Question No 13 Chapter No 20

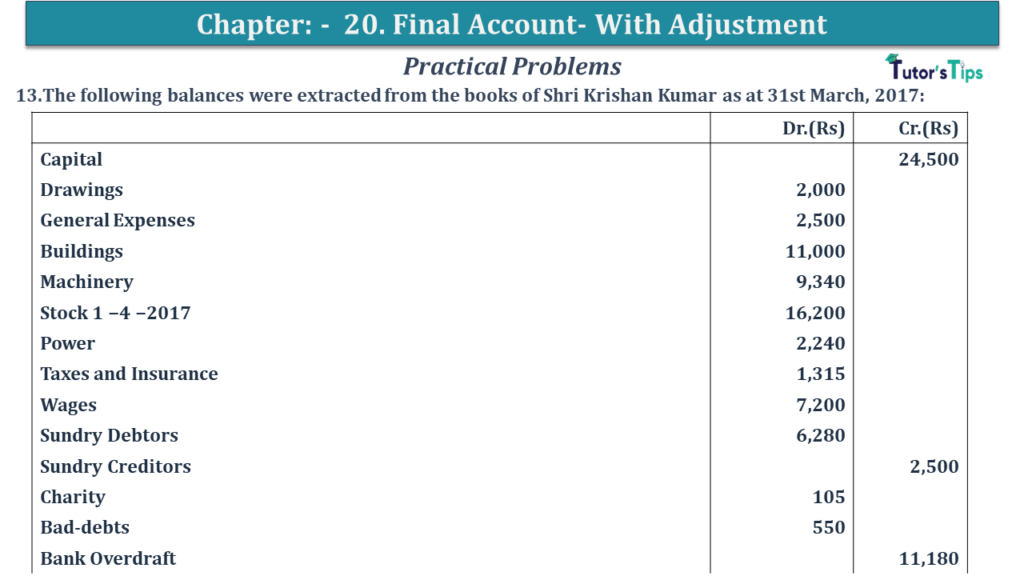

13.The following balances were extracted from the books of Shri Krishan Kumar as at 31st March, 2017:

| Dr.(Rs) | Cr.(Rs) | |

| Capital | 24,500 | |

| Drawings | 2,000 | |

| General Expenses | 2,500 | |

| Buildings | 11,000 | |

| Machinery | 9,340 | |

| Stock 1 −4 −2017 | 16,200 | |

| Power | 2,240 | |

| Taxes and Insurance | 1,315 | |

| Wages | 7,200 | |

| Sundry Debtors | 6,280 | |

| Sundry Creditors | 2,500 | |

| Charity | 105 | |

| Bad-debts | 550 | |

| Bank Overdraft | 11,180 | |

| Sales | 65,360 | |

| Purchases | 47,000 | |

| Scooter | 2,000 | |

| Scooter Expenses | 500 | |

| Bad-debts Provision | 900 | |

| Commission | 1,320 | |

| Trade Expenses | 1,280 | |

| Bills Payable | 3,850 | |

| Cash | 100 | |

| 1,09,610 | 1,09,610 |

Adjustments:-

i Stock on 31st March, 2017 was valued at 23,500.

ii 1/5th of general expenses and taxes & insurance to be charged to factory and the balance to the office.

iii Write off a further Bad-debts of 160 and maintain the provision for Bad-debts at 5% on Debtors.

iv Depreciate Machinery at 10% and Scooter by 240.

v Provide 700 for outstanding interest on Bank Overdraft.

vi Prepaid Insurance is to the extent of 50.

vii Provide for Manager’s Commission at 10% on the Net Profit after charging such Commission.

Prepare final accounts for the year ended 31st March, 2017 after giving effect to the above adjustments.

The solution of Question No 13 Chapter No 20: –

| Trading Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Opening Stock A/c | 16,200 | By Sales | 65,360 | ||

| To Purchases A/c | 47,000 | ||||

| To Wages | 7,200 | ||||

| To General Expenses (1/5th) | 500 | By Closing Stock | 23,500 | ||

| To Taxes and Insurance (1/5th) | 253 | ||||

| To Power | 2,240 | ||||

| To Gross Profit A/c | 15,467 | ||||

| 88,860 | 88,860 | ||||

| Profit & Loss Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Depreciation: (WN1) | By Gross Profit | 15,467 | |||

| Machinery | 934 | By Commission Received | 1,320 | ||

| Scooter | 240 | 1,174 | |||

| To Old Bad Debts | 550 | ||||

| Add: Further Bad Debts | 160 | ||||

| Add: New Provision (WN2) | 306 | 116 | |||

| To Outstanding Interest on Bank | 700 | ||||

| Taxes & Insurance | 1,315 | ||||

| Less: Pre-paid | 50 | ||||

| Less: T/f to Trading A/c | 253 | 1,012 | |||

| To Charity |

1,800 |

||||

| To Scooter Expenses | 600 | ||||

| To Trade Expenses | 10,000 | ||||

| To Outstanding Manager’s | 3,200 | ||||

| To Commission (WN3) | 900 | ||||

| General Expenses | 2,500 | ||||

| Less: T/f to Trading A/c | 500 | 2,000 | |||

| To Net Profit A/c | 9,000 | ||||

| 16,787 | 16,787 | ||||

| Balance Sheet |

|||||

| Liabilities |

Amount | Assets |

Amount | ||

| Capital | 24,500 | Machinery | 9,340 | ||

| Less: Net Loss | 9,000 | Less: Depreciation | 934 | 8,406 | |

| Less: Drawings 12, 000 +150 | 2,000 | 31,500 | Scooter | 2,000 | |

| Creditors | 2,500 | Less: Depreciation | 240 | 1,760 | |

| Outstanding Manager’s Commission | 900 | Building | 11,000 | ||

| Bills Payable | 3,850 | Closing Stock | 23,500 | ||

| Outstanding Interest on Bank Overdraft | 700 | Prepaid Insurance | 50 | ||

| Bank Overdraft | 11,180 | Cash in Hand | 100 | ||

| Debtors | 6,280 | ||||

| Less: Provision for Bad Debt | 160 | ||||

| Less: Provision for Discount | 306 | 5,814 | |||

| 50,630 | 50,630 | ||||

Working Note: –

Advertisement

Calculation of Depreciation

| Depreciation on Machinery | = | 10 | X | 6,340 |

| 100 | ||||

| = | Rs 934 |

Calculation of Outstanding Rent

| Prepaid Insurance | = | 9 | X | 1,200 |

| 12 | ||||

| = | Rs 900 |

Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts = Sundry Debtors −Further Bad Debts × Rate 100

| Provision for Doubtful Debts | = | 5 | X | (6,280 – 160) |

| 100 | ||||

| = | Rs 306 |

Calculation of Manager’s Commission

Profit before Manager’s Commission = Rs 9, 900 (16, 787 −6, 887)

Advertisement

| Manager’s Commission | = | 10 | X | 9,900 |

| 100 | ||||

| = | Rs 900 |

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.