Question No 03 Chapter No 12 03. Chandra Ltd. purchased a second-hand machine for 8,000 plus CGST and SGST @ 6% each on 1st July, 2015. They spent 3,500 on its overhaul and installation.Depreciation is written off 10% p.a. on Read More …

Advertisement

Question No 03 Chapter No 12 03. Chandra Ltd. purchased a second-hand machine for 8,000 plus CGST and SGST @ 6% each on 1st July, 2015. They spent 3,500 on its overhaul and installation.Depreciation is written off 10% p.a. on Read More …

Question No 02 Chapter No 12 02.On 1st April, 2015, a Company bought Plant and Machinery costing 68,000. It is estimated that its working life is 10 years, at the end of which it will fetch 8,000. Additions are made Read More …

Question No 01 Chapter No 12 1. On 1st April, 2015, a limited company purchased a Machine for 1,90,000 and spent 10,000 on its installation. At the date of purchase, it was estimated that the scrap value of the machine Read More …

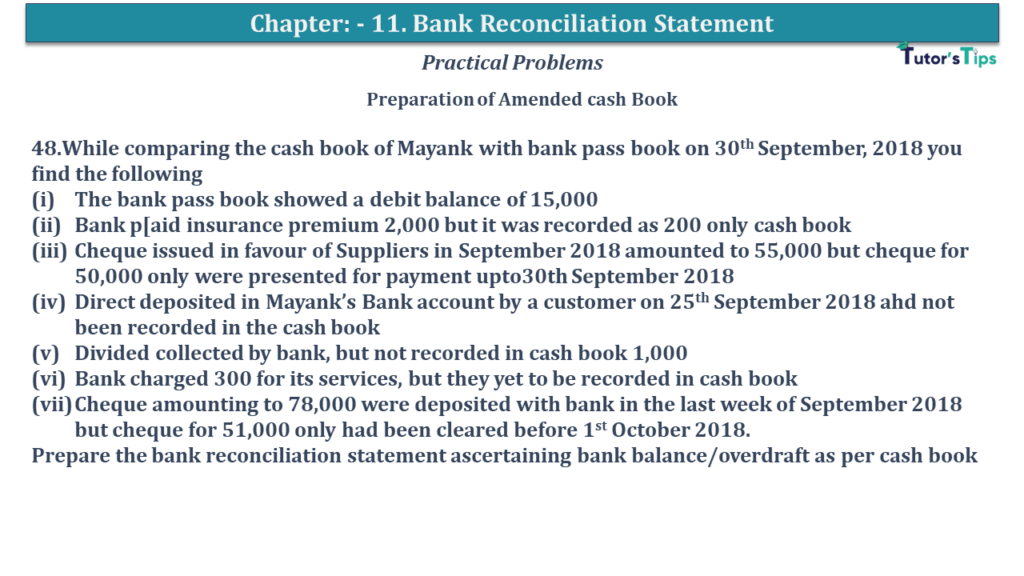

Question No 48 Chapter No 11 – D K Goal 48. While comparing the cash book of Mayank with bank passbook on 30th September 2018 you find the followingThe bank passbook showed a debit balance of 15,000 Bank paid insurance Read More …

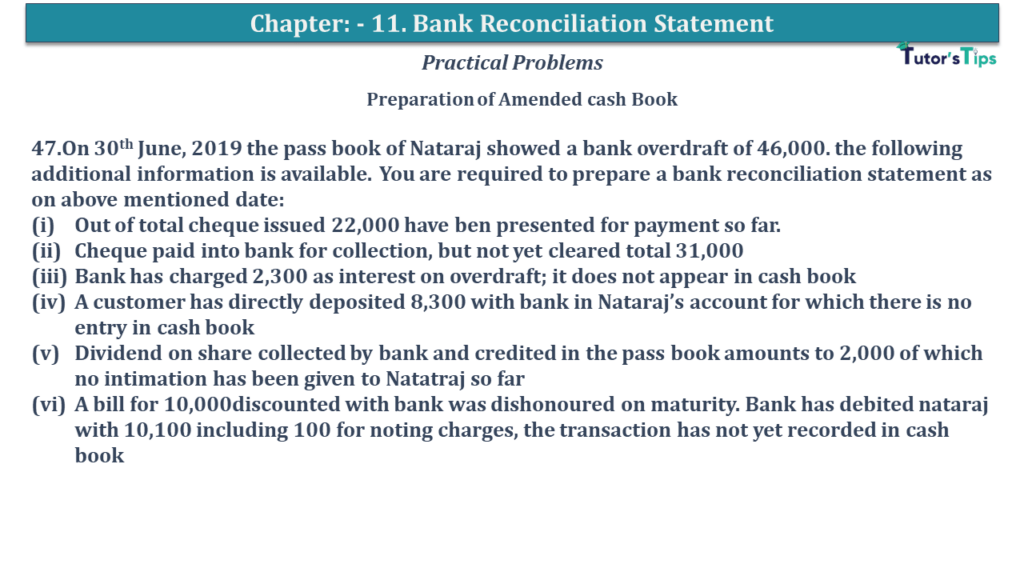

Question No 47 Chapter No 11 47.On 30th June 2019 the passbook of Nataraj showed a bank overdraft of 46,000. the following additional information is available. You are required to prepare a bank reconciliation statement as on the above-mentioned date: Read More …

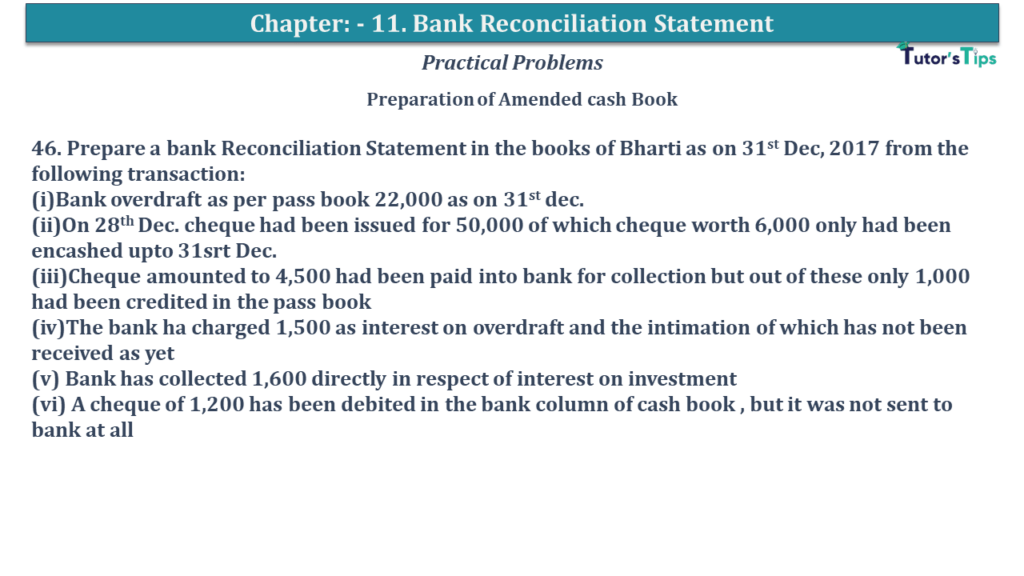

Question No 46 Chapter No 11 46. Prepare a Bank Reconciliation Statement in the books of Bharti as of 31st Dec 2017 from the following transaction:(i)Bank overdraft as per pass book 22,000 as on 31st Dec.(ii)On 28th Dec. cheque had Read More …

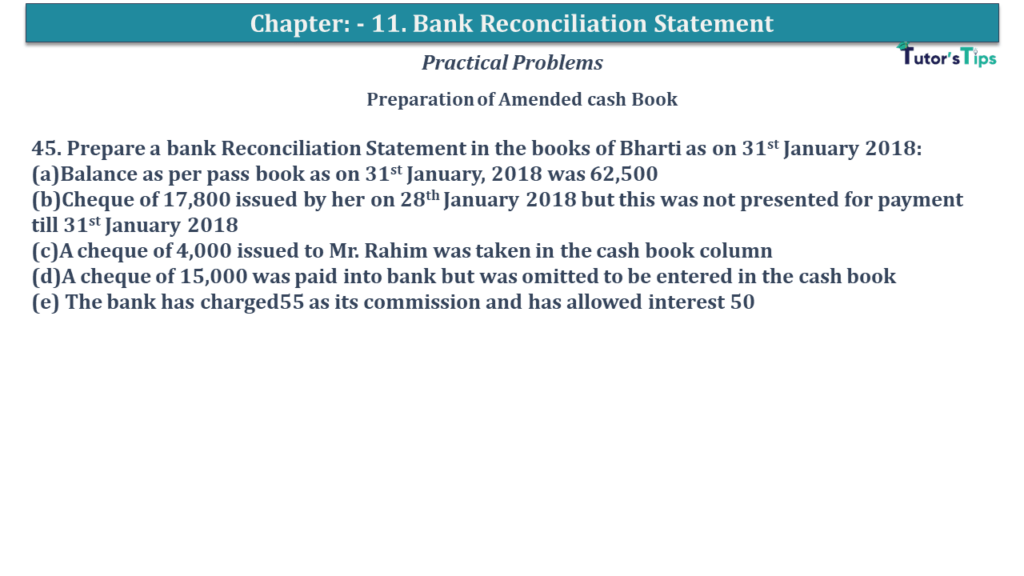

Question No 45 Chapter No 11 45. Prepare a bank Reconciliation Statement in the books of Bharti as on 31st January 2018:(a)Balance as per pass book as on 31st January, 2018 was 62,500(b)Cheque of 17,800 issued by her on 28th Read More …

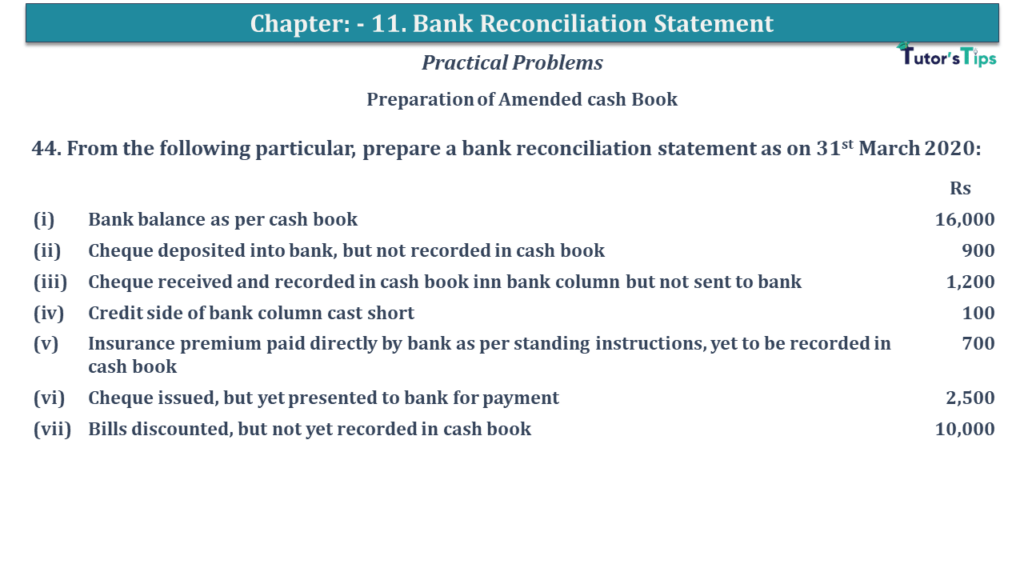

Question No 44 Chapter No 11 44. From the following particular, prepare a bank reconciliation statement as on 31st March 2020: Rs (i) Bank balance as per cash book 16,000 (ii) Cheque deposited into the bank, but not Read More …

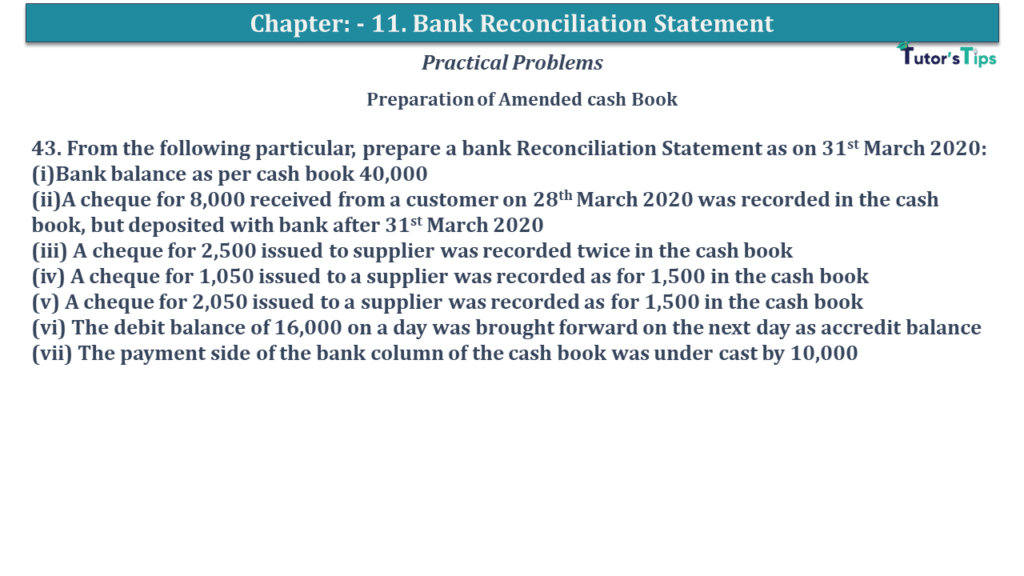

Question No 43 Chapter No 11 43. From the following particular, prepare a Bank Reconciliation Statement as of 31st March 2020:(i)Bank balance as per cash book 40,000(ii)A cheque for 8,000 received from a customer on 28th March 2020 was recorded Read More …

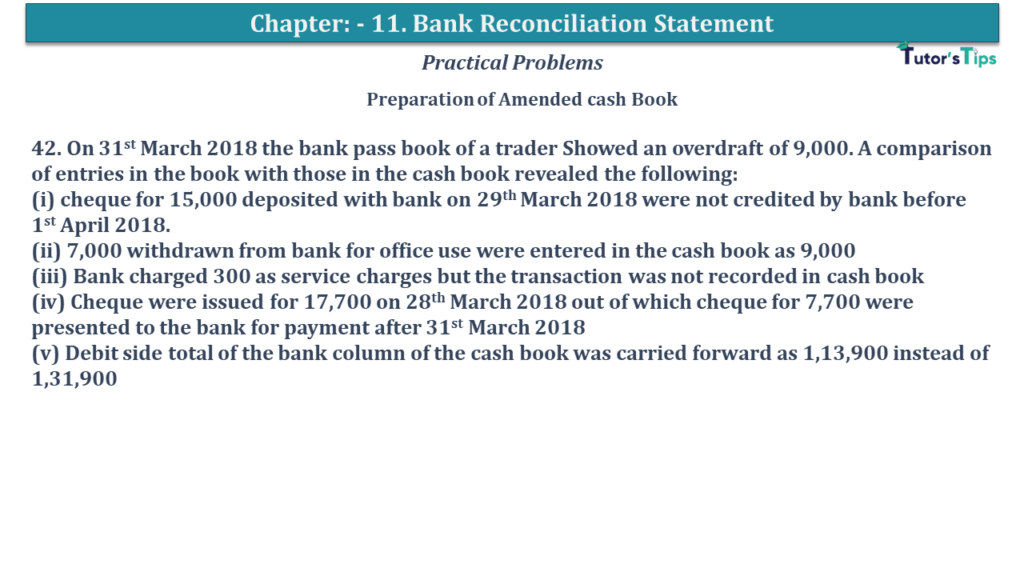

Question No 42 Chapter No 11 42. On 31st March 2018 the bank passbook of a trader Showed an overdraft of 9,000. A comparison of entries in the book with those in the cash book revealed the following: (i) cheque for Read More …

Advertisement