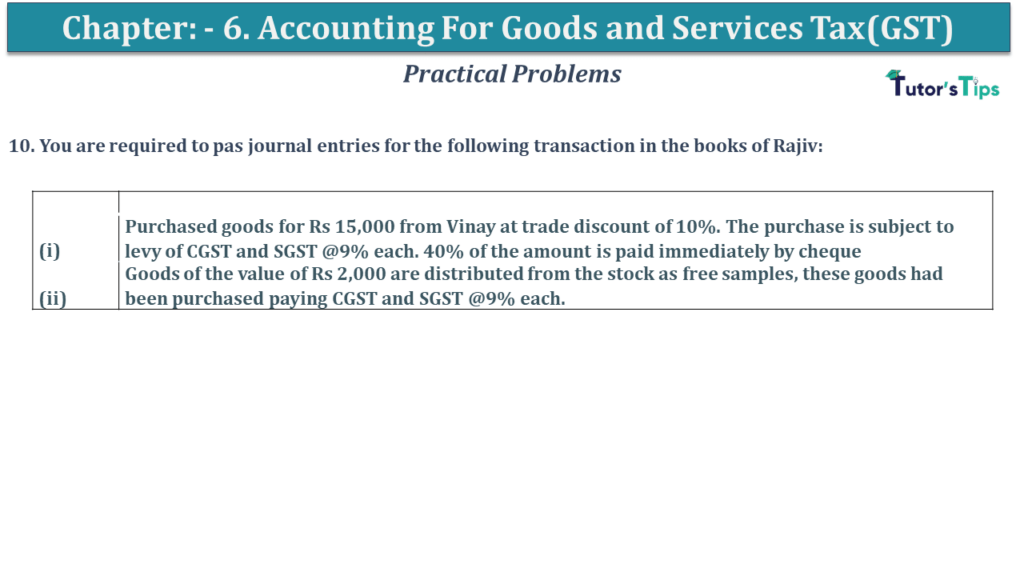

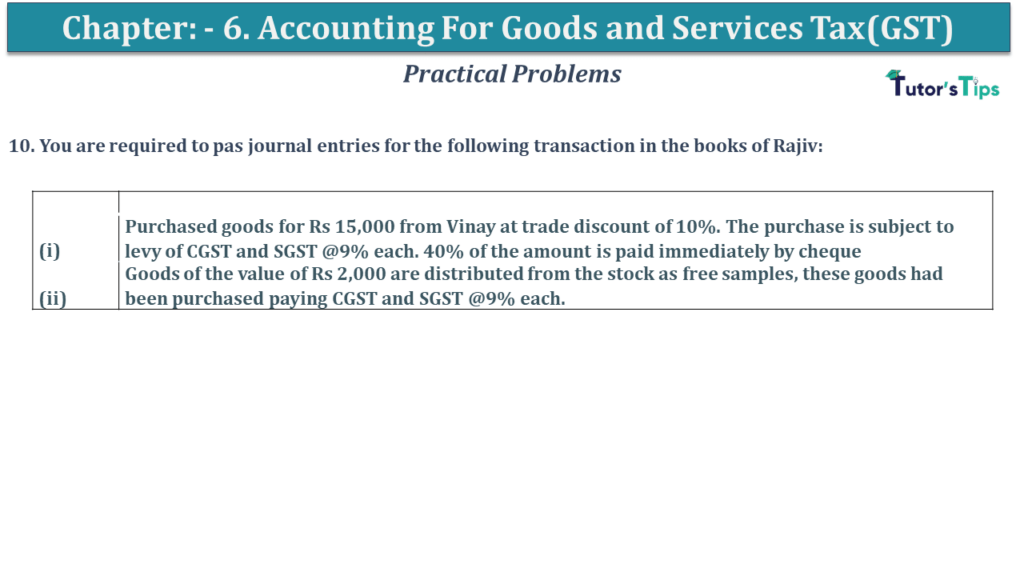

Question No 10 Chapter No 6 10. You are required to pass journal entries for the following transaction in the books of Rajiv: (i) Purchased goods for Rs 15,000 from Vinay at a trade discount of 10%. The purchase is Read More …

Advertisement

Question No 10 Chapter No 6 10. You are required to pass journal entries for the following transaction in the books of Rajiv: (i) Purchased goods for Rs 15,000 from Vinay at a trade discount of 10%. The purchase is Read More …

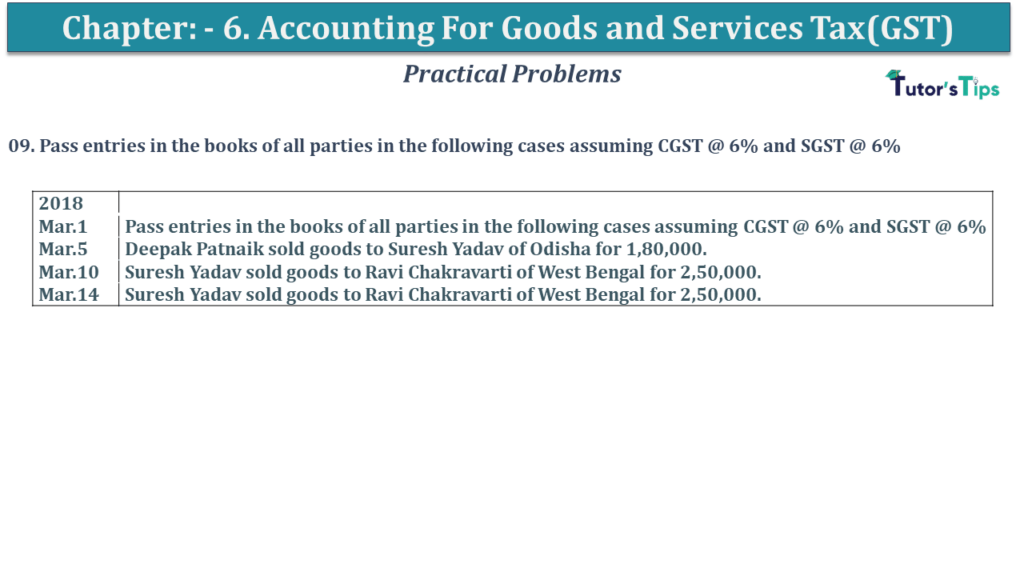

Question No 09 Chapter No 6 09. Pass entries in the books of all parties in the following cases assuming CGST @ 6% and SGST @ 6% 2018 Mar.1 Pass entries in the books of all parties in the Read More …

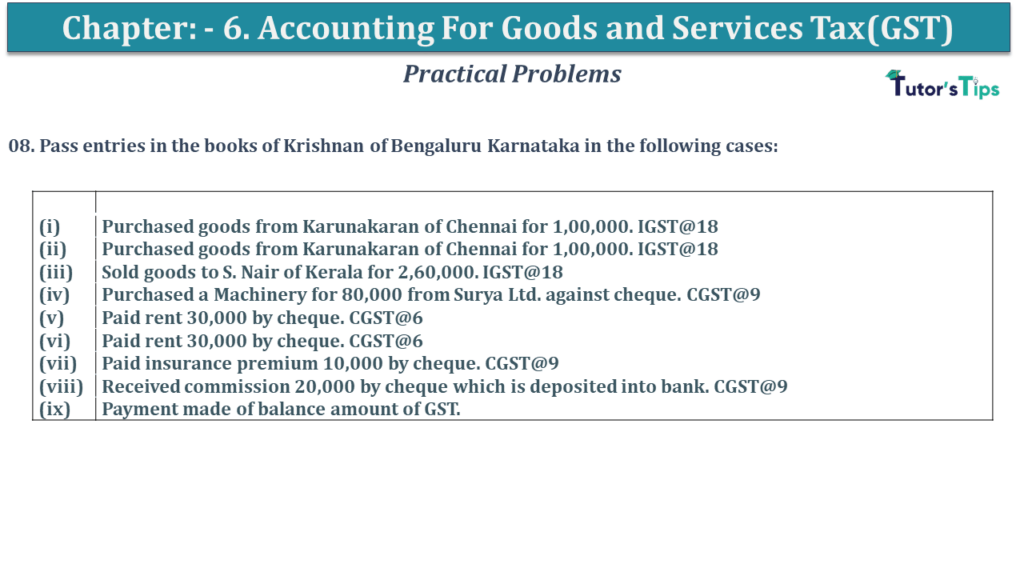

Question No 08 Chapter No 6 08. Pass entries in the books of Krishnan of Bengaluru Karnataka in the following cases: (i) Purchased goods from Karunakaran of Chennai for 1,00,000. IGST@18 (ii) Purchased goods from Karunakaran of Chennai for 1,00,000. Read More …

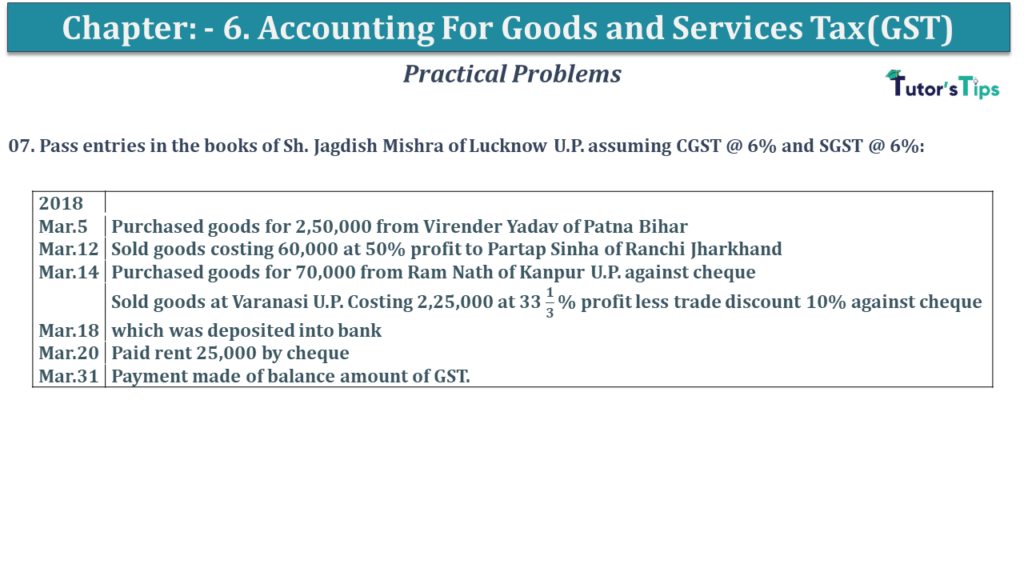

Question No 07 Chapter No 6 07. Pass entries in the books of Sh. Jagdish Mishra of Lucknow U.P. assuming CGST @ 6% and SGST @ 6%: 2018 Mar.5 Purchased goods for 2,50,000 from Virender Yadav of Patna Bihar Read More …

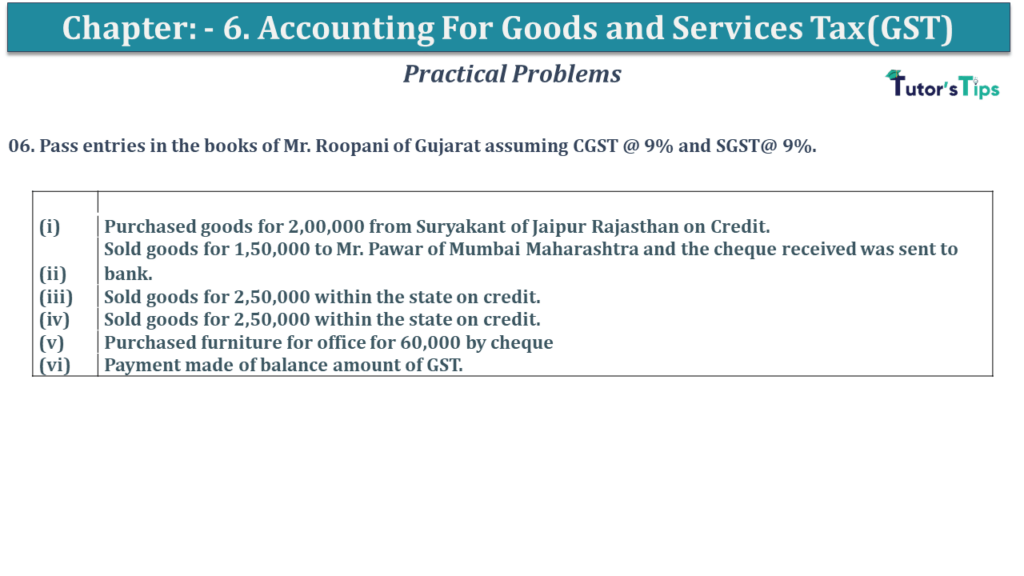

Question No 06 Chapter No 6 06. Pass entries in the books of Mr. Roopani of Gujarat assuming CGST @ 9% and SGST@ 9%. (i) Purchased goods for 2,00,000 from Suryakant of Jaipur Rajasthan on Credit. (ii) Sold goods for Read More …

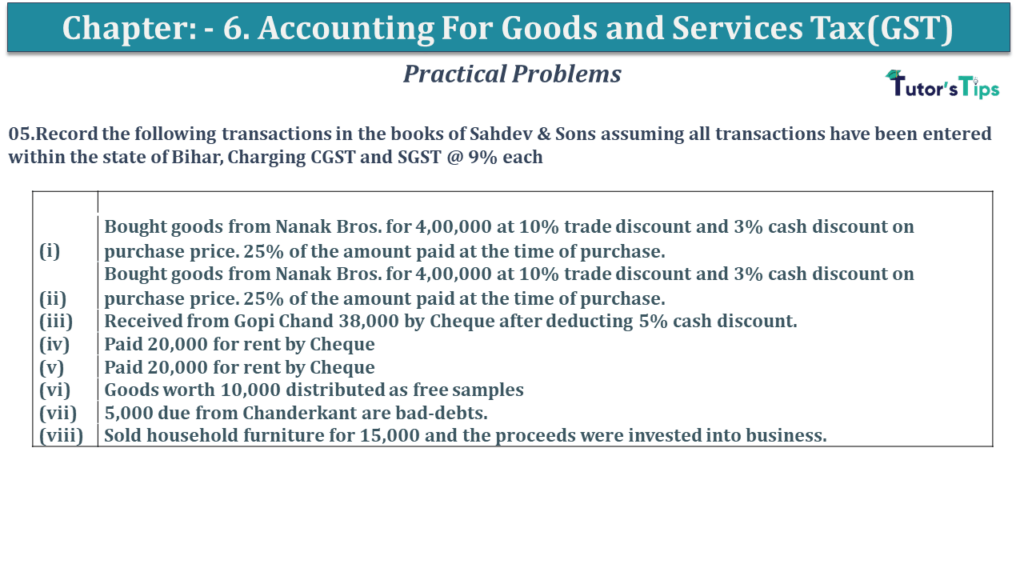

Question No 05 Chapter No 6 05.Record the following transactions in the books of Sahdev & Sons assuming all transactions have been entered within the state of Bihar, Charging CGST and SGST @ 9% each (i) Bought goods from Nanak Read More …

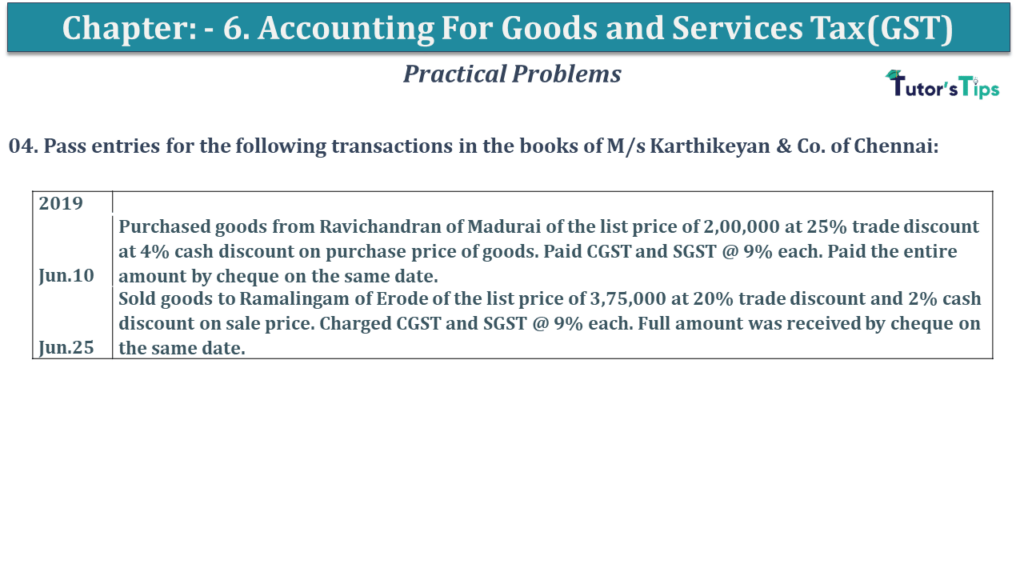

Question No 04 Chapter No 6 04. Pass entries for the following transactions in the books of M/s Karthikeyan & Co. of Chennai: 2019 Jun.10 Purchased goods from Ravichandran of Madurai of the list price of 2,00,000 at 25% Read More …

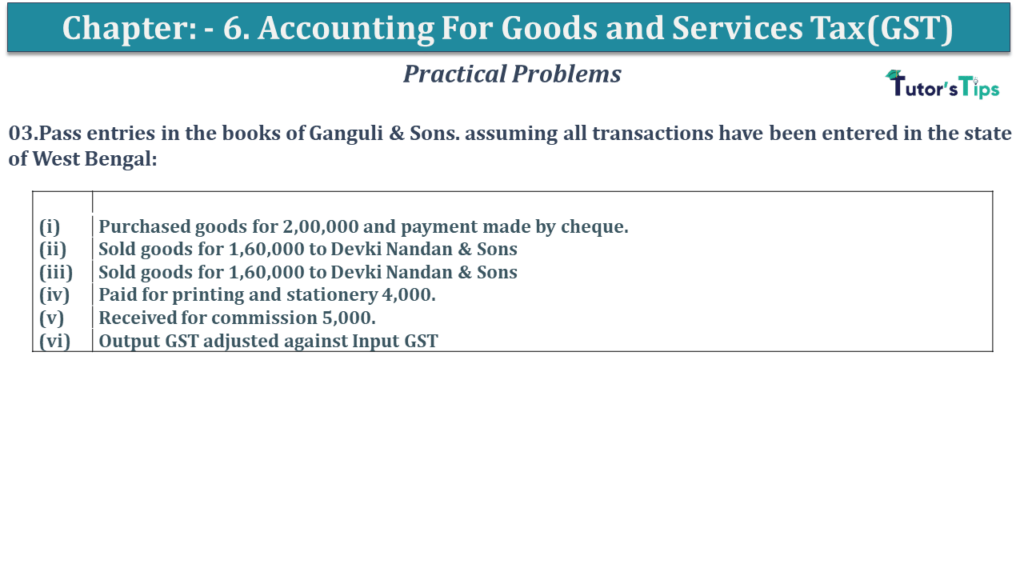

Question No 03 Chapter No 6 03.Pass entries in the books of Ganguli & Sons. assuming all transactions have been entered in the state of West Bengal: (i) Purchased goods for 2,00,000 and payment made by cheque. (ii) Sold goods Read More …

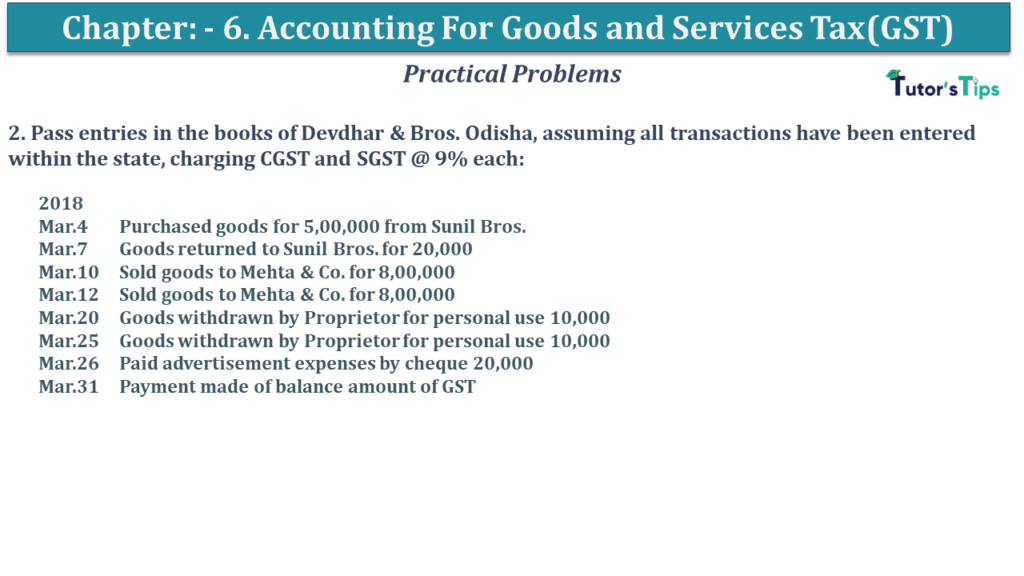

Question No 02 Chapter No 6 2. Pass entries in the books of Devdhar & Bros. Odisha, assuming all transactions have been entered within the state, charging CGST and SGST @ 9% each: 2018 Mar.4 Purchased goods for 5,00,000 Read More …

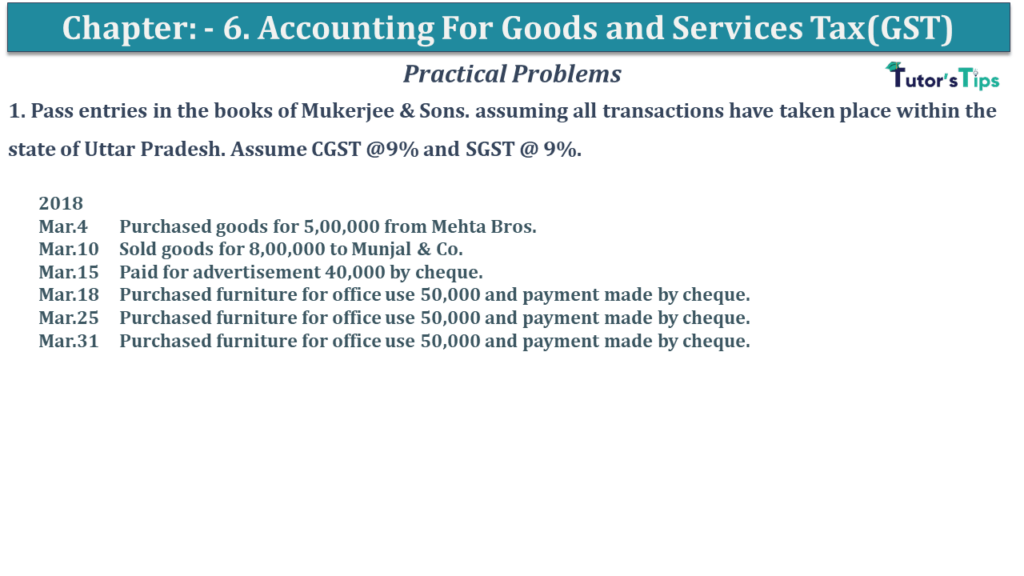

Question No 01 Chapter No 6 1. Pass entries in the books of Mukerjee & Sons. assuming all transactions have taken place within the state of Uttar Pradesh. Assume CGST @9% and SGST @ 9%. 2018 Mar.4 Purchased goods Read More …

Advertisement