Question No 04 B Chapter No 20

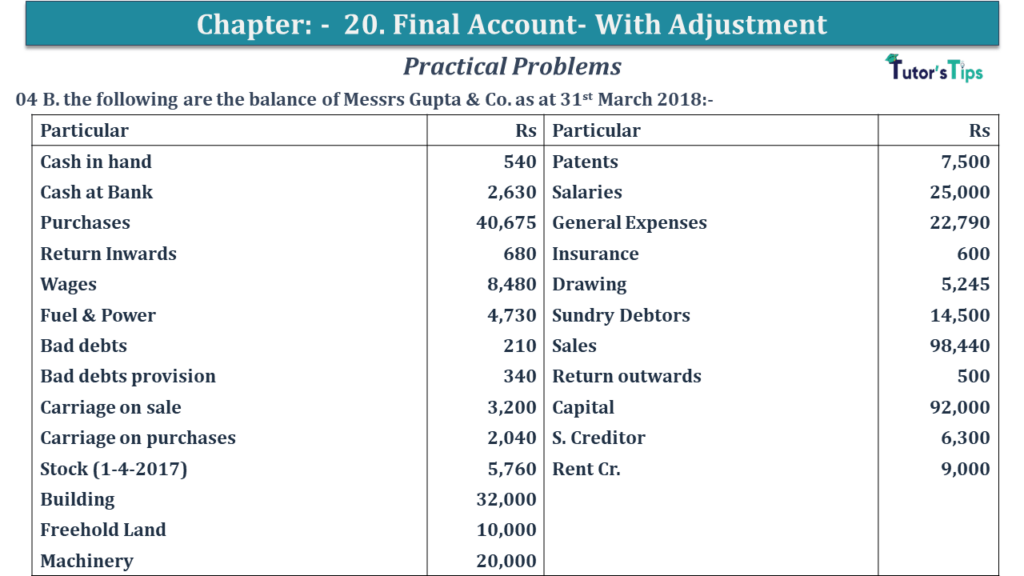

04 B. the following are the balance of Messrs Gupta & Co. as at 31st March 2018:-

| Particular | Rs | Particular | Rs |

| Cash in hand | 540 | Patents | 7,500 |

| Cash at Bank | 2,630 | Salaries | 25,000 |

| Purchases | 40,675 | General Expenses | 22,790 |

| Return Inwards | 680 | Insurance | 600 |

| Wages | 8,480 | Drawing | 5,245 |

| Fuel & Power | 4,730 | Sundry Debtors | 14,500 |

| Bad debts | 210 | Sales | 98,440 |

| Bad debts provision | 340 | Return outwards | 500 |

| Carriage on sale | 3,200 | Capital | 92,000 |

| Carriage on purchases | 2,040 | S. Creditor | 6,300 |

| Stock (1-4-2017) | 5,760 | Rent Cr. | 9,000 |

| Building | 32,000 | ||

| Freehold Land | 10,000 | ||

| Machinery | 20,000 |

Prepare trading and Profit & loss A/c and a balance Sheet as at 31st March 2018 after taking into account the following adjustments:-

i Stock on hand as on 31st March 2018 is Rs 6,800

ii Machinery is to be depreciated at 10% and Patents at 20%

iii Salaries for the month of March 2018 amounting to Rs 1,500 were unpaid

iv Insurance includes a premium of Rs 170 on a policy expiring on 30th September 2018

v Write of Rs 500 as bad debts and Create a provision for doubtful Debts at 5% on Sundry Debtors

vi Rent receivable Rs 1,000

The solution of Question No 04 B Chapter No 20: –

| Trading Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Opening Stock A/c | 5,760 | By Sales | 98,440 | ||

| To Purchases A/c | 40,675 | Less: return | 680 | 97,760 | |

| Less: Return | 500 | 40,175 | |||

| To Carriage on purchases A/c | 2,040 | By Closing Stock | 6,800 | ||

| To Fuel & Power A/c | 4,730 | ||||

| To Wages A/c | 8,480 | ||||

| To Gross Profit | 43,375 | ||||

| 1,04,560 | 1,04,560 | ||||

| Profit & Loss Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| Depreciation on Furniture (WN) | By Gross Profit | 43,375 | |||

| Machinery | 2,000 | By Rent | 9,000 | ||

| Patents | 1,500 | 3,500 | Add: Rent accrued | 1,000 | 10,000 |

| To Salaries | 25,000 | ||||

| Add: Outstanding | 1,500 | 26,500 | |||

| Old Bad Debts | 210 | ||||

| Add: New Bad Debts | 500 | ||||

| Add: New Provision (WN2) | 700 | ||||

| Less: Old Provision | 340 | 1,070 | |||

| To Insurance | 600 | ||||

| Add: Outstanding Taxes | 85 | 515 | |||

| To Carriage on Sale | 3,200 | ||||

| To General Expenses | 22,790 | ||||

| By Net Loss A/c | 4,200 | ||||

| 57,575 | 57,575 | ||||

| Balance Sheet |

|||||

| Liabilities |

Amount | Assets |

Amount | ||

| Capital | 92,000 | Patents | 7,500 | ||

| Less: Net Loss | 4,200 | Less: Depreciation | 1,500 | 6,000 | |

| Less: Drawings | 5,245 | 82,555 | Machinery | 20,000 | |

| Creditors | 6,300 | Less: Depreciation | 2,000 | 18,000 | |

| Outstanding Salaries | 1,500 | Building | 32,000 | ||

| Freehold Land | 10,000 | ||||

| Debtors | 14,500 | ||||

| Less: Further Bad Debts | 500 | ||||

| Less: Provision for Bad Debts | 700 | 13,300 | |||

| Closing Stock | 6,800 | ||||

| Prepaid Insurance | 85 | ||||

| Cash in Hand | 540 | ||||

| Cash At Bank | 2,630 | ||||

| Cash At Bank | 1,000 | ||||

| 90,355 | 90,355 | ||||

Working Note: –

Calculation of Depreciation

| Depreciation on Machinery | = | 10 | X | 20,000 |

| 100 | ||||

| = | Rs 2,000 |

| Depreciation on Patents | = | 20 | X | 7,500 |

| 100 | ||||

| = | Rs 1,500 |

Calculation of Provision for Doubtful Debts

Advertisement

Provision for Doubtful Debts = Sundry Debtors −Further Bad Debts × Rate 100

| Provision for Doubtful Debts | = | 5 | X | 14,500 – 500 |

| 100 | ||||

| = | Rs 700 |

https://tutorstips.com/trading-account/

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.