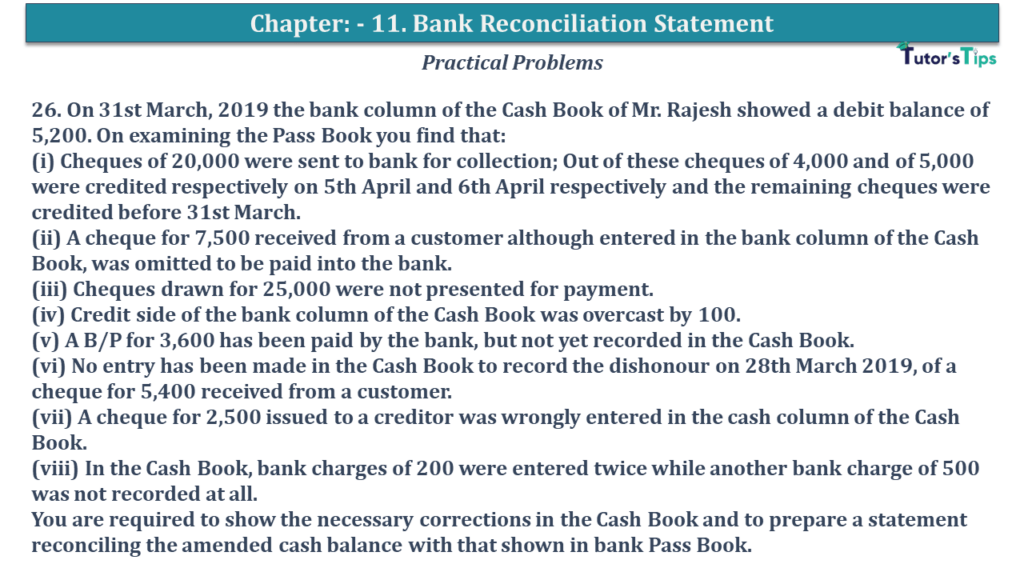

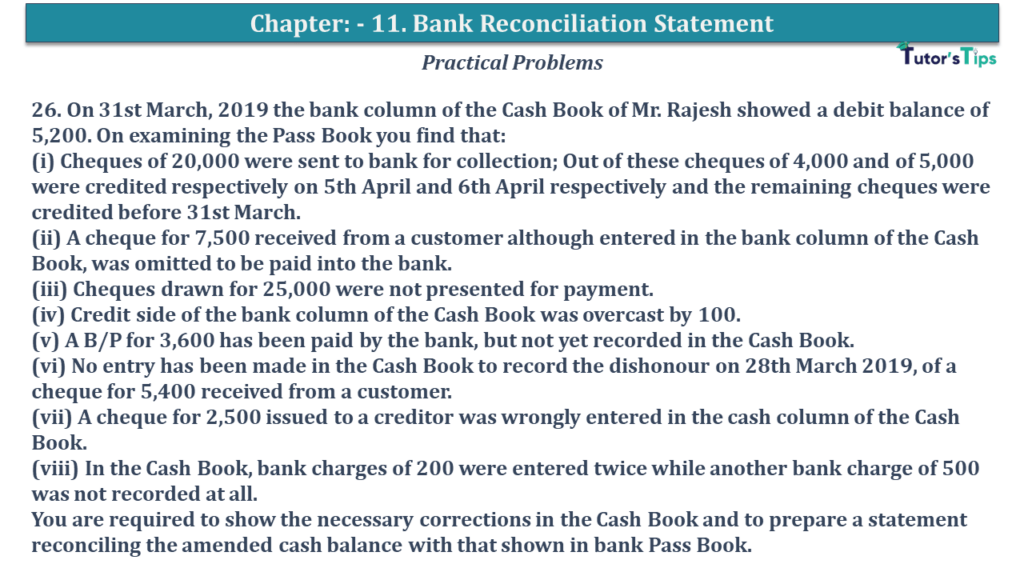

Question No 26 Chapter No 11 26. On 31st March 2019 the bank column of the Cash Book of Mr. Rajesh showed a debit balance of 5,200. On examining the Pass Book you find that:(i) Cheques of 20,000 were sent Read More …

Advertisement

Question No 26 Chapter No 11 26. On 31st March 2019 the bank column of the Cash Book of Mr. Rajesh showed a debit balance of 5,200. On examining the Pass Book you find that:(i) Cheques of 20,000 were sent Read More …

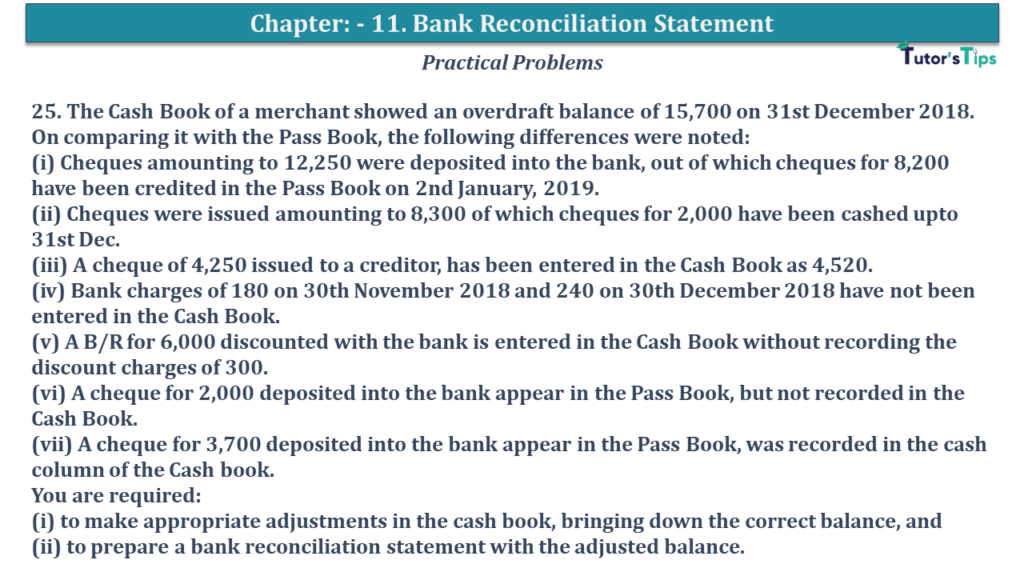

Question No 25 Chapter No 11 25. The Cash Book of a merchant showed an overdraft balance of 15,700 on 31st December 2018. On comparing it with the Pass Book, the following differences were noted:(i) Cheques amounting to 12,250 were Read More …

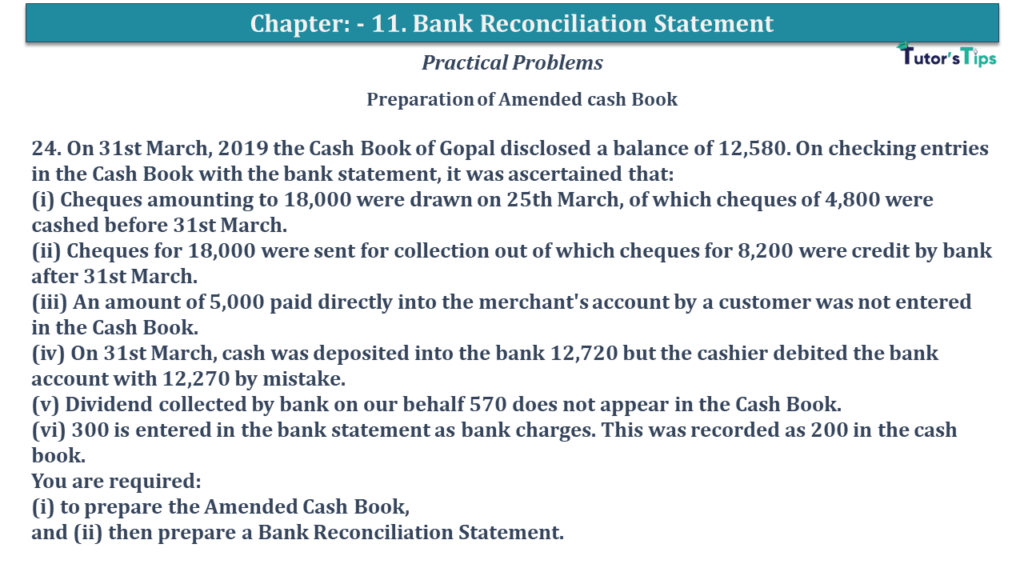

Question No 24 Chapter No 11 24. On 31st March 2019 the Cash Book of Gopal disclosed a balance of 12,580. On checking entries in the Cash Book with the bank statement, it was ascertained that: (i) Cheques amounting to Read More …

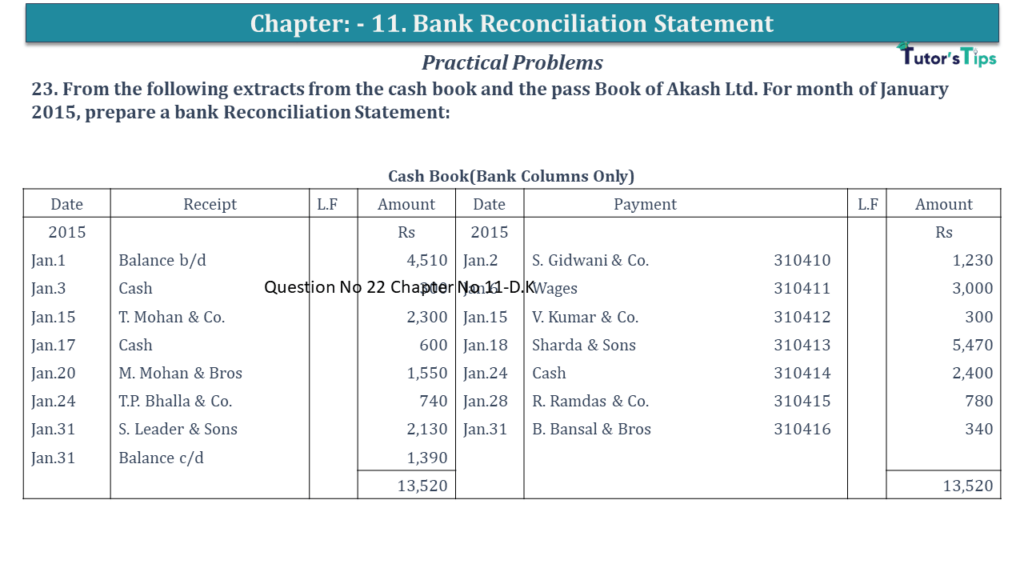

Question No 23 Chapter No 11 23. From the following extracts from the cash book and the pass Book of Akash Ltd. For month of January 2015, prepare a bank Reconciliation Statement: Cash Book(Bank Columns Only) Date Receipt L.F Amount Read More …

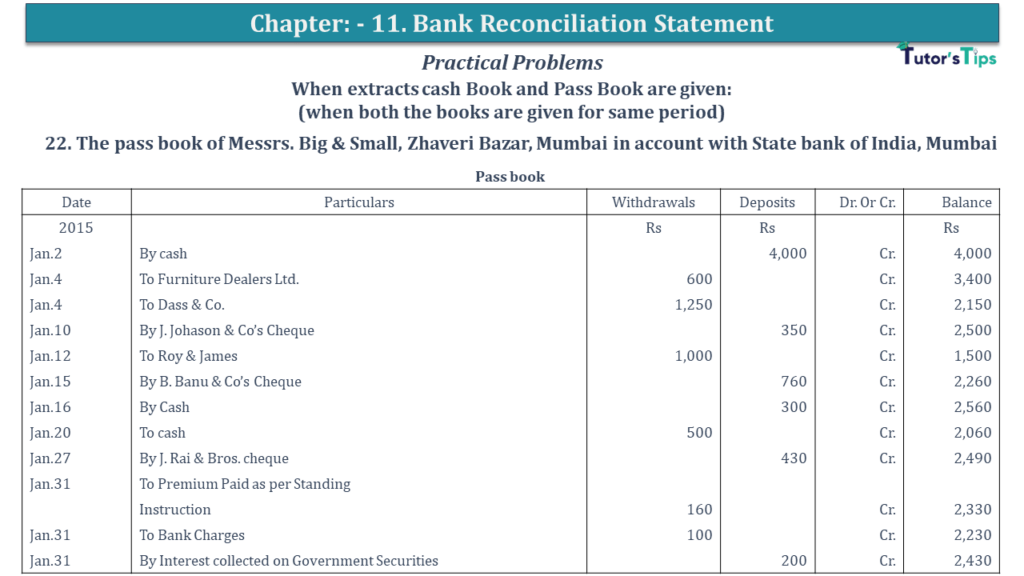

Question No 22 Chapter No 11-D.K 22. The passbook of Messrs. Big & Small, Zaveri Bazar, Mumbai in account with State bank of India, Mumbai Passbook Date Particulars Withdrawals Deposits Dr. Or Cr. Balance 2015 Rs Rs Rs Read More …

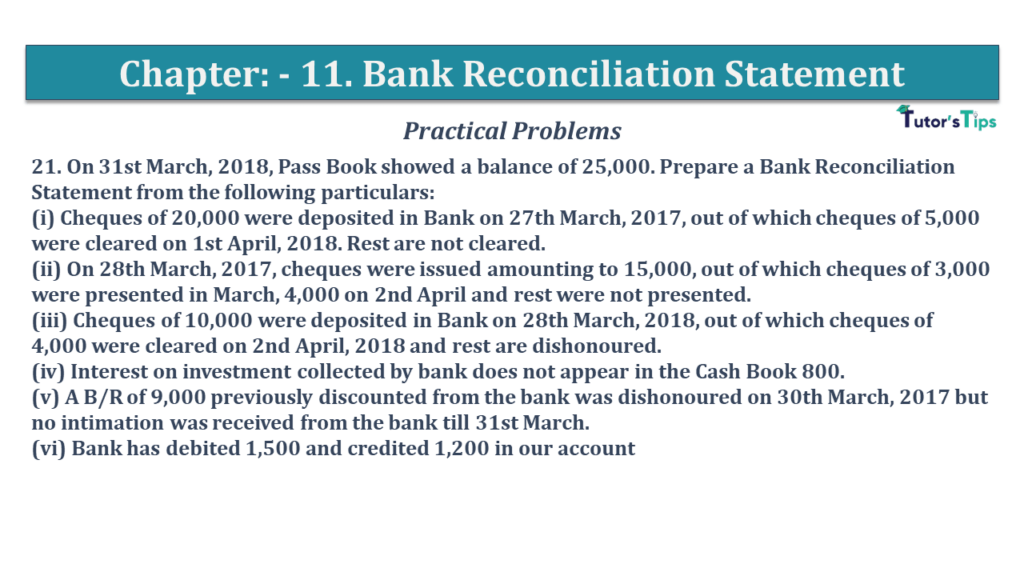

Question No 21 Chapter No 11 21. On 31st March 2018, Pass Book showed a balance of 25,000. Prepare a Bank Reconciliation Statement from the following particulars:(i) Cheques of 20,000 were deposited in Bank on 27th March 2017, out of Read More …

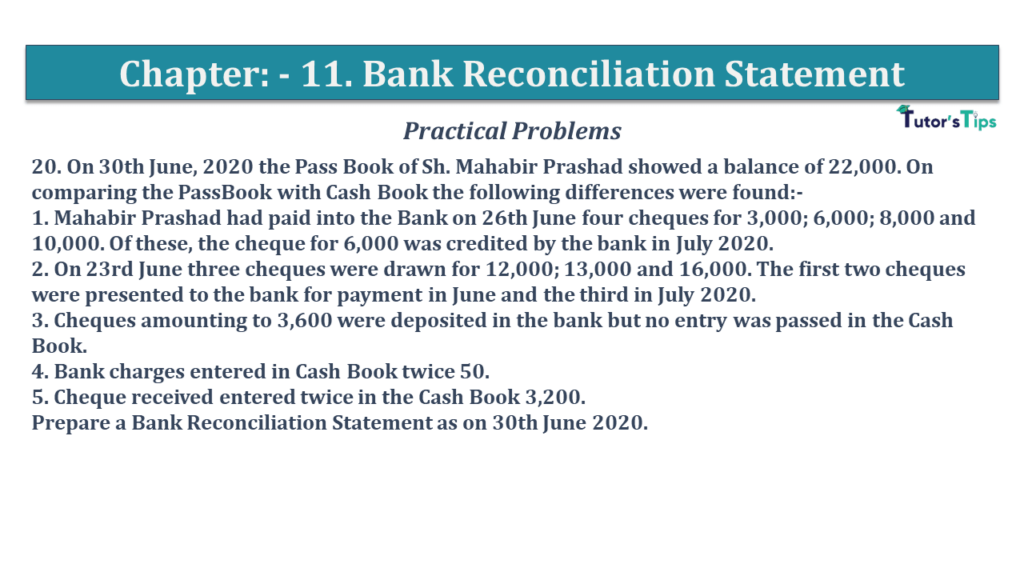

Question No 20 Chapter No 11 20. On 30th June, 2020 the Pass Book of Sh. Mahabir Prashad showed a balance of 22,000. On comparing the PassBook with Cash Book the following differences were found:-1. Mahabir Prashad had paid into Read More …

Question No 19 Chapter No 11 19.On 30th June 2014 Pass Book showed a balance of 5,200. Prepare Bank Reconciliation Statement from the following particulars:-I. Out of total cheques amounting to 16,000 deposited, cheques amounting to 9,000 were credited in Read More …

Question No 18 Chapter No 11 18. Prepare Bank Reconciliation Statement from the following particulars on June 30, 2017:Bank Statement showed a favorable balance of 9,214.(a) On 29th June, the bank credited the sum of 1,650 in error.(b) Certain cheques, Read More …

Question No 17 Chapter No 11 17. From the following particulars, prepare a Bank Reconciliation Statement of Sh. Yadav on 31st December 2019:-Balance as per Pass Book on 31st December, 2014 is 11,000. Cheques for 6,200 were issued during the Read More …

Advertisement