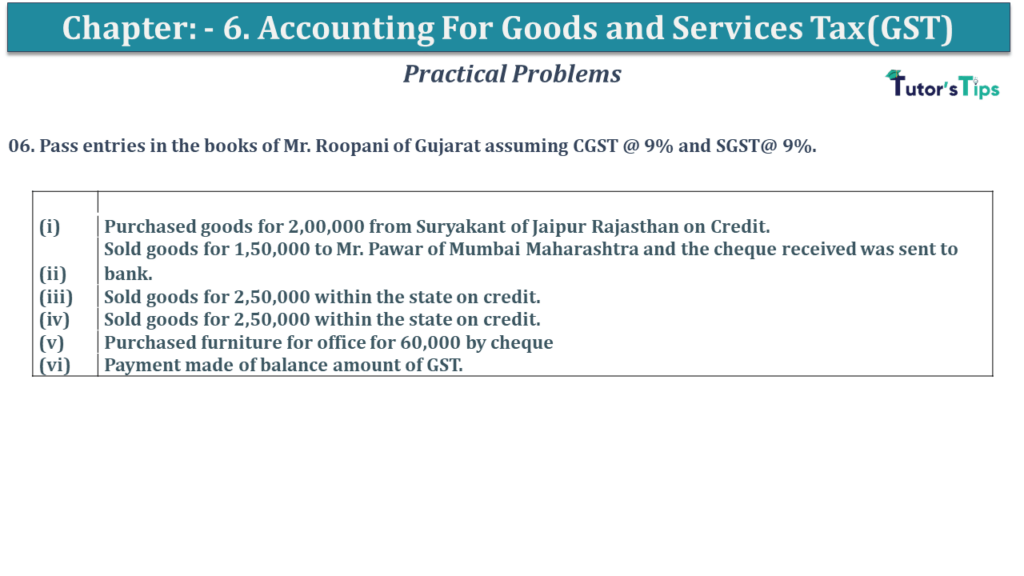

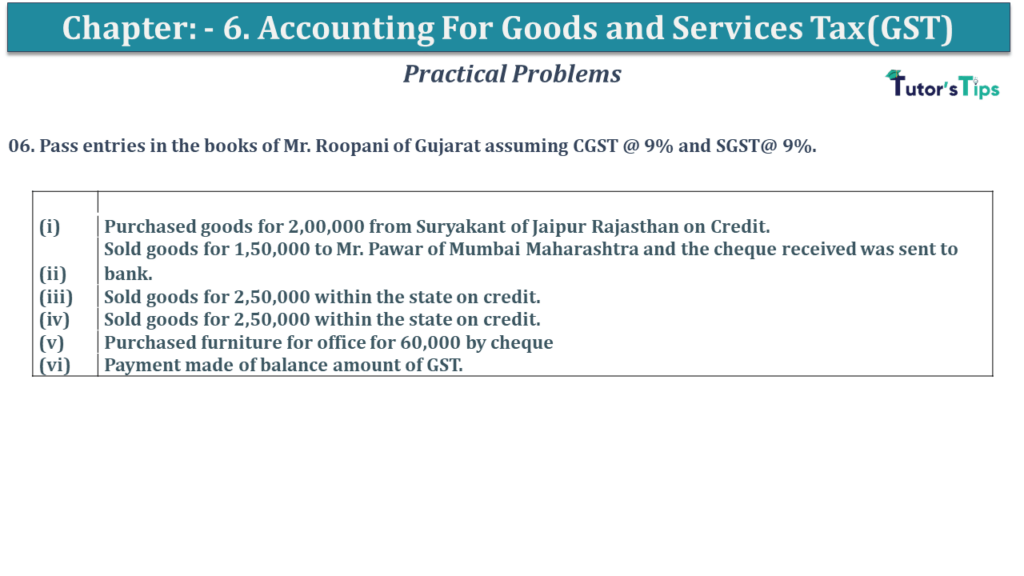

Question No 06 Chapter No 6 06. Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST@ 9%. (i) Purchased goods for 2,00,000 from Suryakant of Jaipur Rajasthan on Credit. (ii) Sold goods for Read More …

Advertisement

Question No 06 Chapter No 6 06. Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST@ 9%. (i) Purchased goods for 2,00,000 from Suryakant of Jaipur Rajasthan on Credit. (ii) Sold goods for Read More …

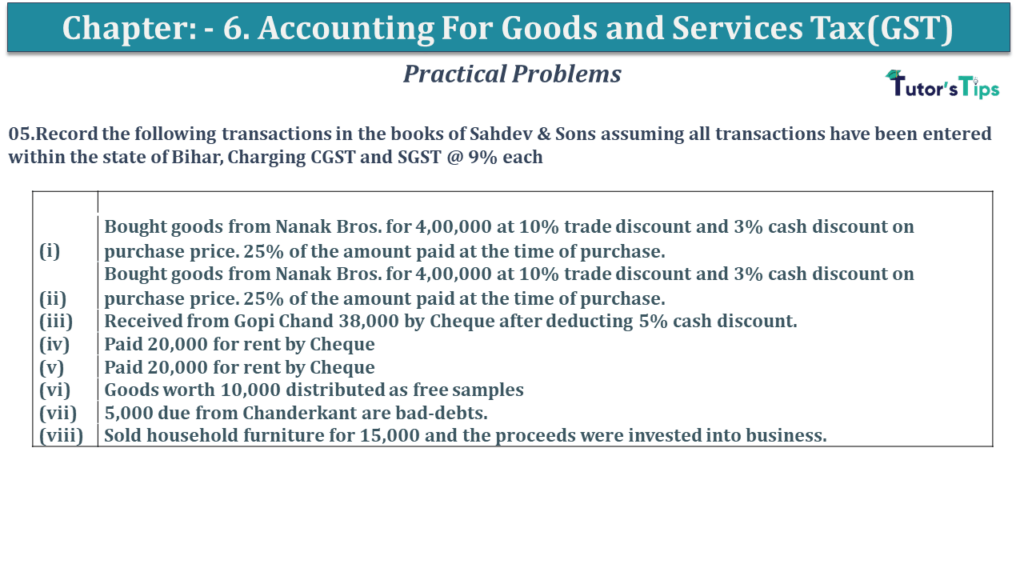

Question No 05 Chapter No 6 05.Record the following transactions in the books of Sahdev & Sons assuming all transactions have been entered within the state of Bihar, Charging CGST and SGST @ 9% each (i) Bought goods from Nanak Read More …

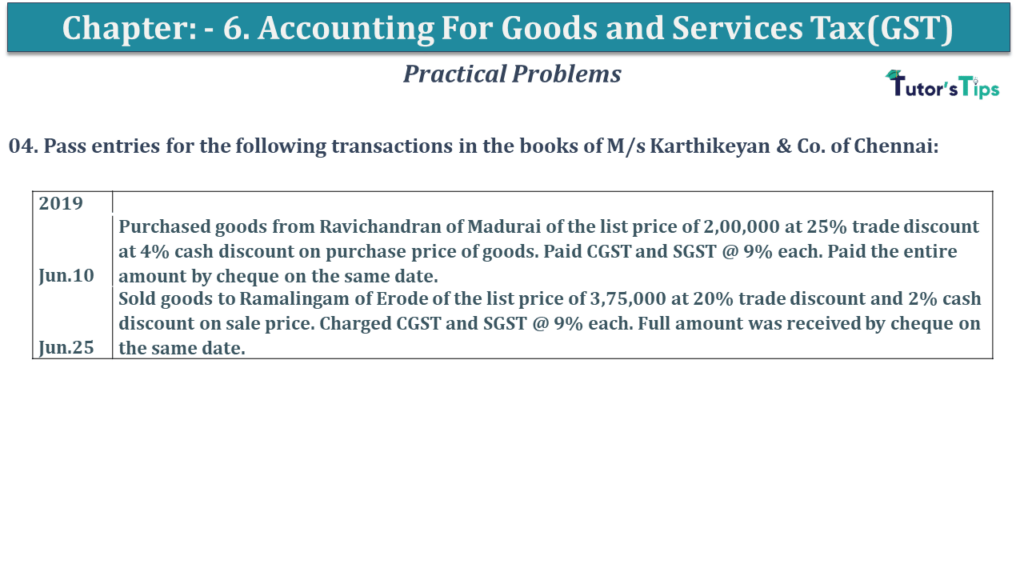

Question No 04 Chapter No 6 04. Pass entries for the following transactions in the books of M/s Karthikeyan & Co. of Chennai: 2019 Jun.10 Purchased goods from Ravichandran of Madurai of the list price of 2,00,000 at 25% Read More …

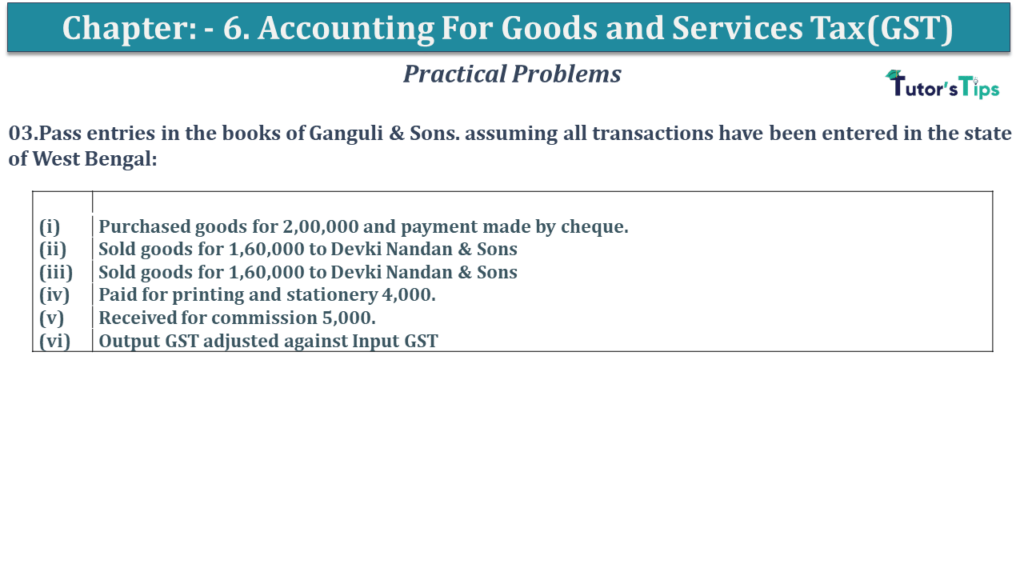

Question No 03 Chapter No 6 03.Pass entries in the books of Ganguli & Sons. assuming all transactions have been entered in the state of West Bengal: (i) Purchased goods for 2,00,000 and payment made by cheque. (ii) Sold goods Read More …

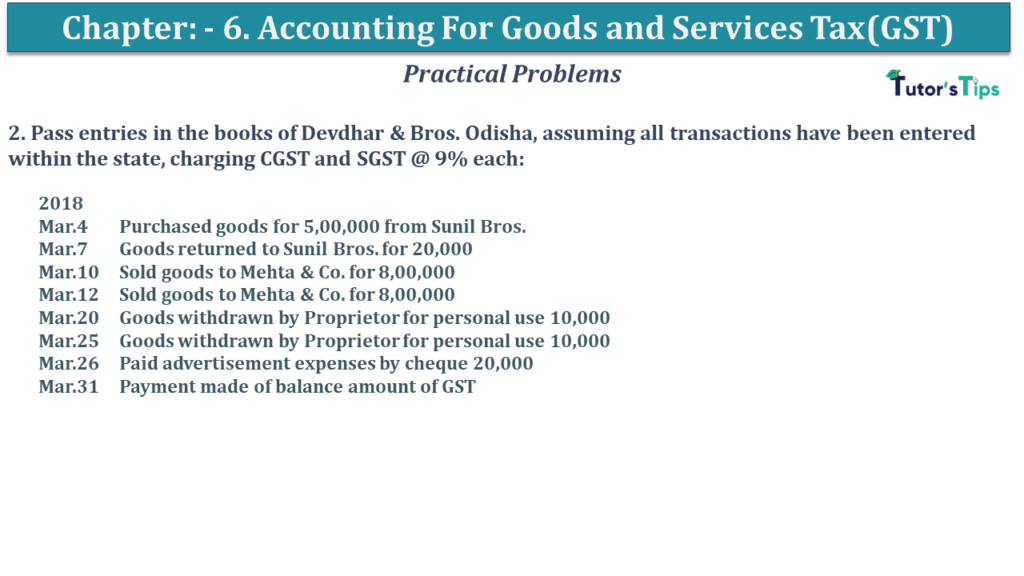

Question No 02 Chapter No 6 2. Pass entries in the books of Devdhar & Bros. Odisha, assuming all transactions have been entered within the state, charging CGST and SGST @ 9% each: 2018 Mar.4 Purchased goods for 5,00,000 Read More …

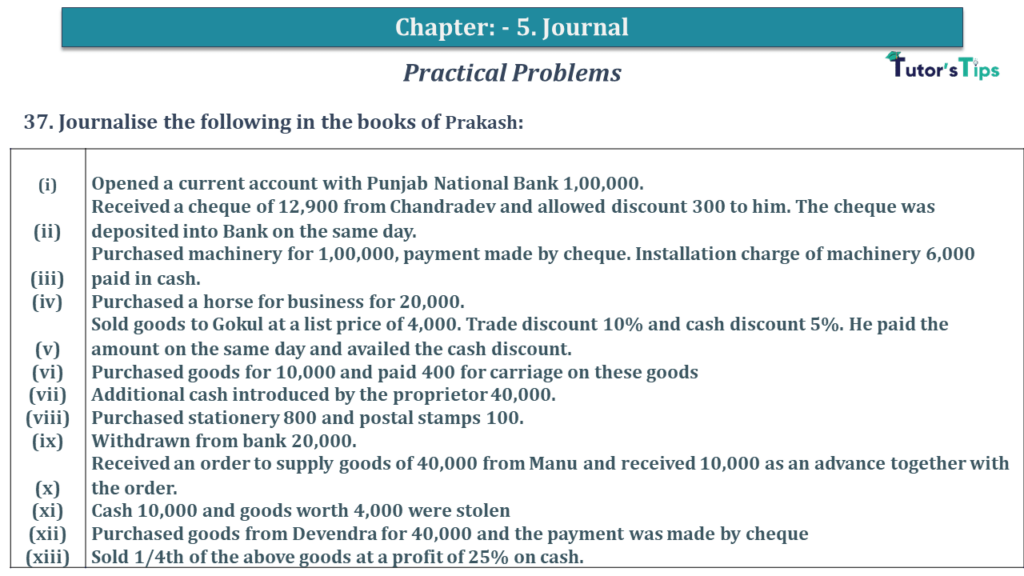

Question No 37 Chapter No 5 37. Journalise the following in the books of Prakash: (i) Opened a current account with Punjab National Bank 1,00,000. (ii) Received a cheque of 12,900 from Chandradev and allowed discount 300 to him. The Read More …

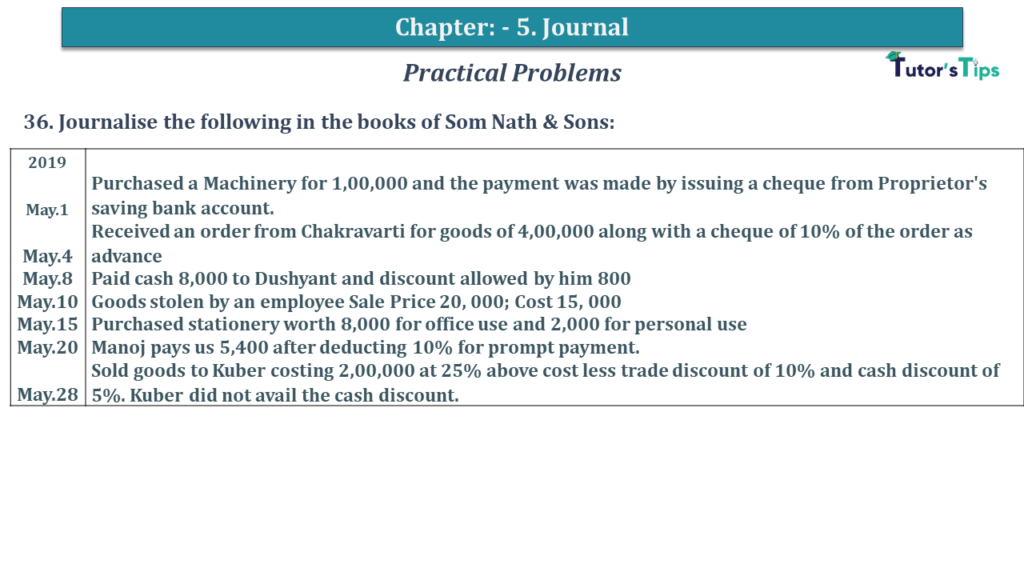

Question No 36 Chapter No 5 36. Journalise the following in the books of Som Nath & Sons: 2019 May.1 Purchased a Machinery for 1,00,000 and the payment was made by issuing a cheque from Proprietor’s saving bank account. Read More …

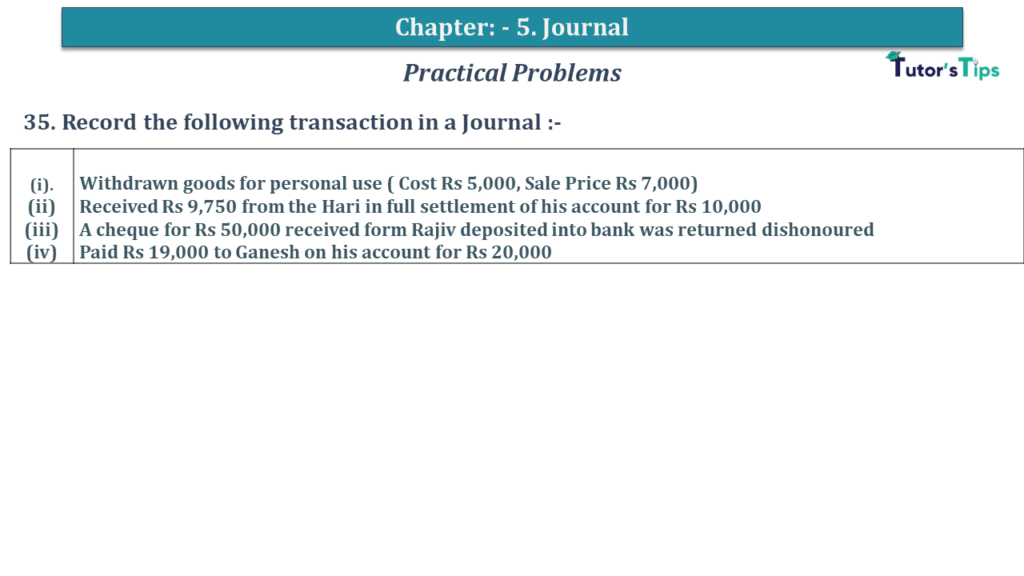

Question No 35 Chapter No 5 35. Record the following transaction in a Journal :- (i). Withdrawn goods for personal use ( Cost Rs 5,000, Sale Price Rs 7,000) (ii) Received Rs 9,750 from the Hari in full settlement of Read More …

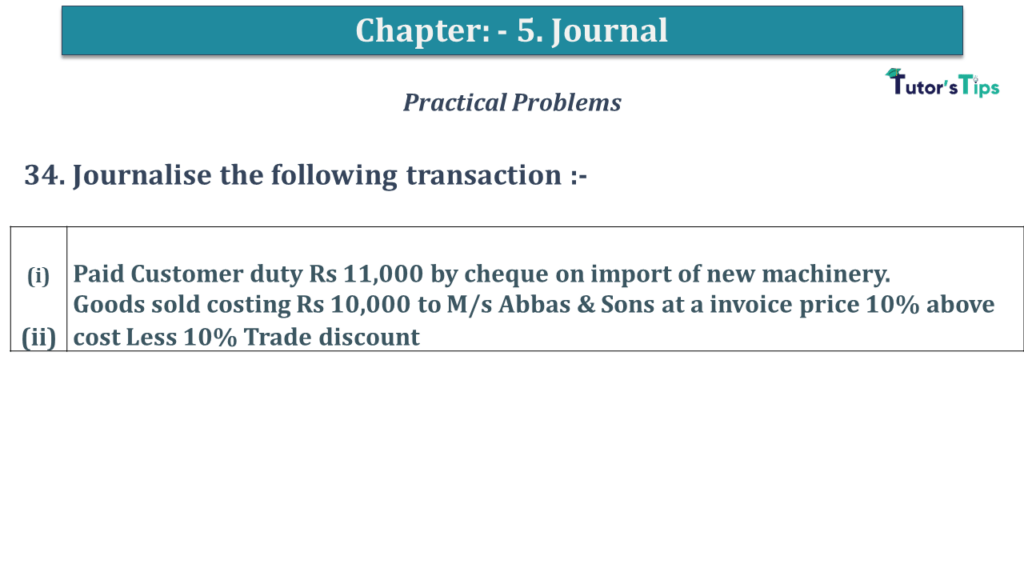

Question No 34 Chapter No 5 34. Journalise the following transaction:- (i) Paid Customer duty Rs 11,000 by cheque on import of new machinery. (ii) Goods sold costing Rs 10,000 to M/s Abbas & Sons at an invoice price 10% Read More …

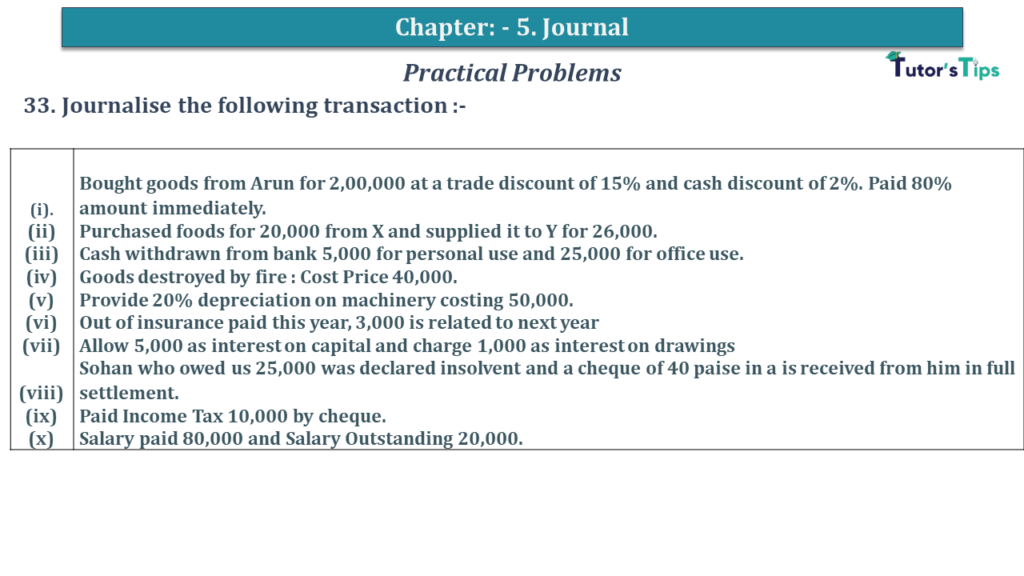

Question No 33 Chapter No 5 33. Journalise the following transaction :- (i). Bought goods from Arun for 2,00,000 at a trade discount of 15% and cash discount of 2%. Paid 80% amount immediately. (ii) Purchased foods for 20,000 from Read More …

Advertisement