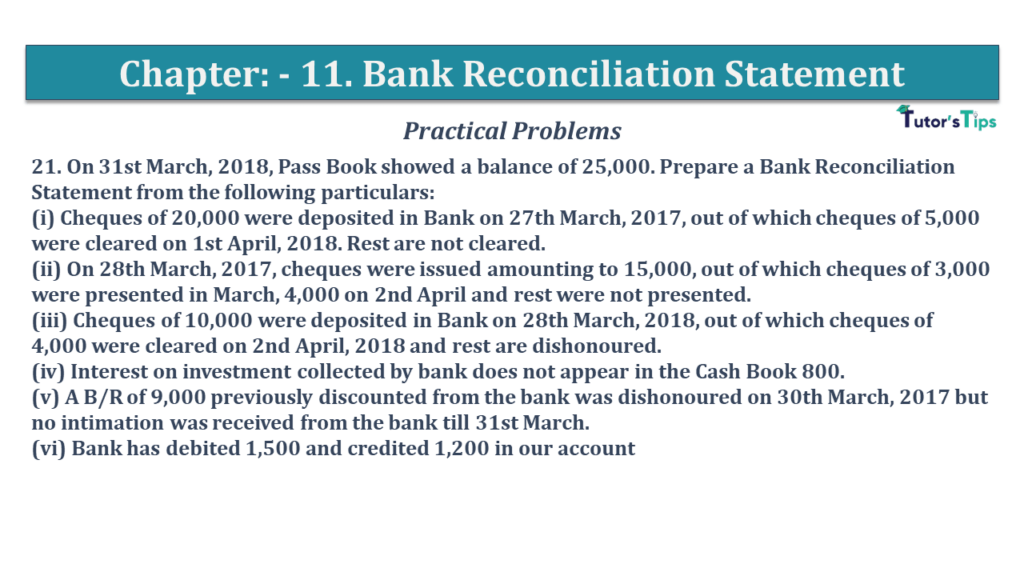

Question No 21 Chapter No 11

21. On 31st March 2018, Pass Book showed a balance of 25,000. Prepare a Bank Reconciliation Statement from the following particulars:

(i) Cheques of 20,000 were deposited in Bank on 27th March 2017, out of which cheques of 5,000 were cleared on 1st April 2018. Rest are not cleared.

(ii) On 28th March 2017, cheques were issued amounting to 15,000, out of which cheques of 3,000 were presented in March, 4,000 on 2nd April, and the rest were not presented.

(iii) Cheques of 10,000 were deposited in Bank on 28th March 2018, out of which cheques of 4,000 were cleared on 2nd April 2018, and the rest are dishonored.

(iv) Interest on investment collected by the bank does not appear in the Cash Book 800.

(v) A B/R of 9,000 previously discounted from the bank was dishonoured on 30th March 2017 but no intimation was received from the bank till 31st March.

(vi) Bank has debited 1,500 and credited 1,200 in our account

The solution of Question No 21 Chapter No 11: –

| Bank Reconciliation Statement |

||

| Particular | Plus Items (Rs) |

Minus Items (Rs) |

| Credit Balance as per Pass Book | 22,000 | |

| Add: (i) Cheque deposited into Bank but not credited | 20,000 | |

| (iii) Cheque deposited but not collected by Bank | 10,000 | |

| (v) Bills Receivable discounted with bank dishonoured | 9,000 | |

| (vi) Bank debited our account | 1,500 | |

| Less: (ii) Cheque issued but not presented for payment (15,000 – 3,000) | 12,000 | |

| (iv) Interest on Investment collected by Bank | 800 | |

| (vi) Bank credited our account | 1,200 | |

| Debit Balance (Overdraft) as per Cash Book | 51,500 | |

| 65,500 | 65,500 | |

https://tutorstips.com/bank-reconciliation-statement/

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

Advertisement

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.