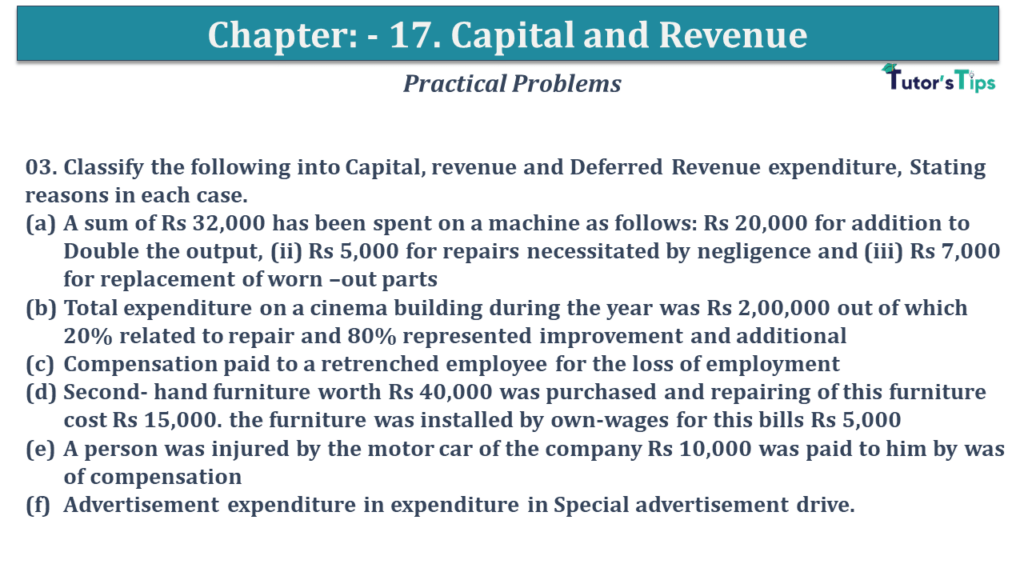

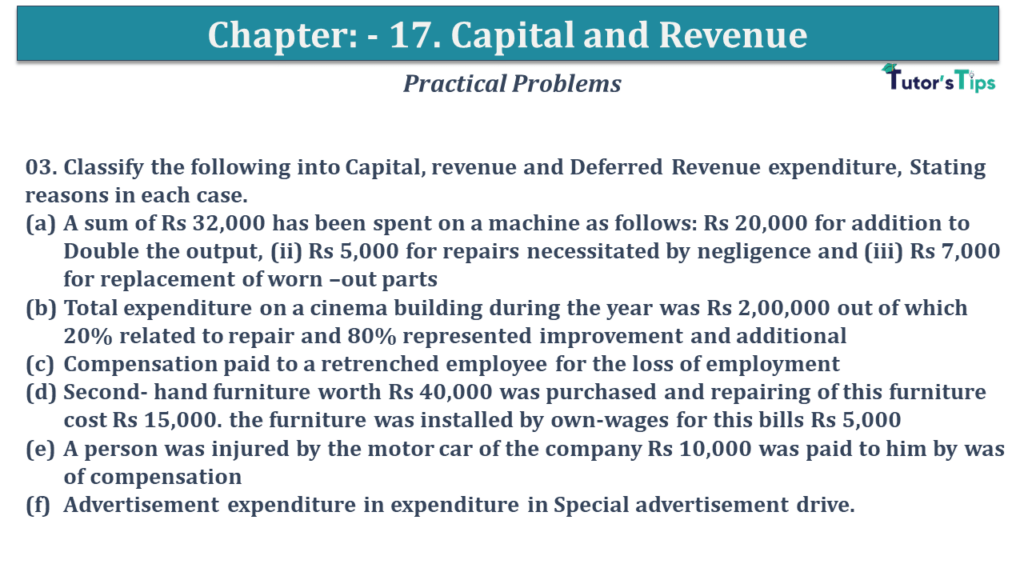

Question No 03 Chapter No 17 03. Classify the following into Capital, revenue and Deferred Revenue expenditure, Stating reasons in each case. A sum of Rs 32,000 has been spent on a machine as follows: Rs 20,000 for addition to Read More …

Advertisement

Question No 03 Chapter No 17 03. Classify the following into Capital, revenue and Deferred Revenue expenditure, Stating reasons in each case. A sum of Rs 32,000 has been spent on a machine as follows: Rs 20,000 for addition to Read More …

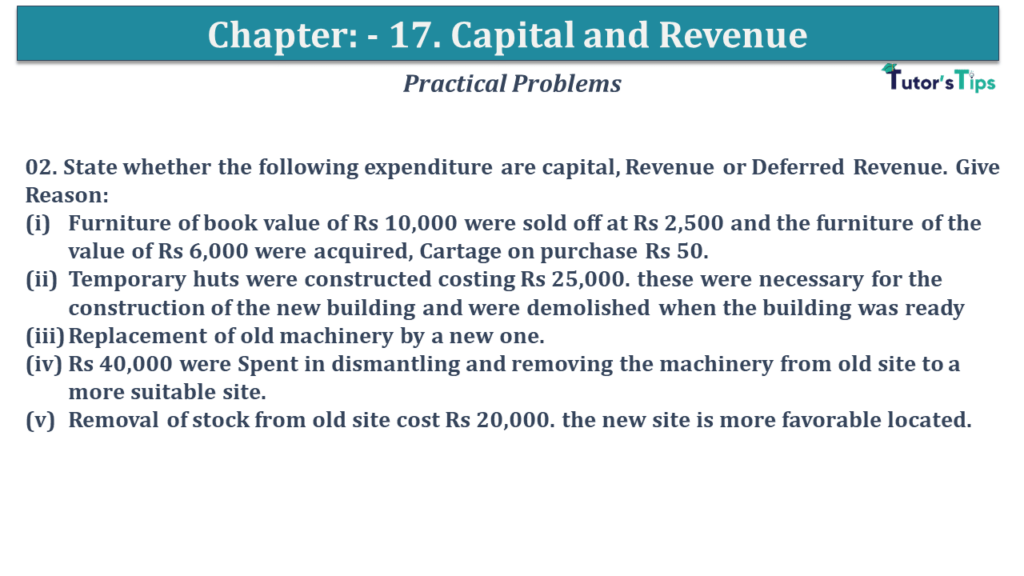

Question No 02 Chapter No 17 02. State whether the following expenditure are capital, Revenue or Deferred Revenue. Give Reason: Furniture of book value of Rs 10,000 were sold off at Rs 2,500 and the furniture of the value of Read More …

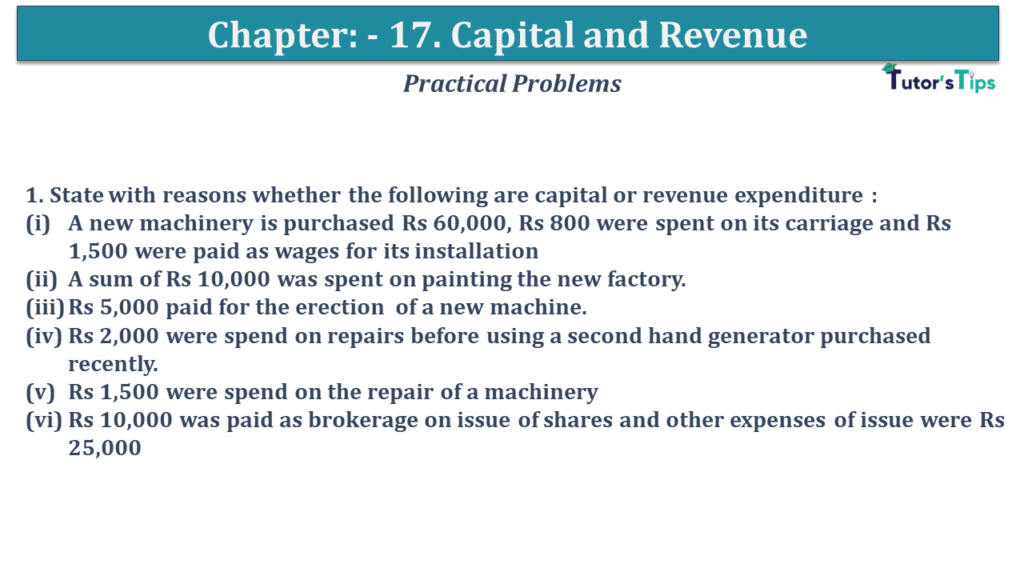

Question No 01 Chapter No 17 1. State with reasons whether the following are capital or revenue expenditure : A new machinery is purchased Rs 60,000, Rs 800 were spent on its carriage and Rs 1,500 were paid as wages Read More …

Advertisement