Question No 06 Chapter No 10

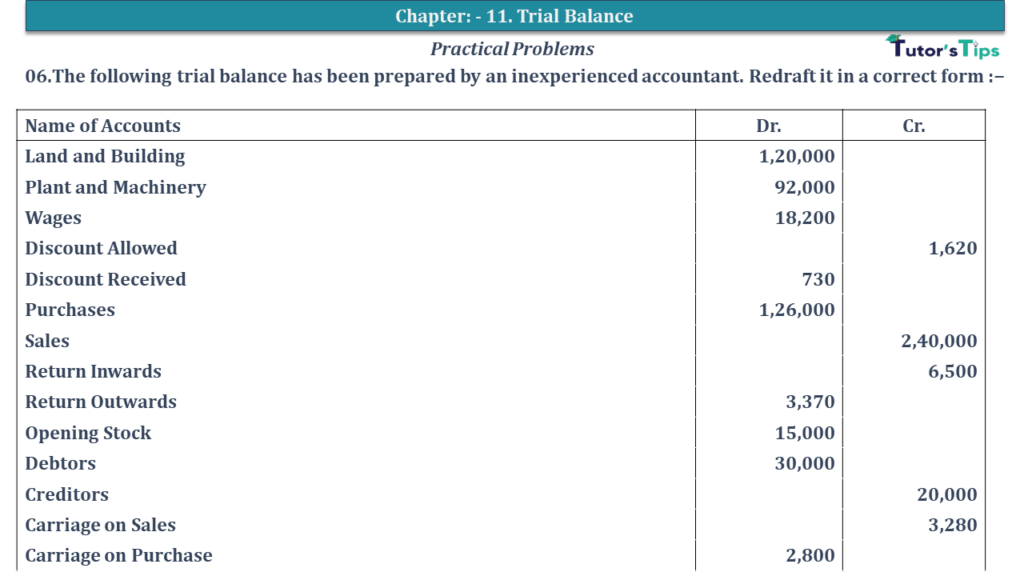

06.The following trial balance has been prepared by an inexperienced accountant. Redraft it in a correct form :−

| Name of Accounts | Dr. | Cr. |

| Land and Building | 1,20,000 | |

| Plant and Machinery | 92,000 | |

| Wages | 18,200 | |

| Discount Allowed | 1,620 | |

| Discount Received | 730 | |

| Purchases | 1,26,000 | |

| Sales | 2,40,000 | |

| Return Inwards | 6,500 | |

| Return Outwards | 3,370 | |

| Opening Stock | 15,000 | |

| Debtors | 30,000 | |

| Creditors | 20,000 | |

| Carriage on Sales | 3,280 | |

| Carriage on Purchase | 2,800 | |

| Insurance | 1,500 | |

| General Expenses | 6,100 | |

| Cash in Hand | 2,400 | |

| Bank Overdraft | 12,100 | |

| Capital | 1,54,000 | |

| Drawings | 4,800 | |

| 4,30,200 | 4,30,200 |

The solution of Question No 06 Chapter No 10: –

| Trail Balance A/c | |||

| Particulars |

J.F. | Debit | Credit |

| Land & Building A/c | 1,20,000 | ||

| Plant & Machinery A/c | 92,000 | ||

| Wages A/c | 18,200 | ||

| Discount Allowed A/c | 1,620 | ||

| Discount Received A/c | 730 | ||

| Purchases A/c | 1,26,000 | ||

| Sales A/c | 2,40,000 | ||

| Return Inwards A/c | 6,500 | ||

| Return Outwards A/c | 3,370 | ||

| Opening Stock A/c | 15,000 | ||

| Debtors A/c | 30,000 | ||

| Creditors A/c | 20,000 | ||

| Carriage on Sales A/c | 3,280 | ||

| Carriage on Purchases A/c | 2,800 | ||

| Insurance A/c | 1,500 | ||

| General Expenses A/c | 6,100 | ||

| Cash in Hand A/c | 2,400 | ||

| Bank Overdraft A/c | 12,100 | ||

| Capital A/c | 154,000 | ||

| Drawings A/c | 4,800 | ||

| 4,30,200 | 4,30,200 | ||

https://tutorstips.com/trial-balance/

Thanks, Please Like and share with your friends

Comment if you have any question.

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)