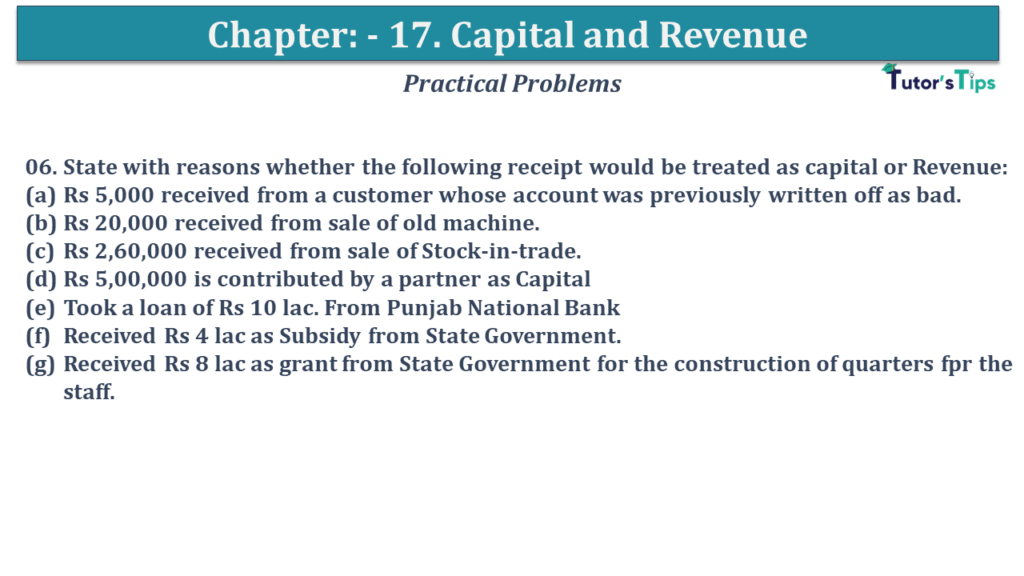

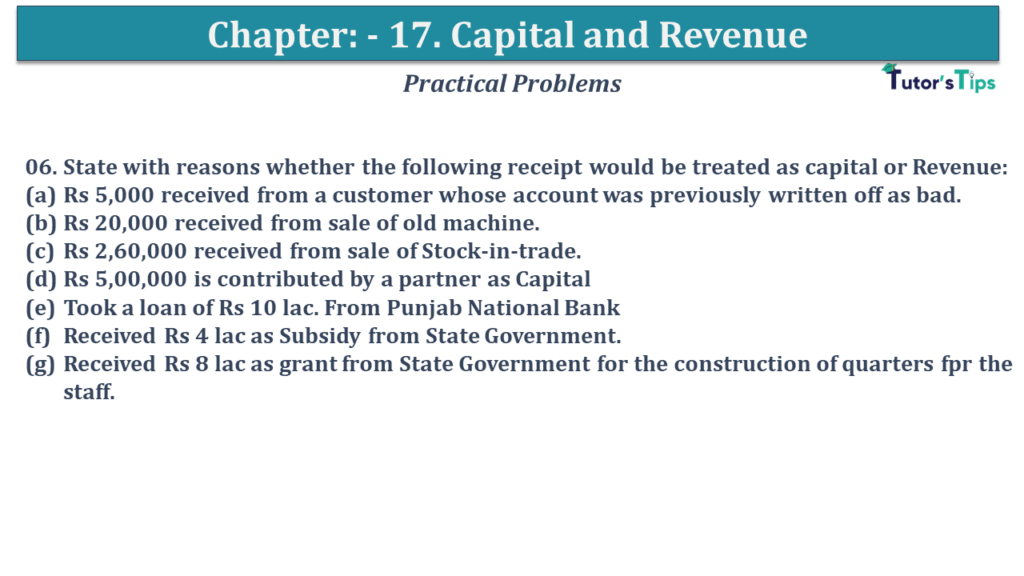

Question No 06 Chapter No 17 06. State with reasons whether the following receipt would be treated as capital or Revenue: Rs 5,000 received from a customer whose account was previously written off as bad. Rs 20,000 received from sale Read More …

Advertisement

Question No 06 Chapter No 17 06. State with reasons whether the following receipt would be treated as capital or Revenue: Rs 5,000 received from a customer whose account was previously written off as bad. Rs 20,000 received from sale Read More …

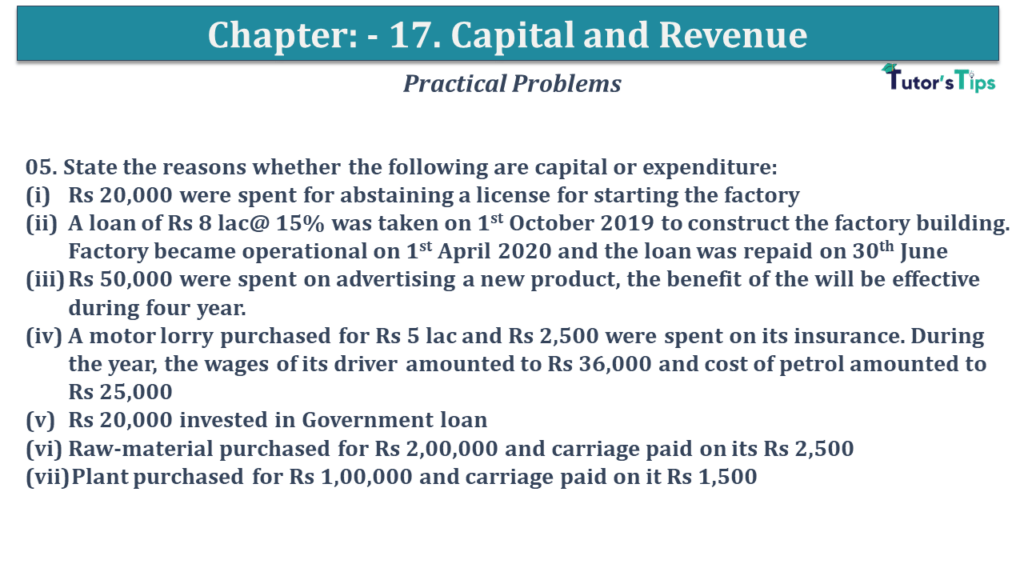

Question No 05 Chapter No 17 05. State the reasons whether the following are capital or expenditure: Rs 20,000 were spent for abstaining a license for starting the factory A loan of Rs 8 lac@ 15% was taken on 1st Read More …

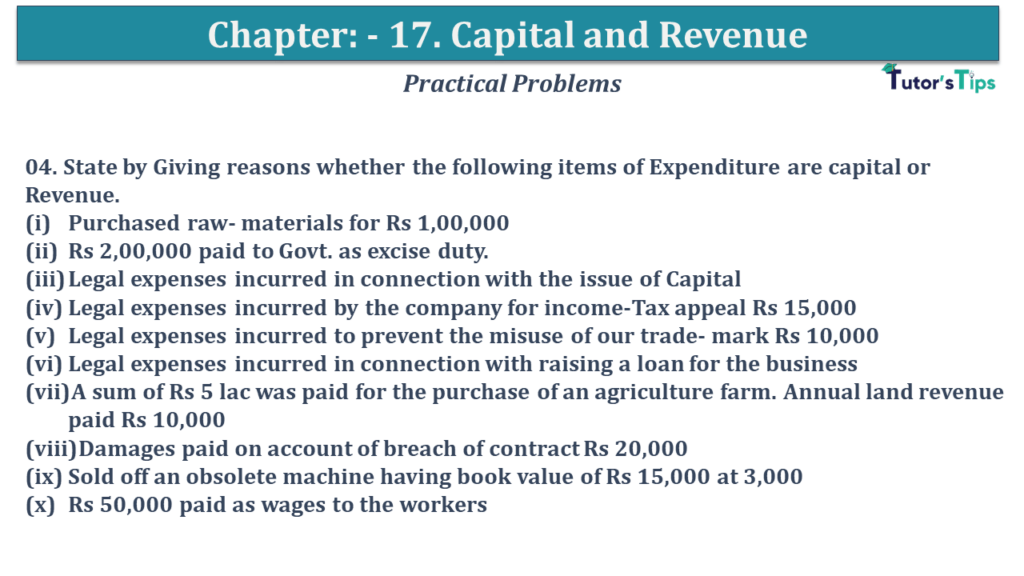

Question No 04 Chapter No 17 04. State by Giving reasons whether the following items of Expenditure are capital or Revenue. Purchased raw- materials for Rs 1,00,000 Rs 2,00,000 paid to Govt. as excise duty. Legal expenses incurred in connection Read More …

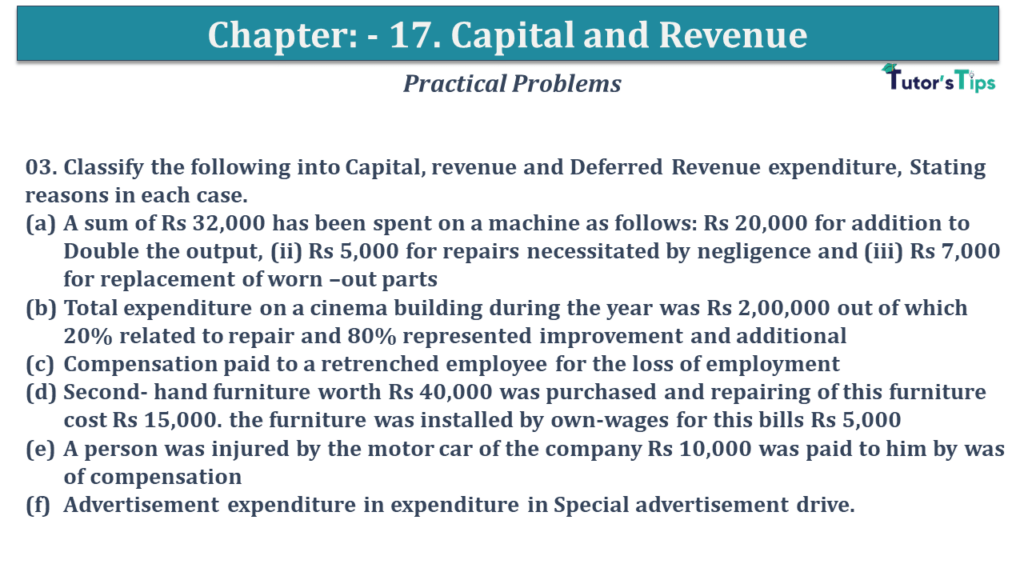

Question No 03 Chapter No 17 03. Classify the following into Capital, revenue and Deferred Revenue expenditure, Stating reasons in each case. A sum of Rs 32,000 has been spent on a machine as follows: Rs 20,000 for addition to Read More …

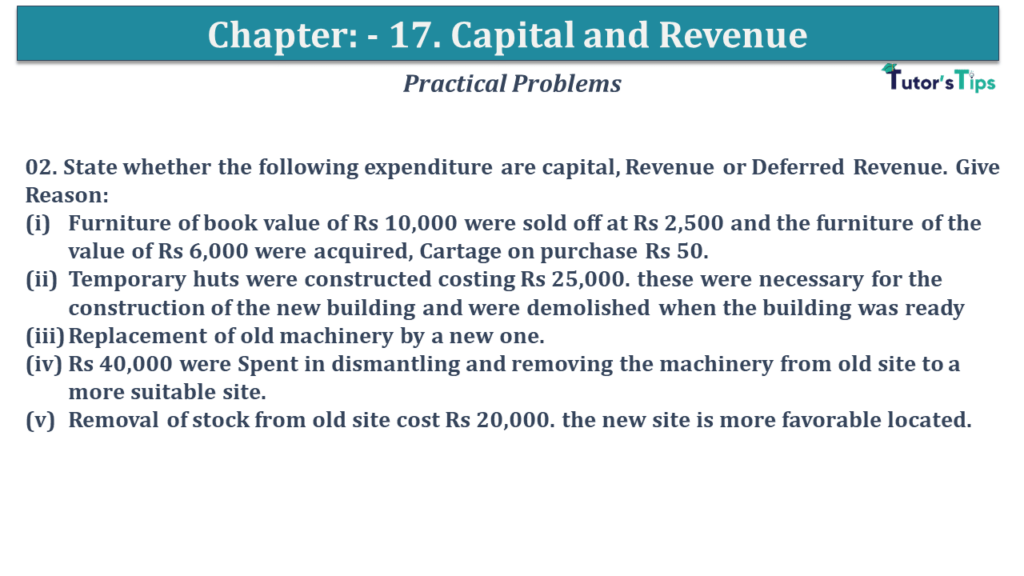

Question No 02 Chapter No 17 02. State whether the following expenditure are capital, Revenue or Deferred Revenue. Give Reason: Furniture of book value of Rs 10,000 were sold off at Rs 2,500 and the furniture of the value of Read More …

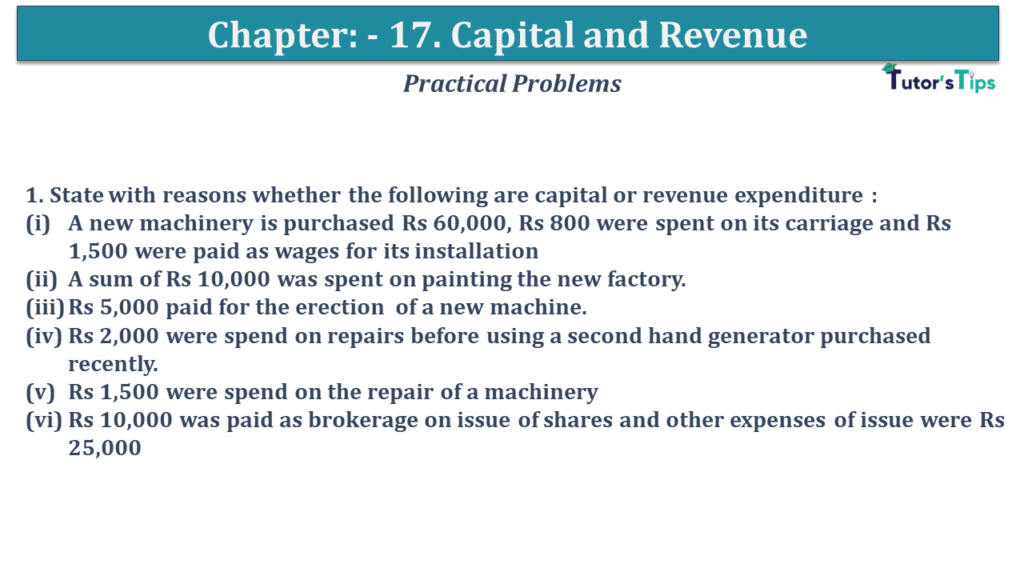

Question No 01 Chapter No 17 1. State with reasons whether the following are capital or revenue expenditure : A new machinery is purchased Rs 60,000, Rs 800 were spent on its carriage and Rs 1,500 were paid as wages Read More …

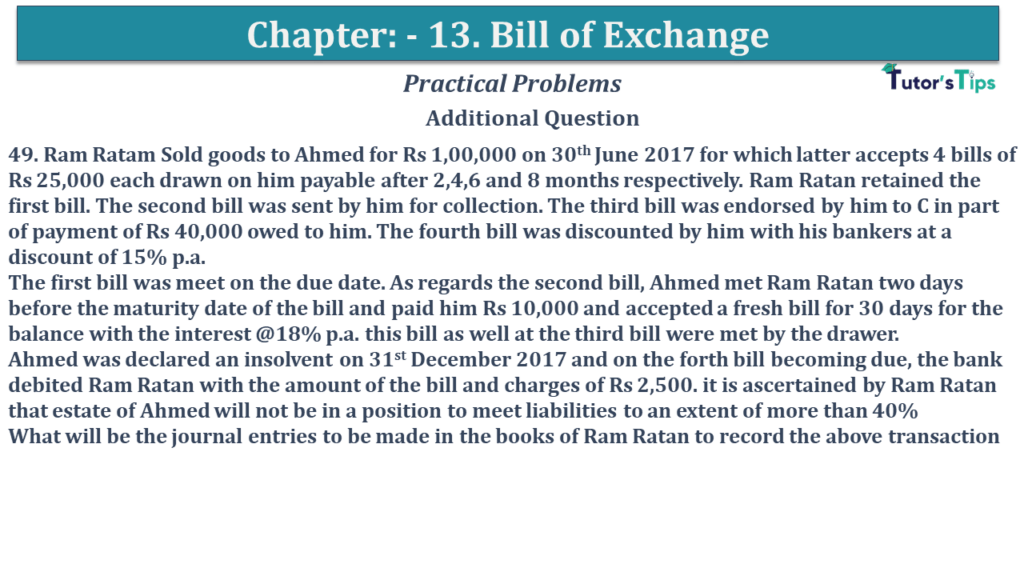

Question No 49 Chapter No 13 Additional Question 49. Ram Ratam Sold goods to Ahmed for Rs 1,00,000 on 30th June 2017 for which latter accepts 4 bills of Rs 25,000 each drawn on him payable after 2,4,6 and 8 Read More …

Question No 48 Chapter No 13 Additional Question 48. On 1st January 2018, P draws a three months bill of exchange for Rs 30,000 on his debtors who accepts it on same date. P discounts the bill on 4th January Read More …

Question No 47 Chapter No 13 Additional Question 47. On 1st January 2017, A owes B Rs 60,000 for which B receives two acceptances from A, one for Rs 20,000 payable in two months, second for Rs 40,000 payable in Read More …

Question No 46 Chapter No 13 Additional Question 46. Journals the following transaction:(i) Our acceptance for Rs 10,000retained by us one month before the due date under a rebate of 18% p.a.(ii) Our acceptance to X for Rs 20,000 was Read More …

Advertisement