Question No 04 Chapter No 8

Sale Book

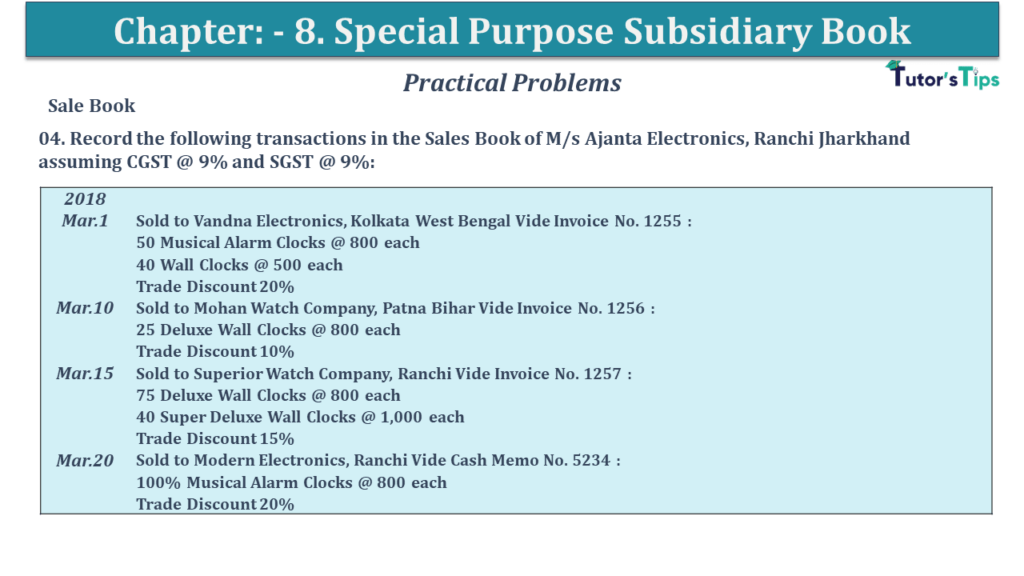

04. Record the following transactions in the Sales Book of M/s Ajanta Electronics, Ranchi Jharkhand assuming CGST @ 9% and SGST @ 9%:

| 2018 | |

| Mar.1 | Sold to Vandna Electronics, Kolkata West Bengal Vide Invoice No. 1255 : |

| 50 Musical Alarm Clocks @ 800 each | |

| 40 Wall Clocks @ 500 each | |

| Trade Discount 20% | |

| Mar.10 | Sold to Mohan Watch Company, Patna Bihar Vide Invoice No. 1256 : |

| 25 Deluxe Wall Clocks @ 800 each | |

| Trade Discount 10% | |

| Mar.15 | Sold to Superior Watch Company, Ranchi Vide Invoice No. 1257 : |

| 75 Deluxe Wall Clocks @ 800 each | |

| 40 Super Deluxe Wall Clocks @ 1,000 each | |

| Trade Discount 15% | |

| Mar.20 | Sold to Modern Electronics, Ranchi Vide Cash Memo No. 5234 : |

| 100% Musical Alarm Clocks @ 800 each | |

| Trade Discount 20% |

The solution of Question No 04 Chapter No 8: –

| Sele Book | ||||||||

| Date | Particular | Invoice No. |

Detail | Cost |

Output CGST | Output SGST | Output ISGT |

Total |

| 2018 Mar. |

||||||||

| 1 | Vandna Electronics, Kolkata | 1255 | ||||||

| 50 Musical Alarm Clocks @ Rs 800 each | 40,000 | |||||||

| 40 Wall Clocks @ Rs 500 each | 20,000 | |||||||

| 60,000 | ||||||||

| Less: 20% Trade Discount | 12,000 | |||||||

| 48,000 | ||||||||

| Add: 18% IGST | 8,640 | |||||||

| 56,640 | 48,000 | 8,640 | 56,640 | |||||

| 10 | Mohan Watch Company, Patna Bihar | 1256 | ||||||

| 25 Deluxe Wall Clocks @ Rs 800 each | 20,000 | |||||||

| Less: Trade Discount @10% | 2,000 | |||||||

| 18,000 | ||||||||

| Add: 18% IGST | 3,240 | |||||||

| 21,240 | 18,000 | 3,240 | 21,240 | |||||

| 15 | Superior Watch Company, Ranchi | 1257 | ||||||

| 75 Deluxe Wall Clocks @ Rs 800 each | 60,000 | |||||||

| 40 Super Deluxe Wall Clocks @ Rs 1,000 each | 40,000 | |||||||

| 1,00,000 | ||||||||

| Less: 20% Trade Discount | 15,000 | |||||||

| 85,000 | ||||||||

| Add: CGST | 7,650 | |||||||

| Add: SGST | 7,650 | |||||||

| 1,80,000 | 85,000 | 7,650 | 7,650 | 1,00,300 | ||||

| 1,51,000 | 7,650 | 7,650 | 11,880 | 1,78,180 | ||||

Note: In Sales Book, we record only the credit sale of goods, so the transaction dated March 20 being the sale of electronics for cash will not be recorded..

https://tutorstips.com/sales-book/

Thanks, Please Like and share with your friends

Advertisement

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.