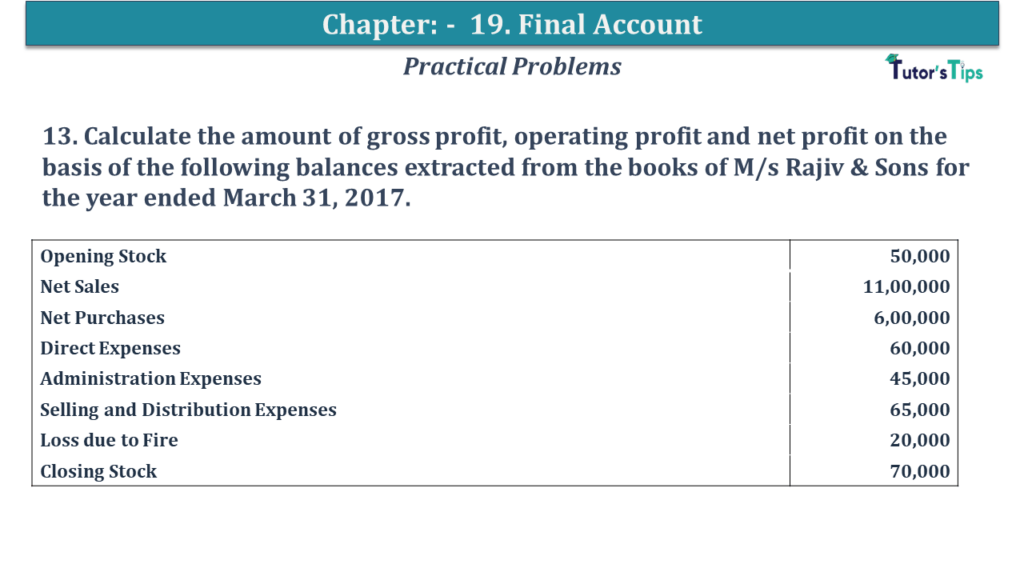

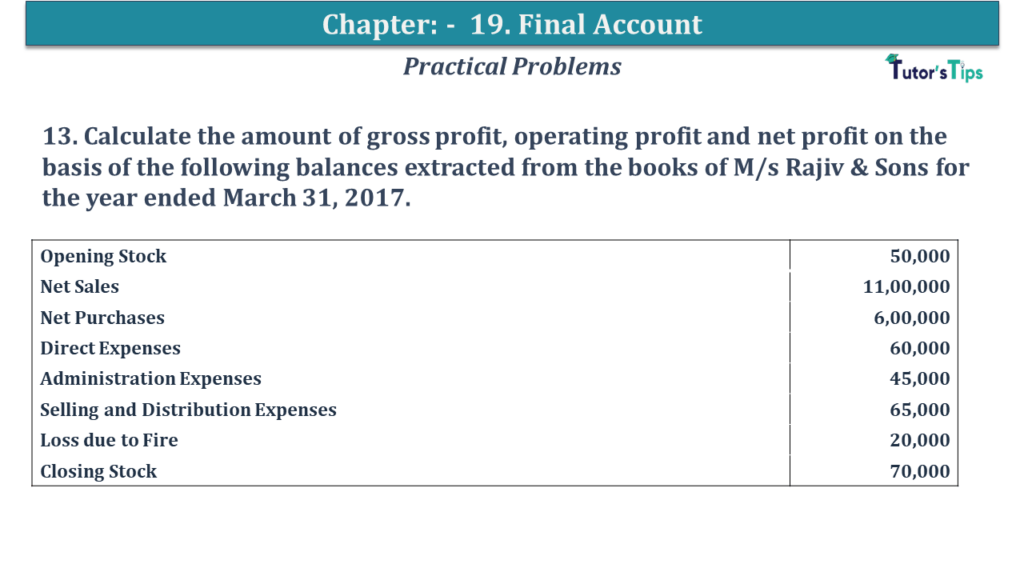

Question No 13 Chapter No 19 13. Calculate the amount of gross profit, operating profit and net profit on the basis of the following balances extracted from the books of M/s Rajiv & Sons for the year ended March 31, Read More …

Advertisement

Question No 13 Chapter No 19 13. Calculate the amount of gross profit, operating profit and net profit on the basis of the following balances extracted from the books of M/s Rajiv & Sons for the year ended March 31, Read More …

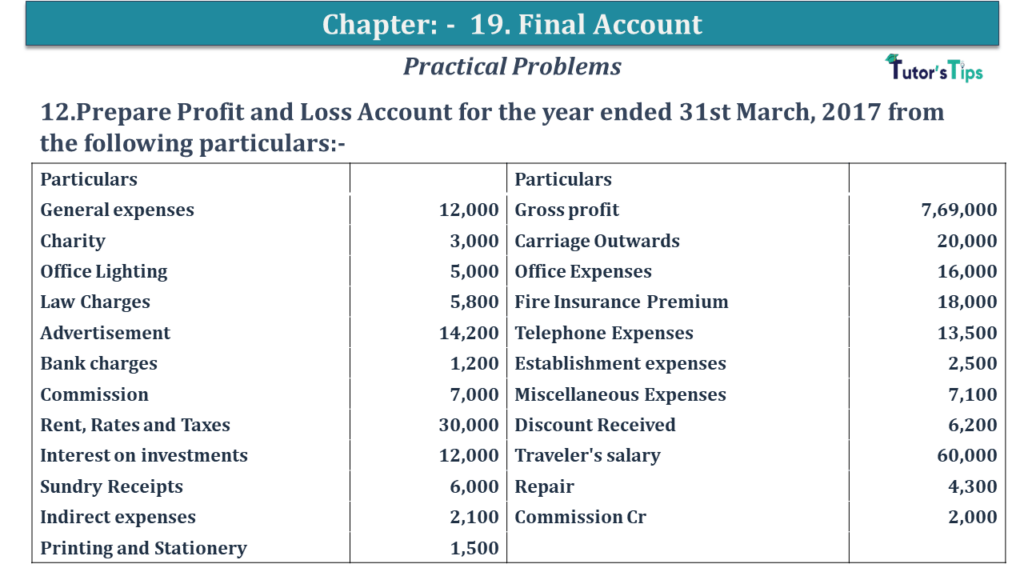

Question No 12 Chapter No 19 12.Prepare Profit and Loss Account for the year ended 31st March, 2017 from the following particulars:- Particulars Particulars General expenses 12,000 Gross profit 7,69,000 Charity 3,000 Carriage Outwards 20,000 Office Lighting 5,000 Read More …

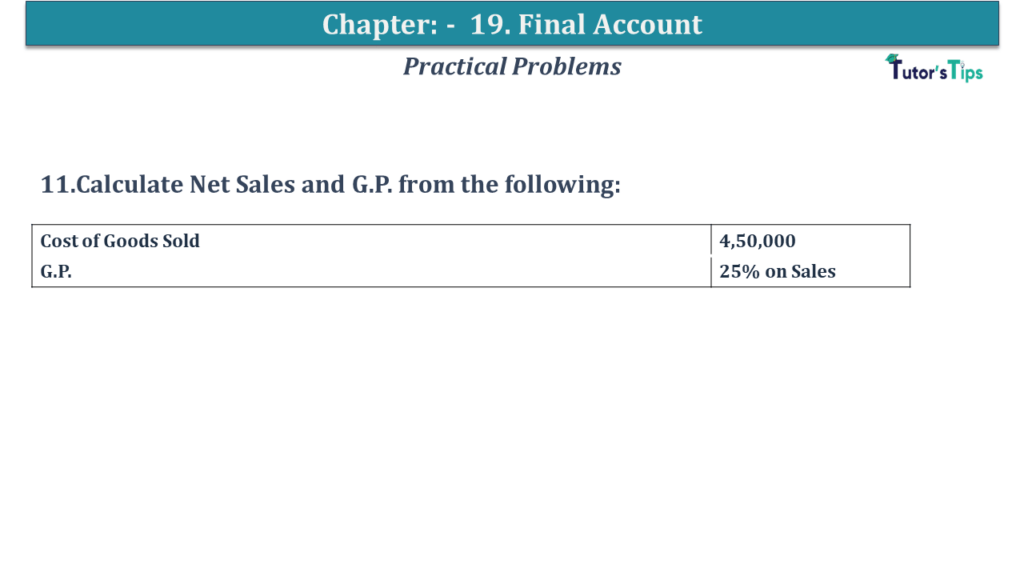

Question No 11 Chapter No 19 11.Calculate Net Sales and G.P. from the following: Cost of Goods Sold 4,50,000 G.P. 25% on Sales The solution of Question No 11 Chapter No 19: – Gross Profit = 25% on Sales or Read More …

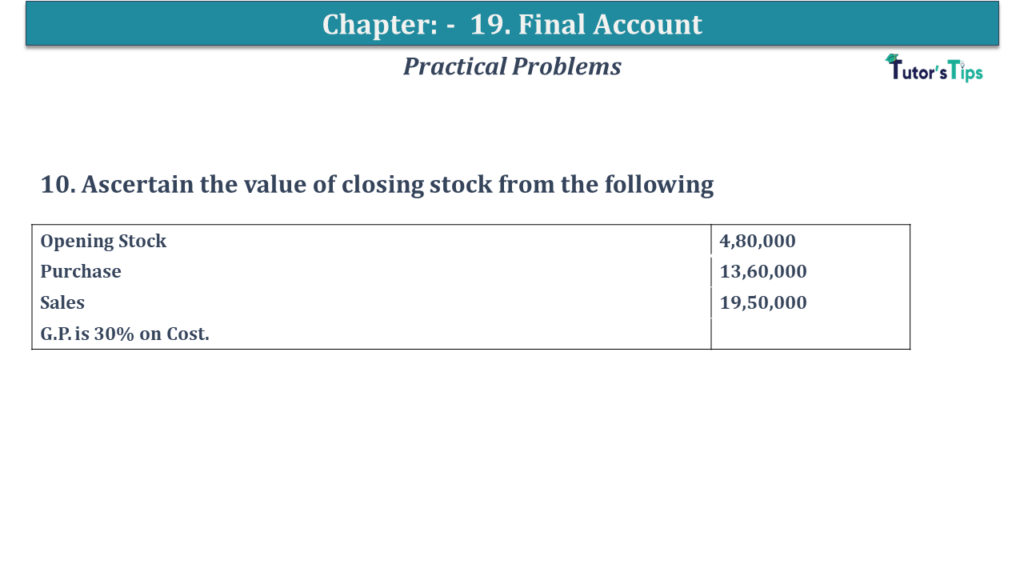

Question No 10 Chapter No 19 10. Ascertain the value of closing stock from the following Opening Stock 4,80,000 Purchase 13,60,000 Sales 19,50,000 G.P. is 30% on Cost. The solution of Question No 10 Chapter No 19: – Gross Read More …

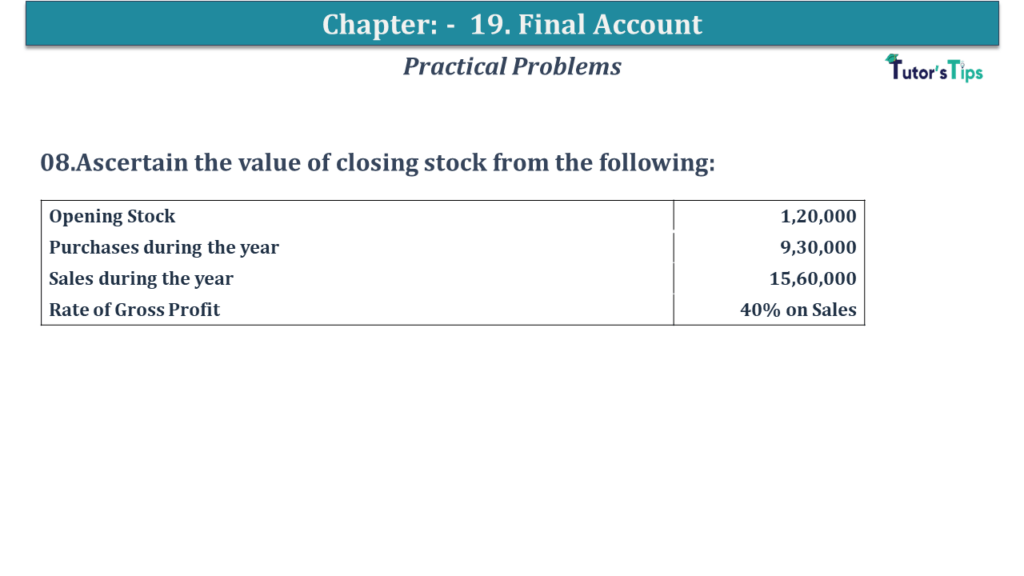

Question No 08 Chapter No 19 08.Ascertain the value of closing stock from the following: Opening Stock 1,20,000 Purchases during the year 9,30,000 Sales during the year 15,60,000 Rate of Gross Profit 40% on Sales The solution of Question No Read More …

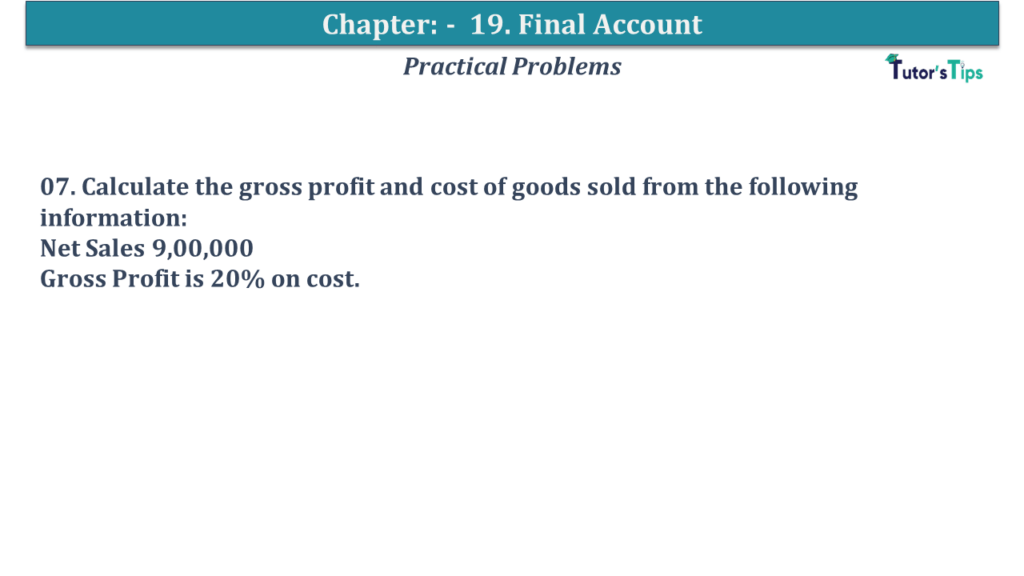

Question No 07 Chapter No 19 07. Calculate the gross profit and cost of goods sold from the following information: Net Sales 9,00,000 Gross Profit is 20% on cost. The solution of Question No 07 Chapter No 19: – Gross Read More …

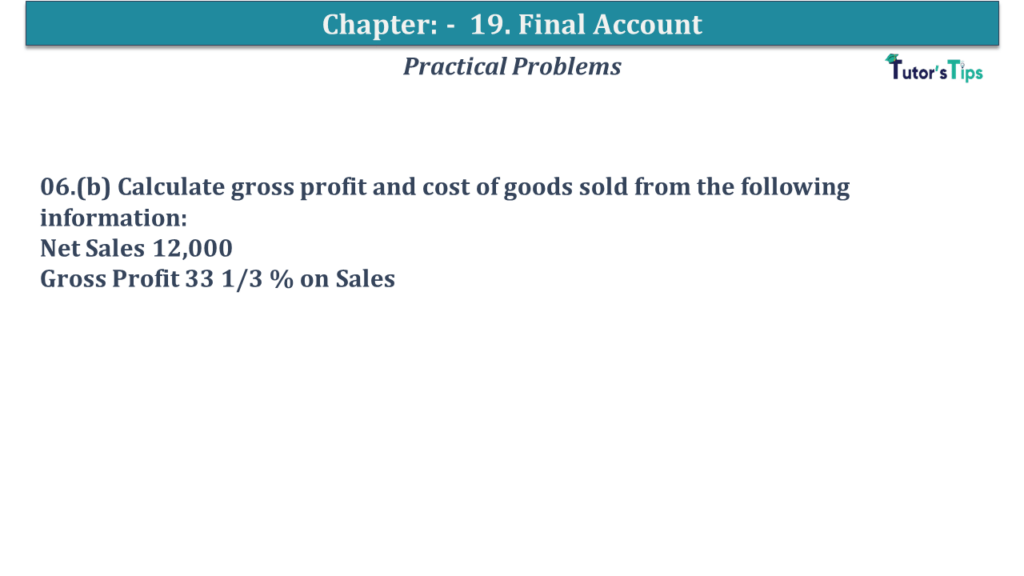

Question No 06 B Chapter No 19 06.(b) Calculate gross profit and cost of goods sold from the following information: Net Sales 12,000 Gross Profit 33 1/3 % on Sales The solution of Question No 06 B Chapter No 19: Read More …

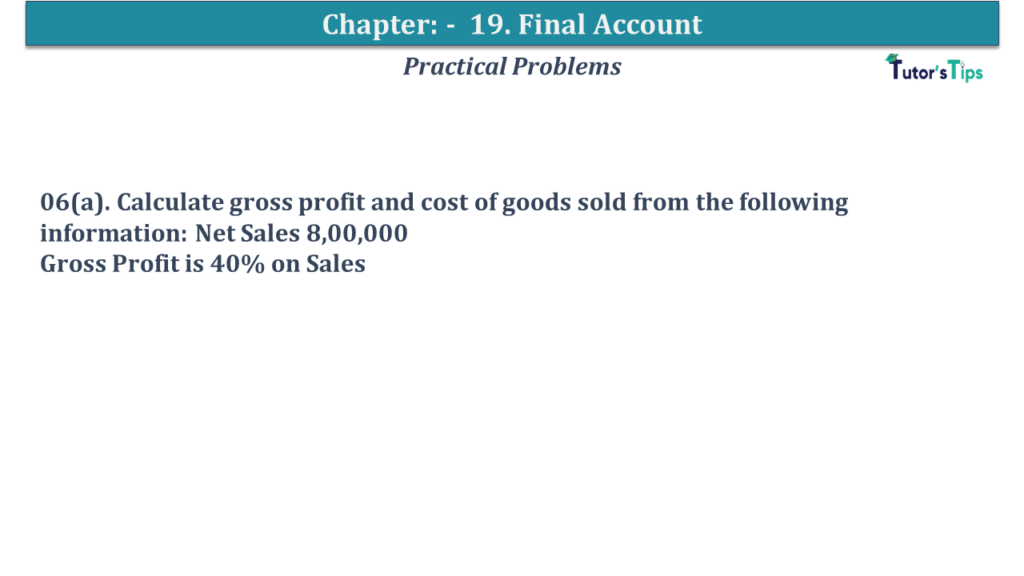

Question No 06 A Chapter No 19 06(a). Calculate gross profit and cost of goods sold from the following information: Net Sales 8,00,000 Gross Profit is 40% on Sales The solution of Question No 06 A Chapter No 19: – Gross Read More …

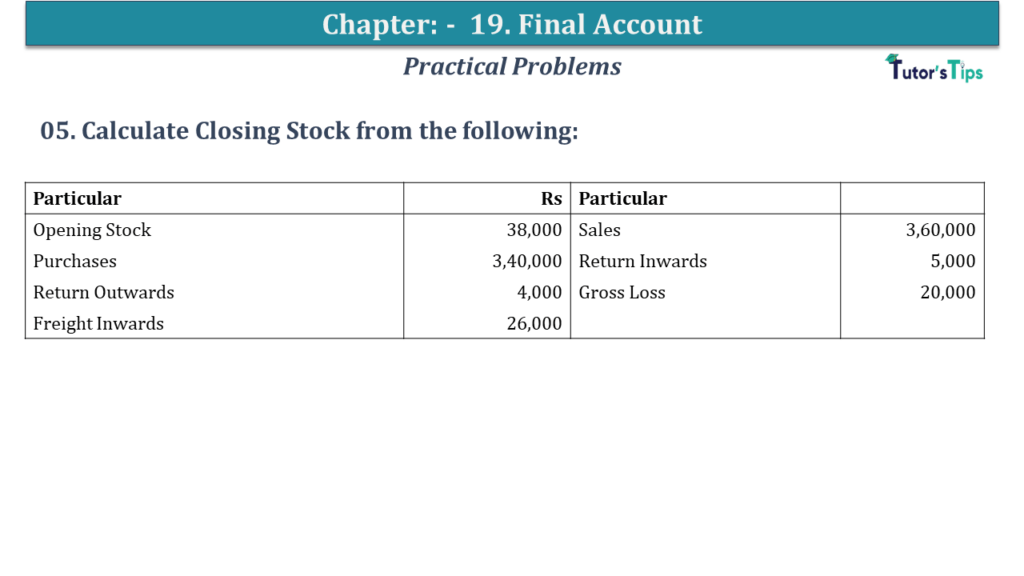

Question No 05 Chapter No 19 05. Calculate Closing Stock from the following: Particular Rs Particular Opening Stock 38,000 Sales 3,60,000 Purchases 3,40,000 Return Inwards 5,000 Return Outwards 4,000 Gross Loss 20,000 Freight Inwards 26,000 The solution Read More …

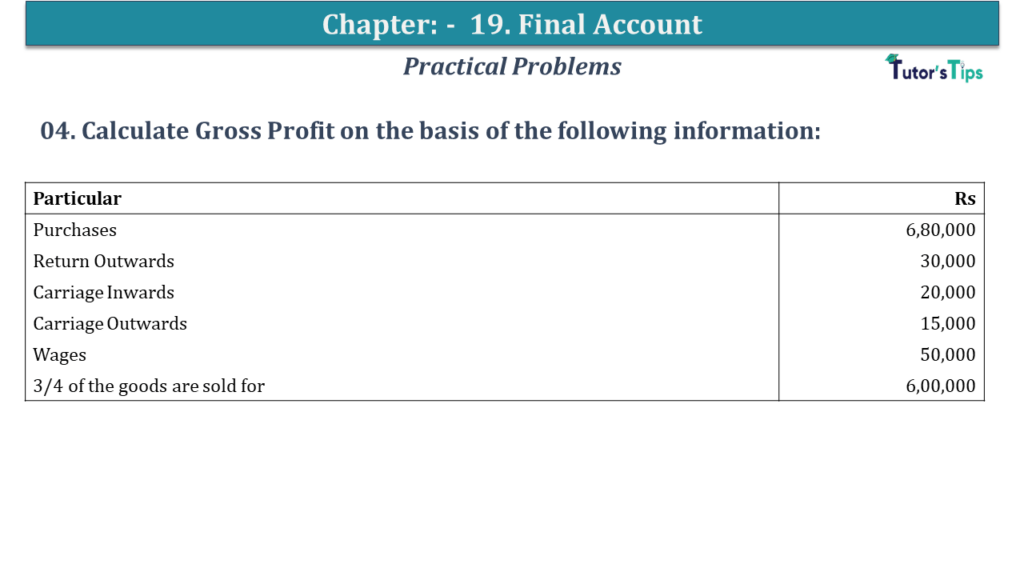

Question No 04 Chapter No 19 04. Calculate Gross Profit on the basis of the following information: Particular Rs Purchases 6,80,000 Return Outwards 30,000 Carriage Inwards 20,000 Carriage Outwards 15,000 Wages 50,000 3/4 of the goods are sold for 6,00,000 Read More …

Advertisement