Question No 07 Chapter No 19 07. Calculate the gross profit and cost of goods sold from the following information: Net Sales 9,00,000 Gross Profit is 20% on cost. The solution of Question No 07 Chapter No 19: – Gross Read More …

Advertisement

Question No 07 Chapter No 19 07. Calculate the gross profit and cost of goods sold from the following information: Net Sales 9,00,000 Gross Profit is 20% on cost. The solution of Question No 07 Chapter No 19: – Gross Read More …

Question No 06 B Chapter No 19 06.(b) Calculate gross profit and cost of goods sold from the following information: Net Sales 12,000 Gross Profit 33 1/3 % on Sales The solution of Question No 06 B Chapter No 19: Read More …

Question No 06 A Chapter No 19 06(a). Calculate gross profit and cost of goods sold from the following information: Net Sales 8,00,000 Gross Profit is 40% on Sales The solution of Question No 06 A Chapter No 19: – Gross Read More …

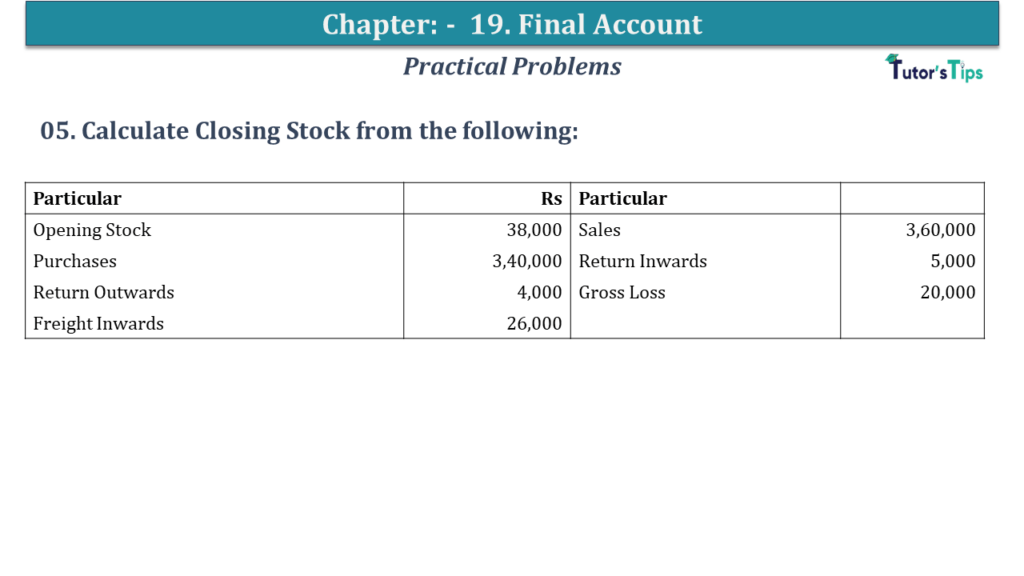

Question No 05 Chapter No 19 05. Calculate Closing Stock from the following: Particular Rs Particular Opening Stock 38,000 Sales 3,60,000 Purchases 3,40,000 Return Inwards 5,000 Return Outwards 4,000 Gross Loss 20,000 Freight Inwards 26,000 The solution Read More …

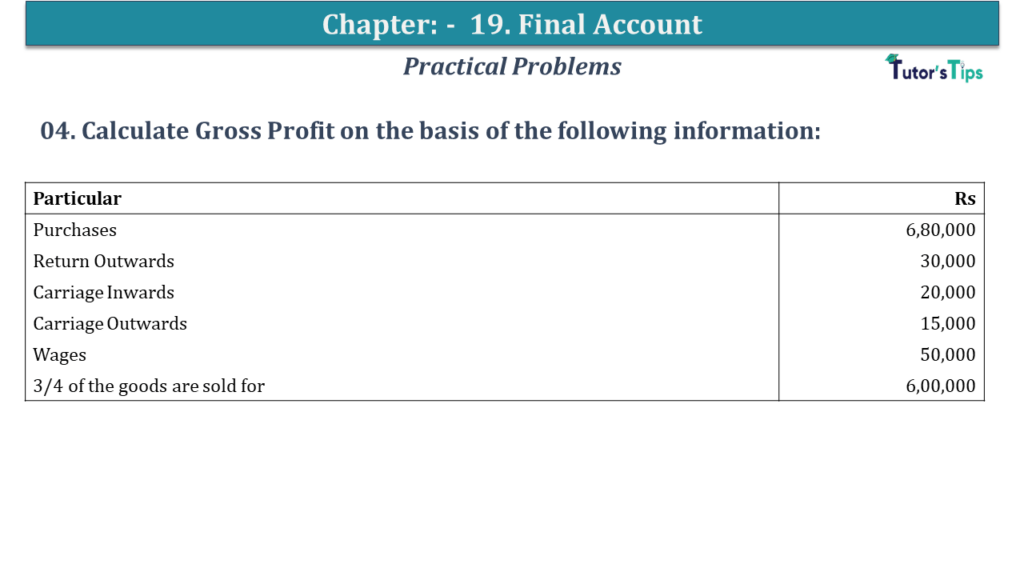

Question No 04 Chapter No 19 04. Calculate Gross Profit on the basis of the following information: Particular Rs Purchases 6,80,000 Return Outwards 30,000 Carriage Inwards 20,000 Carriage Outwards 15,000 Wages 50,000 3/4 of the goods are sold for 6,00,000 Read More …

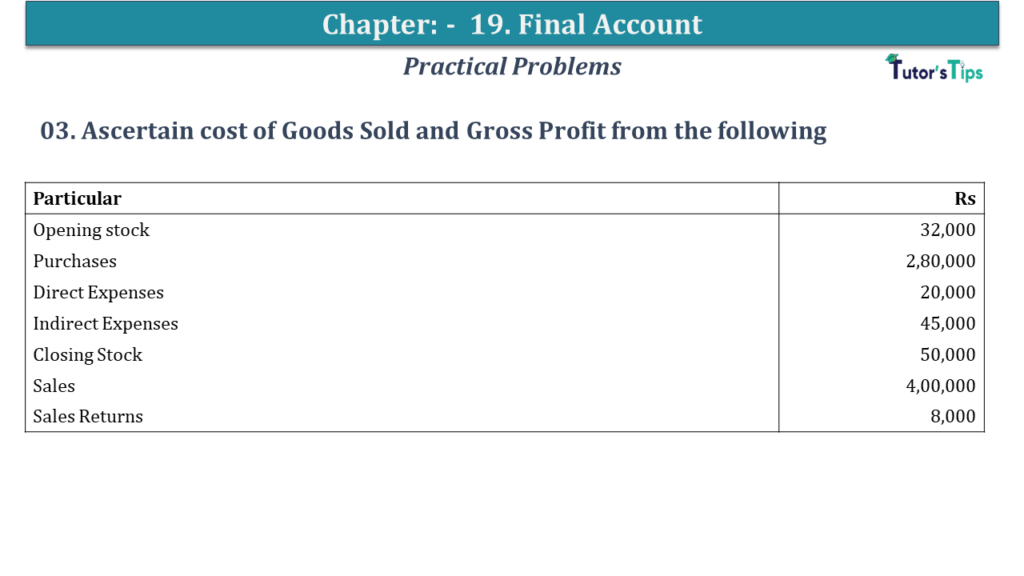

Question No 03 Chapter No 19 03. Ascertain cost of Goods Sold and Gross Profit from the following Particular Rs Opening stock 32,000 Purchases 2,80,000 Direct Expenses 20,000 Indirect Expenses 45,000 Closing Stock 50,000 Sales 4,00,000 Sales Returns 8,000 The Read More …

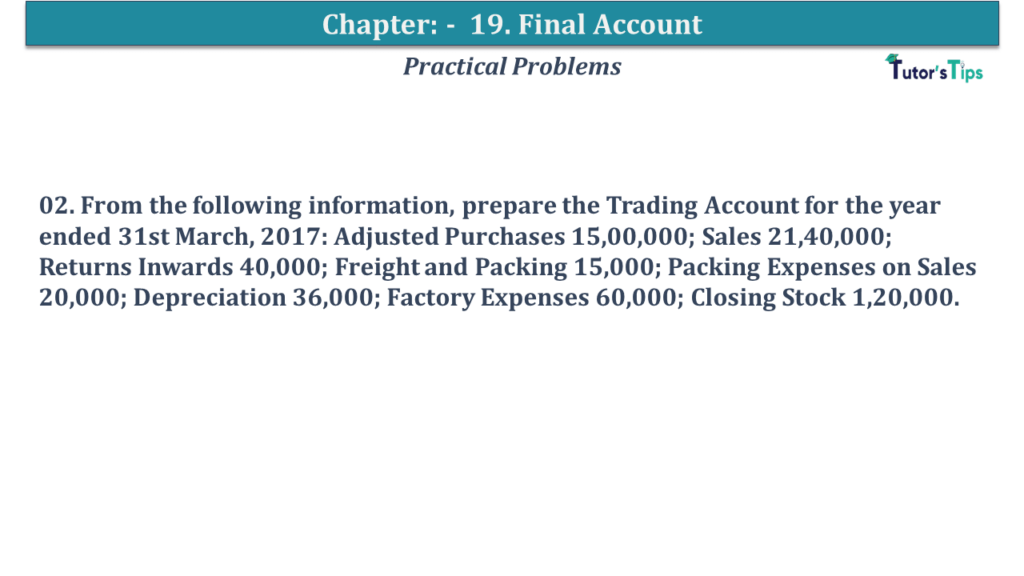

Question No 02 Chapter No 19 02. From the following information, prepare the Trading Account for the year ended 31st March, 2017: Adjusted Purchases 15,00,000; Sales 21,40,000; Returns Inwards 40,000; Freight and Packing 15,000; Packing Expenses on Sales 20,000; Depreciation Read More …

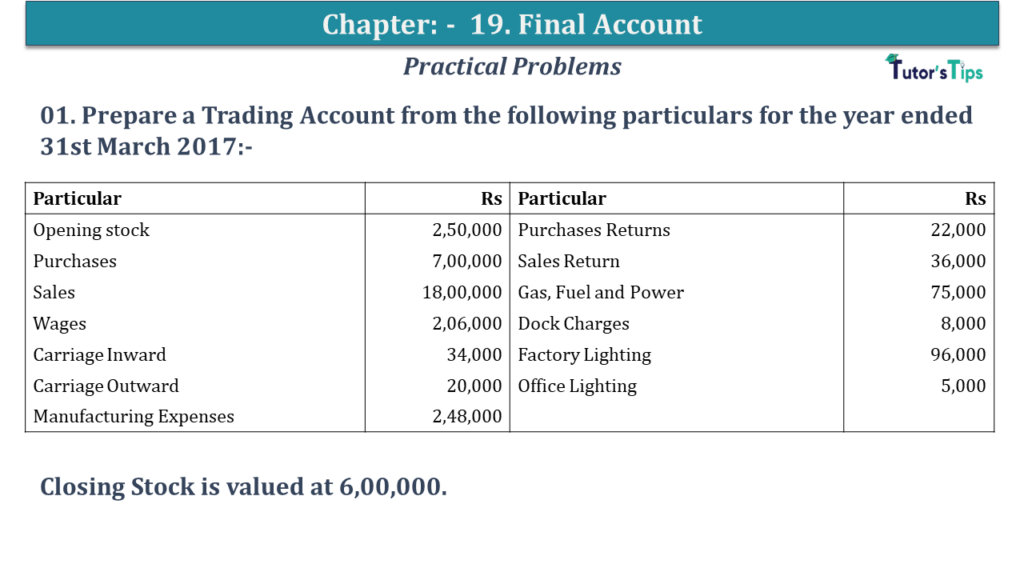

Question No 01 Chapter No 19 01. Prepare a Trading Account from the following particulars for the year ended 31st March 2017:- Particular Rs Particular Rs Opening stock 2,50,000 Purchases Returns 22,000 Purchases 7,00,000 Sales Return 36,000 Sales 18,00,000 Gas, Read More …

Advertisement