Question No 14 Chapter No 8 – D.K Goal

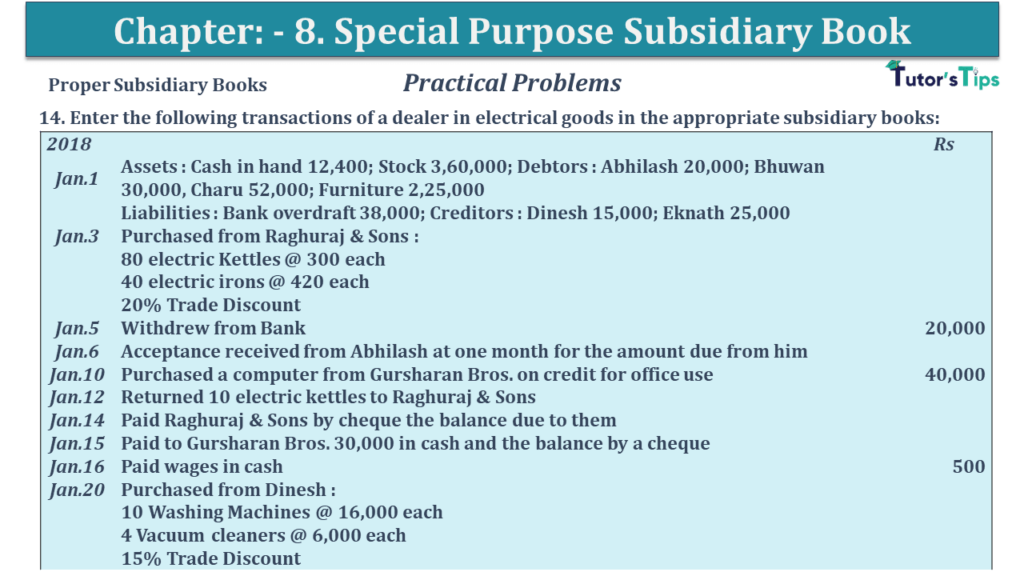

14. Enter the following transactions of a dealer in electrical goods in the appropriate subsidiary books:

| 2018 | Rs | |

| Jan.1 | Assets : Cash in hand 12,400; Stock 3,60,000; Debtors : Abhilash 20,000; Bhuwan 30,000, Charu 52,000; Furniture 2,25,000 | |

| Liabilities : Bank overdraft 38,000; Creditors : Dinesh 15,000; Eknath 25,000 | ||

| Jan.3 | Purchased from Raghuraj & Sons : | |

| 80 electric Kettles @ 300 each | ||

| 40 electric irons @ 420 each | ||

| 20% Trade Discount | ||

| Jan.5 | Withdrew from Bank | 20,000 |

| Jan.6 | Acceptance received from Abhilash at one month for the amount due from him | |

| Jan.10 | Purchased a computer from Gursharan Bros. on credit for office use | 40,000 |

| Jan.12 | Returned 10 electric kettles to Raghuraj & Sons | |

| Jan.14 | Paid Raghuraj & Sons by cheque the balance due to them | |

| Jan.15 | Paid to Gursharan Bros. 30,000 in cash and the balance by a cheque | |

| Jan.16 | Paid wages in cash | 500 |

| Jan.20 | Purchased from Dinesh : | |

| 10 Washing Machines @ 16,000 each | ||

| 4 Vacuum cleaners @ 6,000 each | ||

| 15% Trade Discount | ||

| Jan.22 | Sold to Charu | |

| 200 electric shavers @ 250 each | ||

| 400 toasters @ 150 each | ||

| 450 heaters @ 200 each | ||

| 10% Trade Discount | ||

| Jan.24 | Received from Charu a cheque in full settlement of his account. The cheque is paid into the bank. | 2,30,000 |

| Jan.25 | Acceptance is given to Dinesh for 30 days | 1,50,000 |

| Jan.25 | Cheque issued to Dinesh in full settlement of his account | 21,000 |

| Jan.25 | Sold for Cash 20 electric irons | 9,000 |

| Jan.27 | Deposited into bank | 5,000 |

| Jan.30 | Paid staff salaries by cheque | 15,000 |

| Jan.30 | Bank charged incidental expenses 50 and charged interest 1,200. |

The solution of Question No 14 Chapter No 8 – D.K Goal: –

| Dr. | Cash Book | Cr. | |||||||||

| Date | Particulars |

L. F. |

Discount Allowed |

Cash | Bank | Date | Particulars |

L. F. |

Discount Received | Cash | Bank |

| 2020 | 2020 | ||||||||||

| Jan.1 | To Balance b/d | – | 12,400 | – | Jan.08 | By Balance b/d | – | – | 38,000 | ||

| Jan.5 | To Bank A/c | – | 20,000 | – | Jan.5 | By Cash A/c | – | – | 20,000 | ||

| Jan.24 | To Charu A/c | 2,000 | – | 2,30,000 | Jan.14 | By Raghuraj & Sons A/c | – | – | 30,240 | ||

| Jan. 25 | To Sale A/c | – | 9,000 | – | Jan.15 | By Gursharan Bros. A/c | – | 30,000 | 10,000 | ||

| Jan.27 | To Cash A/c | – | – | 5,000 | Jan.16 | By Wages A/c | 500 | – | |||

| Jan.25 | By Dinesh A/c | 400 | – | 21,000 | |||||||

| Jan.27 | By Bank A/c | – | 5,000 | – | |||||||

| Jan.30 | By Salary A/c A/c | 15,000 | |||||||||

| Jan.30 | By Bank Charge A/c | 50 | |||||||||

| Jan.30 | By Bank Interest A/c | – | – | 1,200 | |||||||

| Jun.30 | To Balance c/d | 2,000 | – | Jun.30 | By Balance C/d | 400 |

7,500 | 48,310 | |||

| 2,000 | 41,400 | 2,35,000 | 400 | 41,400 | 2,35,000 | ||||||

| Purchases Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 3 | Raghuraj & Sons | ||

| 80 Electric Kettles @ Rs 300 each | 24,000 | ||

| 40 Electric Irons @ Rs 420 each | 16,800 | ||

| Less: 20% Trade Discount | 8,160 | ||

| 32,640 | 32,640 | ||

| 20 | Dinesh | ||

| 10 Washing Machines @ Rs 16,000 each | 1,60,000 | ||

| 4 Vacuum Cleaners @ Rs 6,000 each | 24,000 | ||

| Less: 15% Trade Discount | 27,600 | ||

| 1,56,400 | 1,56,400 | ||

| 1,89,040 | |||

| Sale Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 22 | Charu | ||

| 200 Electric Shavers @ Rs 250 each | 50,000 | ||

| 400 Toasters @ Rs 150 each | 60,000 | ||

| 450 Heaters @ Rs 200 each | 90,000 | ||

| Less: 10% Trade Discount | 20,000 | ||

| 1,80,000 | 1,80,000 | ||

| 1,80,000 | |||

| Purchases Return Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 12 | Raghuraj & Sons | ||

| 10 Electric Kettles @ Rs 300 each | 3,000 | ||

| Less: 20% Trade Discount | 600 | ||

| 2,400 | 2,400 | ||

| 2,400 | |||

Advertisement

| In the Books of Radhika Traders |

|||||

| Date | Particulars |

L.F. | Debit | Credit | |

| 2019 | |||||

| Jan.1 | Cash A/c | Dr. | 12,400 | ||

| Stock A/c | Dr. | 3,60,000 | |||

| Abhilash A/c | Dr. | 20,000 | |||

| Bhuwan A/c | Dr. | 30,000 | |||

| Charu A/c | Dr. | 52,000 | |||

| Furniture A/c | Dr. | 2,25,000 | |||

| To Bank Overdraft A/c | 38,000 | ||||

| To Dinesh A/c | 15,000 | ||||

| To Eknath A/c | 25,000 | ||||

| To Capital A/c (balancing figure) | 6,21,400 | ||||

| (Being Opening balances brought forward.) | |||||

| Jan.6 | Bills Receivable A/c | Dr. | 20,000 | ||

| To Abhilash A/c | 20,000 | ||||

| (Being Acceptance received for the amount due from him ) | |||||

| Jan.10 | Computer A/c | Dr. | 40,000 | ||

| To Gurusharan Bros A/c | 40,000 | ||||

| (Being Acceptance given to Ganga Parshad.) | |||||

| Jan.24 | Discount Allowed A/c | Dr. | 2,000 | ||

| To Charu A/c | 2,000 | ||||

| (Being Discount of Rs2,000 allowed to Charu) | |||||

| Jan.25 | Dinesh A/c | Dr. | 1,50,000 | ||

| To Bills Payable A/c | 1,50,000 | ||||

| (Being Acceptance given ) | |||||

| Jan.25 | Dinesh A/c | Dr. | 400 | ||

| To Discount Received A/c | 400 | ||||

| (Being Discount of Rs 400 received on payment to Dinesh) | |||||

https://tutorstips.com/purchase-return-book/

Thanks, Please Like and share with your friends

Comment if you have any questions.

Also, Check out the solved question of all Chapters: –

Advertisement

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.