Question No 20 Chapter No 5

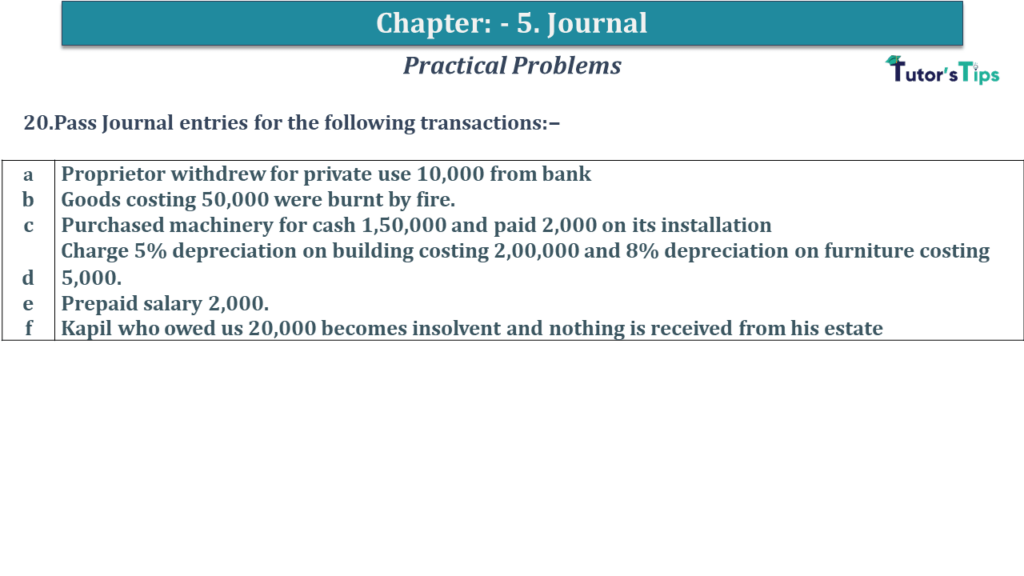

20.Pass Journal entries for the following transactions:−

| a | Proprietor withdrew for private use 10,000 from bank |

| b | Goods costing 50,000 were burnt by fire. |

| c | Purchased machinery for cash 1,50,000 and paid 2,000 on its installation |

| d | Charge 5% depreciation on building costing 2,00,000 and 8% depreciation on furniture costing 5,000. |

| e | Prepaid salary 2,000. |

| f | Kapil who owed us 20,000 becomes insolvent and nothing is received from his estate |

The solution of Question No 20 Chapter No 5: –

| In the Books of Radhika Traders |

|||||

| Date | Particulars |

L.F. | Debit | Credit | |

| 2019 | |||||

| a | Drawings A/c | Dr. | 10,000 | ||

| To Bank A/c | 10,000 | ||||

| (Being Cash withdrawn from bank for personal use) | |||||

| b | Loss by Fire A/c | Dr. | 50,000 | ||

| To Purchases A/c | 50,000 | ||||

| (Being Goods destroyed by fire) | |||||

| c | Machinery A/c | Dr. | 1,52,000 | ||

| To Cash A/c | 1,52,000 | ||||

| (Being Purchased machinery for cash and installation charges were paid) | |||||

| d | Depreciation A/c | Dr. | 10,400 | ||

| To Building A/c | 10,000 | ||||

| To Furniture A/c | 400 | ||||

| (Being Bad debts written −off) | |||||

| e | Prepaid Salary A/c | Dr. | 2,000 | ||

| To Salary A/c | 2,000 | ||||

| (Being Prepaid salary recorded ) | |||||

| f | Bad Debts A/c | Dr. | 20,000 | ||

| To Kapil’s A/c | 20,000 | ||||

| (Being Bad debts written −off) | |||||

Advertisement

https://tutorstips.com/introduction-to-financial-accounting/

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

Chapter 1 Evolution of Accounting & Basic Accounting Terms

Advertisement

Chapter 2 Accounting Equations

Chapter 3 Meaning and Objectives of Accounting

Chapter 5 Books of Original Entry – Journal

Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

Chapter 7 Books of Original Entry – Cash Book (Coming soon)

Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

Advertisement

Chapter 9 Ledger (Coming soon)

Chapter 10 Trial Balance and Errors (Coming soon)

Chapter 11 Bank Reconciliation Statement (Coming soon)

Chapter 12 Depreciation (Coming soon)

Chapter 13 Bills of Exchange (Coming soon)

Advertisement

Chapter 14 Generally Accepted Accounting Principles(GAAP)

Chapter 15 Bases of Accounting

Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

Advertisement

Chapter 17 Capital and Revenue

Chapter 18 Provisions and Reserves

Chapter 19 Final Accounts (Coming soon)

Chapter 20 Final Accounts – With Adjustments (Coming soon)

Chapter 21 Errors and their Rectification (Coming soon)

Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

Chapter 24 Computerised Accounting System (Coming soon)

Chapter 25 Introduction to Accounting Information System (Coming soon)