Question No 14 Chapter No 5

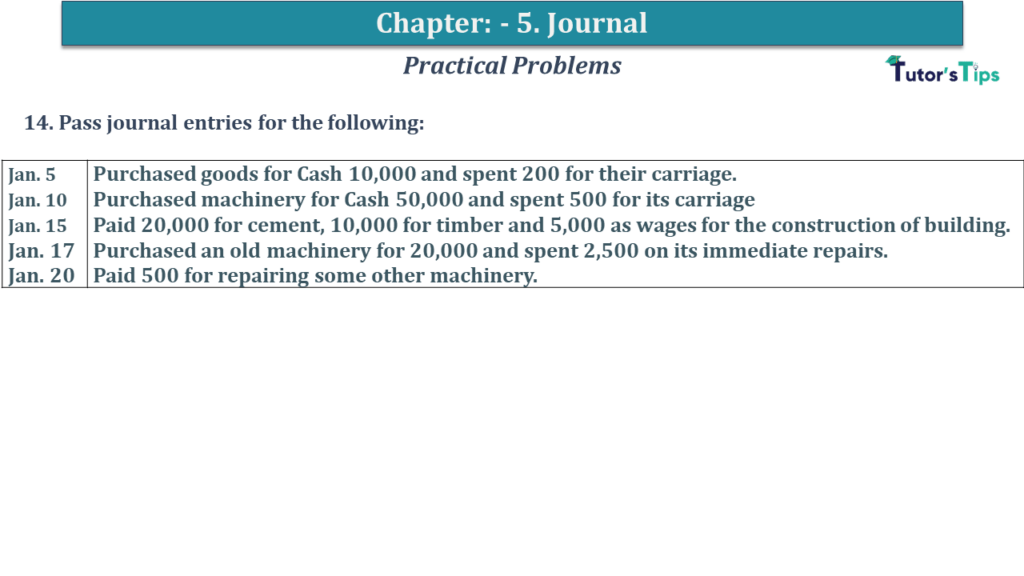

14. Pass journal entries for the following:

| Jan. 5 | Purchased goods for Cash 10,000 and spent 200 for their carriage. |

| Jan. 10 | Purchased machinery for Cash 50,000 and spent 500 for its carriage |

| Jan. 15 | Paid 20,000 for cement, 10,000 for timber and 5,000 as wages for the construction of the building. |

| Jan. 17 | Purchased old machinery for 20,000 and spent 2,500 on its immediate repairs. |

| Jan. 20 | Paid 500 for repairing some other machinery. |

The solution of Question No 14 Chapter No 5: –

| In the Books of Hari Shankar & Co | |||||

| Date | Particulars |

L.F. | Debit | Credit | |

| 2019 | |||||

| Jan. 05 | Purchases A/c | Dr. | 10,000 | ||

| Carriage A/c | Dr. | 200 | |||

| To Cash A/c | 10,200 | ||||

| (Being Goods purchased for cash and paid carriage.) | |||||

| Jan. 10 | Machinery A/c | Dr. | 50,500 | ||

| To Cash A/c | 50,500 | ||||

| (Being Machinery purchased for cash and carriage paid) | |||||

| Jan. 15 | Building A/c | Dr. | 35,000 | ||

| To Cash A/c | 35,000 | ||||

| (Being Payment made for the construction of a building ) | |||||

| Jan. 17 | Machinery A/c | Dr. | 22,500 | ||

| To Cash A/c | 22,500 | ||||

| (Being Machinery purchased and expenses paid) | |||||

| Jan. 20 | Repairs A/c | Dr. | 500 | ||

| To Cash A/c | 500 | ||||

| (Being Payment made for repairs) | |||||

Advertisement

https://tutorstips.com/introduction-to-financial-accounting/

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

Chapter 1 Evolution of Accounting & Basic Accounting Terms

Advertisement

Chapter 2 Accounting Equations

Chapter 3 Meaning and Objectives of Accounting

Chapter 5 Books of Original Entry – Journal

Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

Chapter 7 Books of Original Entry – Cash Book (Coming soon)

Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

Advertisement

Chapter 9 Ledger (Coming soon)

Chapter 10 Trial Balance and Errors (Coming soon)

Chapter 11 Bank Reconciliation Statement (Coming soon)

Chapter 12 Depreciation (Coming soon)

Chapter 13 Bills of Exchange (Coming soon)

Advertisement

Chapter 14 Generally Accepted Accounting Principles(GAAP)

Chapter 15 Bases of Accounting

Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

Advertisement

Chapter 17 Capital and Revenue

Chapter 18 Provisions and Reserves

Chapter 19 Final Accounts (Coming soon)

Chapter 20 Final Accounts – With Adjustments (Coming soon)

Chapter 21 Errors and their Rectification (Coming soon)

Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

Chapter 24 Computerised Accounting System (Coming soon)

Chapter 25 Introduction to Accounting Information System (Coming soon)