Question No 10 Chapter No 7

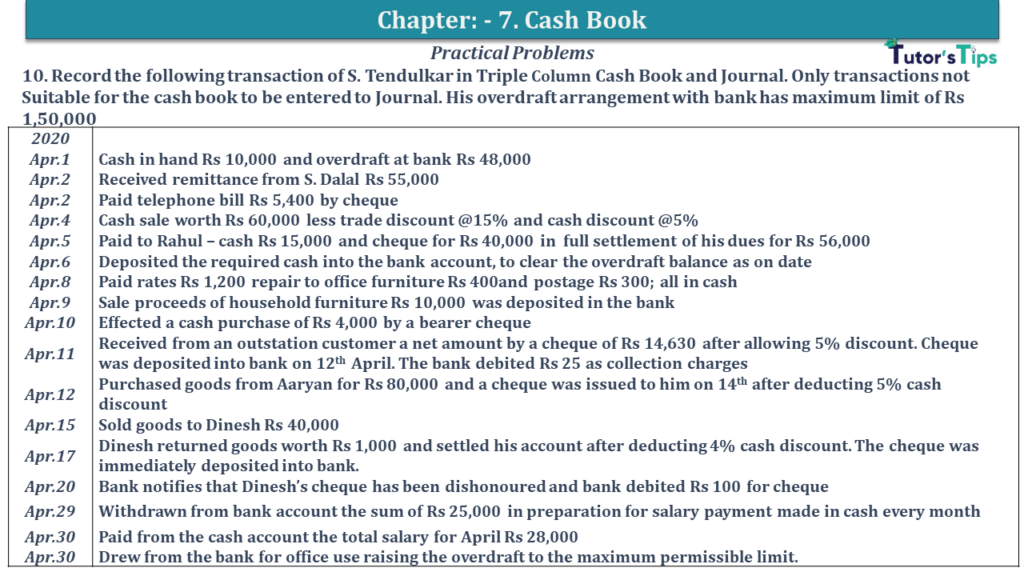

10. Record the following transaction of S. Tendulkar in Triple Column Cash Book and Journal. Only transactions not Suitable for the cash book to be entered to Journal. His overdraft arrangement with the bank has a maximum limit of Rs 1,50,000

| 2020 | |

| Apr.1 | Cash in hand Rs 10,000 and overdraft at bank Rs 48,000 |

| Apr.2 | Received remittance from S. Dalal Rs 55,000 |

| Apr.2 | Paid telephone bill Rs 5,400 by cheque |

| Apr.4 | Cash sale worth Rs 60,000 less trade discount @15% and cash discount @5% |

| Apr.5 | Paid to Rahul – cash Rs 15,000 and cheque for Rs 40,000 in full settlement of his dues for Rs 56,000 |

| Apr.6 | Deposited the required cash into the bank account, to clear the overdraft balance as on date |

| Apr.8 | Paid rates Rs 1,200 repair to office furniture Rs 400and postage Rs 300; all in cash |

| Apr.9 | Sale proceeds of household furniture Rs 10,000 was deposited in the bank |

| Apr.10 | Effected a cash purchase of Rs 4,000 by a bearer cheque |

| Apr.11 | Received from an outstation customer a net amount by a cheque of Rs 14,630 after allowing 5% discount. The cheque was deposited into the bank on 12th April. The bank debited Rs 25 as collection charges |

| Apr.12 | Purchased goods from Aaryan for Rs 80,000 and a cheque was issued to him on 14th after deducting 5% cash discount |

| Apr.15 | Sold goods to Dinesh Rs 40,000 |

| Apr.17 | Dinesh returned goods worth Rs 1,000 and settled his account after deducting 4% cash discount. The cheque was immediately deposited into the bank. |

| Apr.20 | Bank notifies that Dinesh’s cheque has been dishonored and the bank debited Rs 100 for the cheque |

| Apr.29 | Withdrawn from bank account the sum of Rs 25,000 in preparation for salary payment made in cash every month |

| Apr.30 | Paid from the cash account the total salary for April Rs 28,000 |

| Apr.30 | Drew from the bank for office use raising the overdraft to the maximum permissible limit. |

The solution of Question No 10 Chapter No 7: –

| Dr. | Cash Book | Cr. | |||||||||

| Date | Particulars |

L. F. |

Discount Allowed |

Cash | Bank | Date | Particulars |

L. F. |

Discount Received | Cash | Bank |

| 2020 | 2020 | ||||||||||

| Apr.1 | To Balance b/d | – | 10,000 | – | Apr.01 | By Balance b/d | – | – | 48,000 | ||

| Apr.3 | To S. Dalal A/c | – | 55,000 | – | Apr.02 | By Telephone A/c | – | – | 5,400 | ||

| Apr.04 | To Sale A/c | 2,550 | 48,450 | – | Apr.05 | By Rahul A/c | 1,000 | 15,000 | 40,000 | ||

| Apr.06 | To Cash A/c | – | – | 93,400 | Apr.06 | By Bank A/c | – | 93,400 | – | ||

| Apr.09 | To Capital A/c | – | – | 10,000 | Apr.08 | By Rates , repair & postage A/c | 1,900 | – | |||

| Apr.12 | To Debtor A/c*1 | 770 | 14,605 | Apr.10 | By Purchases A/c | – | – | 4,000 | |||

| Apr.17 | To Dinesh A/c | 1,560 | – | 37,440 | Apr.14 | By Aryan A/c | 4,000 | 76,000 | |||

| Apr.29 | To Bank A/c | – | 25,000 | – | Apr.20 | By Aryan A/c | 37,540 | ||||

| Apr.30 | To Bank A/c | – | 69,505 | – | Apr.29 | By Cash A/c | 25,000 | ||||

| Apr.30 | By Salary A/c | – | 28,000 | – | |||||||

| Apr.30 | By Cash A/c | 69,505 | |||||||||

| Jun.30 | To Balance C/d | 4,880 | – | 1,50,000 | Jun.30 | By Balance C/d | 5,000 |

69,655 | – | ||

| 4,880 | 2,07,955 | 3,05,445 | 5,000 | 2,07,955 | 3,05,445 | ||||||

Note: In this question there is the difference in the answer of Cash Account in the book the answer is Rs 69,665 but the answer real answer is Rs 69,655.

Working Note:

*1

Advertisement

April 12: Calculation of Amount of discount:

Amount of Discount = Amount received * Rate / 100- Rate (Because net amount received is given)

= 14630 * 5/100-5

= 14630 * 5/95

= 770

https://tutorstips.com/cash-book/

Advertisement

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.

How how the answer of the last transaction has came please explain thank you

How have you calculated tha amount of discount in entry of April 11

Amount of Discount = 14630 * 5/100-5

= 14630 * 5/95

= 770

SUM OF THE BANK COLUMN OF CREDIT SIDE – SUM OF BANK COLUMN OF DEBIT SIDE

=235965 – 155470

=80495

MAX LIMIT = 150000

=150000-80495

69505

THANK YOU 🙂

HAPPY ACCOUNTING!!

Correct.

Welcome