Question No 09 A Chapter No 20

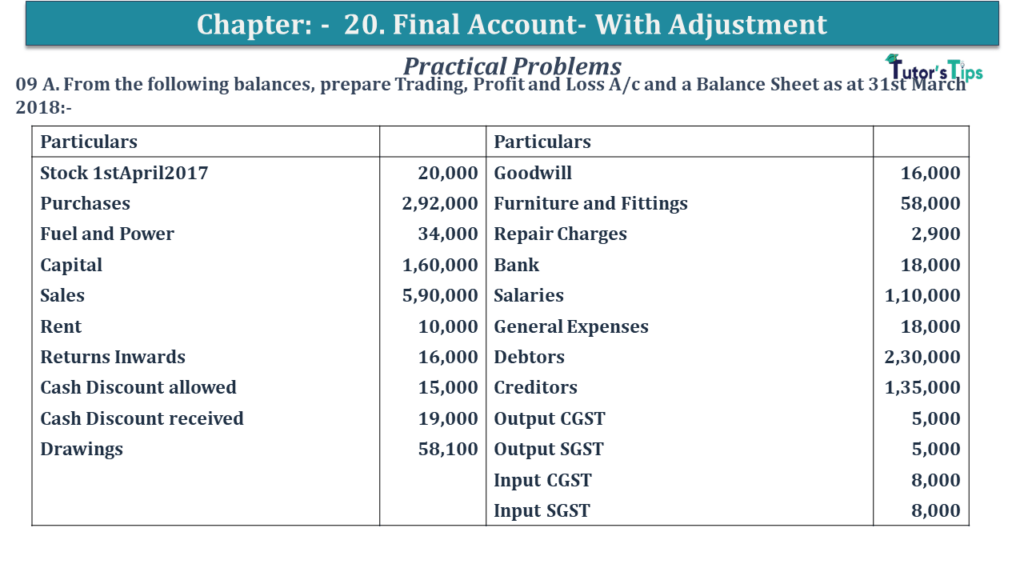

09 A. From the following balances, prepare Trading, Profit and Loss A/c and a Balance Sheet as at 31st March 2018:-

| Particulars | Particulars | ||

| Stock 1stApril2017 | 20,000 | Goodwill | 16,000 |

| Purchases | 2,92,000 | Furniture and Fittings | 58,000 |

| Fuel and Power | 34,000 | Repair Charges | 2,900 |

| Capital | 1,60,000 | Bank | 18,000 |

| Sales | 5,90,000 | Salaries | 1,10,000 |

| Rent | 10,000 | General Expenses | 18,000 |

| Returns Inwards | 16,000 | Debtors | 2,30,000 |

| Cash Discount allowed | 15,000 | Creditors | 1,35,000 |

| Cash Discount received | 19,000 | Output CGST | 5,000 |

| Drawings | 58,100 | Output SGST | 5,000 |

| Input CGST | 8,000 | ||

| Input SGST | 8,000 |

Take the following adjustments into account:

a General expenses include 5,000 chargeable to Furniture purchased on 1st October 2017.

b Create a provision of 5% on debtors for Bad and Doubtful Debts after treating 30,000 as a Bad-debt.

c Depreciation on Furniture and Fittings for the year is to be at the rate of 10% per annum.

d Closing Stock was 40,000, but there was a loss by fire on 20th March to the extent of 8,000. Insurance Company admitted the claim in full.

e I Goods costing 2,500 were used by the proprietor.

II Goods costing 1,500 were distributed as free samples.

Goods were purchased paying CGST and SGST @ 6% each.

The solution of Question No 09 A Chapter No 20: –

| Trading Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Opening Stock A/c | 20,000 | By Sales | 5,90,000 | ||

| To Purchases A/c | 2,92,000 | Less: return | 16,000 | 5,74,000 | |

| Less: Goods Destroyed by Fire | 8,000 | ||||

| Less: Drawings | 2,500 | ||||

| Less: Advertisement | 1,500 | 2,80,000 | By Closing Stock | 40,000 | |

| To Fuel and Power | 34,000 | ||||

| To Gross Profit A/c | 2,80,000 | ||||

| 6,14,000 | 6,14,000 | ||||

| Profit & Loss Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Depreciation on Furniture (WN1) | 6,050 | Gross Profit | 2,80,000 | ||

| To Rent | 10,000 | By Discount Received | 19,000 | ||

| To General Expenses | 18,000 | ||||

| Less: Furniture | 5,000 | 13,000 | |||

| To Further Bad Debts | 30,000 | ||||

| Add: New Provision (WN3) | 10,000 | 40,000 | |||

| To Discount Allowed | 15,000 | ||||

| To Repair Charges | 2,900 | ||||

| To Advertisement Free Samples | 1,680 | ||||

| To Salaries | 1,10,000 | ||||

| To Net Profit A/c | 1,00,370 | ||||

| 2,99,000 | 2,99,000 | ||||

| Balance Sheet |

|||||

| Liabilities |

Amount | Assets |

Amount | ||

| Capital | 1,60,000 | Goodwill | 16,000 | ||

| Add: Net Profit | 1,00,370 | Closing Stock | 40,000 | ||

| Less: Drawings | 60,900 | 1,99,470 | Insurance company8,000 +12 | 8,960 | |

| Creditors | 1,35,000 | Input CGST8, 000 −240 −480 | 7,280 | ||

| Less: Output CGST | 5,000 | 2,280 | |||

| Input SGST8, 000 −240 −480 | 7,280 | ||||

| Less: Output SGST | 5,000 | 2,280 | |||

| Cash at Bank | 18,000 | ||||

| Furniture & Fittings | 58,000 | ||||

| Add: Additions | 5,000 | ||||

| Less: Depreciation | 6,050 | 6,050 | |||

| Debtors | 2,30,000 | ||||

| Less: Bad Debts | 30,000 | ||||

| Less: Provision for Bad Debts | 10,000 | 1,90,000 | |||

| 3,34,470 | 3,34,470 | ||||

Working Note: –

Calculation of Depreciation

| Furniture of Rs 5,000 was purchased on Oct 01, 2013 | = | 10 | X | 58,000 |

| 100 | ||||

| = | Rs 5,800 |

| Furniture of Rs 5,000 was purchased on Oct 01, 2013 | = | 10 | X | 6 | X | 5,000 |

| 100 | 12 | |||||

| = | Rs 250 | |||||

| Total Depreciation for furniture is | = | 5,800 + 250 | = | 6,050 |

Calculation of Outstanding Rent

Advertisement

| Amount of Rent Outstanding | = | 2 | X | 10,000 |

| 10 | ||||

| = | Rs 2,000 |

Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts = Sundry Debtors −Further Bad Debts × Rate 100

| Provision for Doubtful Debts | = | 5 | X | (2,30,000 – 30,000) |

| 100 | ||||

| = | Rs 10,000 |

https://tutorstips.com/trading-account/

Also, Check out the solved question of all Chapters: –

Advertisement

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.