Question No 03 B Chapter No 10

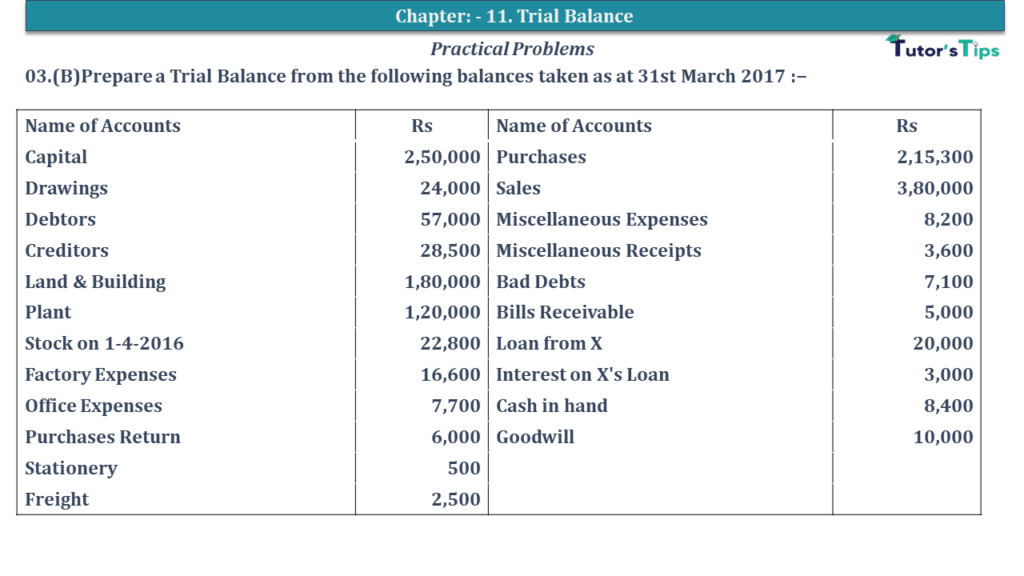

03. B Prepare a Trial Balance from the following balances taken as of 31st March 2017 :−

| Name of Accounts | Rs | Name of Accounts | Rs |

| Capital | 2,50,000 | Purchases | 2,15,300 |

| Drawings | 24,000 | Sales | 3,80,000 |

| Debtors | 57,000 | Miscellaneous Expenses | 8,200 |

| Creditors | 28,500 | Miscellaneous Receipts | 3,600 |

| Land & Building | 1,80,000 | Bad Debts | 7,100 |

| Plant | 1,20,000 | Bills Receivable | 5,000 |

| Stock on 1-4-2016 | 22,800 | Loan from X | 20,000 |

| Factory Expenses | 16,600 | Interest on X’s Loan | 3,000 |

| Office Expenses | 7,700 | Cash in hand | 8,400 |

| Purchases Return | 6,000 | Goodwill | 10,000 |

| Stationery | 500 | ||

| Freight | 2,500 |

The solution of Question No 03 B Chapter No 10: –

| Trail Balance A/c | |||

| Particulars |

J.F. | Debit | Credit |

| Capital A/c | 2,50,000 | ||

| Drawings A/c | 24,000 | ||

| Debtors A/c | 57,000 | ||

| Creditors A/c | 28,500 | ||

| Land & Building A/c | 1,80,000 | ||

| Plant A/c | 1,20,000 | ||

| Stock on 1-4-2007 A/c | 22,800 | ||

| Factory Expenses A/c | 16,600 | ||

| Office Expenses A/c | 7,700 | ||

| Purchases Return A/c | 6,000 | ||

| Stationery A/c | 500 | ||

| Freight A/c | 2,500 | ||

| Purchases A/c | 2,15,300 | ||

| Sales A/c | 3,80,000 | ||

| Miscellaneous Expenses A/c | 8,200 | ||

| Miscellaneous Receipts A/c | 3,600 | ||

| Bad Debts A/c | 7,100 | ||

| Bills Receivable A/c | 5,000 | ||

| Loan from X A/c | 20,000 | ||

| Interest on X’s Loan A/c | 3,000 | ||

| Cash A/c | 8,400 | ||

| Goodwill A/c | 10,000 | ||

| 6,88,100 | 6,88,100 | ||

https://tutorstips.com/trial-balance/

Thanks, Please Like and share with your friends

Comment if you have any question.

Advertisement

Also, Check out the solved question of previous Chapters: –

- Chapter No. 1 – Introduction to Accounting

- Chapter No. 2 – Basic Accounting Terms

- Chapter No. 3 – Theory Base of Accounting, Accounting Standards and International Financial Reporting Standards(IFRS)

- Chapter No. 4 – Bases of Accounting

- Chapter No. 5 – Accounting Equation

- Chapter No. 6 – Accounting Procedures – Rules of Debit and Credit

- Goods and Services Tax(GST)

- Chapter No. 7 – Origin of Transactions – Source Documents and Preparation of Vouchers

- Chapter No. 8 – Journal

- Chapter No. 9 – Ledger

- Chapter No. 10 – Special Purpose Books I – Cash Book

- Chapter No. 11 – Special Purpose Books II – Other Books

- Chapter No. 12 – Bank Reconciliation Statement

- Chapter No. 13 – Trial Balance

- Chapter No. 14 – Depreciation

- Chapter No. 15 – Provisions and Reserves

- Chapter No. 16 – Accounting for Bills of Exchange

- Chapter No. 17 – Rectification of Errors

- Chapter No. 18 – Financial Statements of Sole Proprietorship

- Chapter No. 19 – Adjustments in preparation of Financial Statements

- Chapter No. 20 – Accounts from incomplete Records – Single Entry System

- Chapter No. 21 – Computers in Accounting

- Chapter No. 22 – Accounting Software – Tally

- Chapter No. 5 – Accounting Equation

- Chapter No. 6 – Accounting Procedures – Rules of Debit and Credit

- Goods and Services Tax(GST)

- Chapter No. 8 – Journal

- Chapter No. 9 – Ledger

- Chapter No. 10 – Special Purpose Books I – Cash Book

Check out T.S. Grewal +1 Book 2019 @ Official Website of Sultan Chand Publication