Question No 33 Chapter No 12 33. On 1st June, 2017, Kedarnath Ltd. purchased a machinery for 27,00,000. Depreciation is provided @ 10% p.a. on diminishing balance method and the books are closed on 31st March each year. On 1st Read More …

Advertisement

Question No 33 Chapter No 12 33. On 1st June, 2017, Kedarnath Ltd. purchased a machinery for 27,00,000. Depreciation is provided @ 10% p.a. on diminishing balance method and the books are closed on 31st March each year. On 1st Read More …

Question No 32 Chapter No 12 32. On 1st September 2016, Gopal Ltd. purchased a plant for 10,20,000. On 1st July 2017 another plant was purchased for 6,00,000. The firm writes off depreciation @ 10% p.a. on original cost and Read More …

Question No 31 Chapter No 12 31.On 1st July 2017, X Ltd. purchased machinery for 15,00,000. Depreciation is provided @ 20% p.a. on the original cost of the machinery and books are closed on 31st March each year. On 31st Read More …

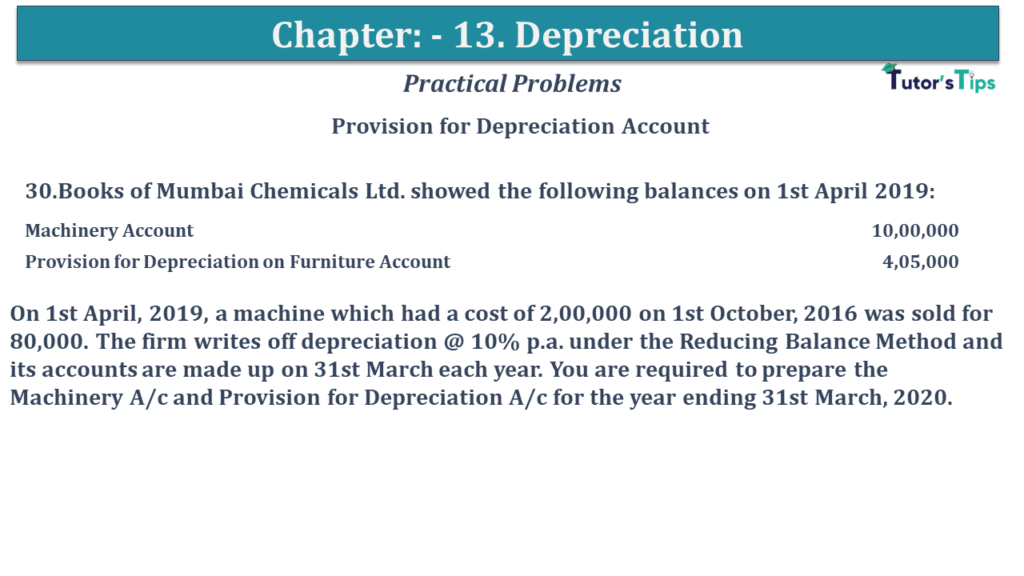

Question No 30 Chapter No 12 30.Books of Mumbai Chemicals Ltd. showed the following balances on 1st April 2019: Machinery Account 10,00,000 Provision for Depreciation on Furniture Account 4,05,000 On 1st April, 2019, a machine which had a cost of Read More …

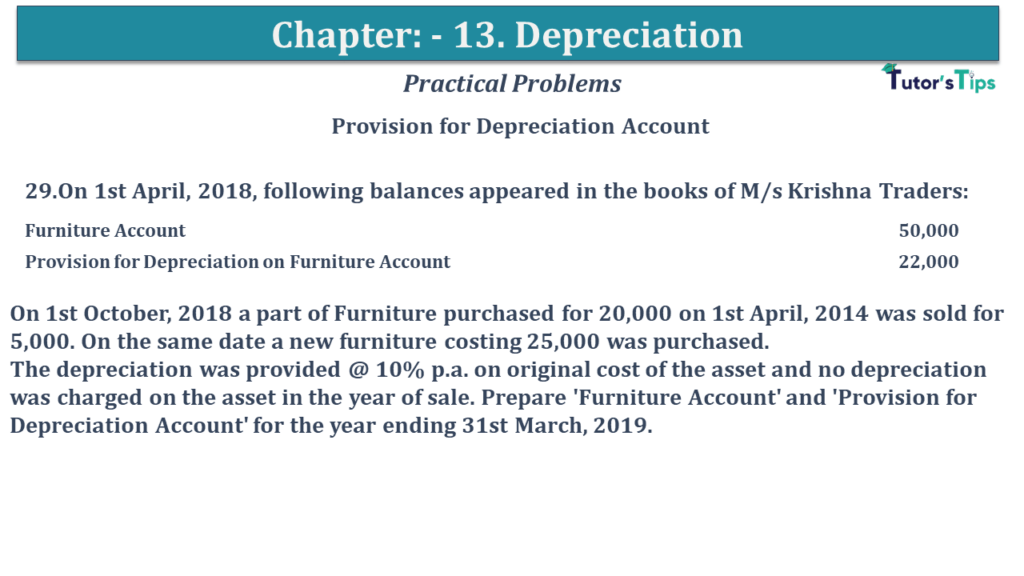

Question No 29 Chapter No 12 29.On 1st April, 2018, following balances appeared in the books of M/s Krishna Traders: Furniture Account 50,000 Provision for Depreciation on Furniture Account 22,000 On 1st October 2018, a part of Furniture purchased for Read More …

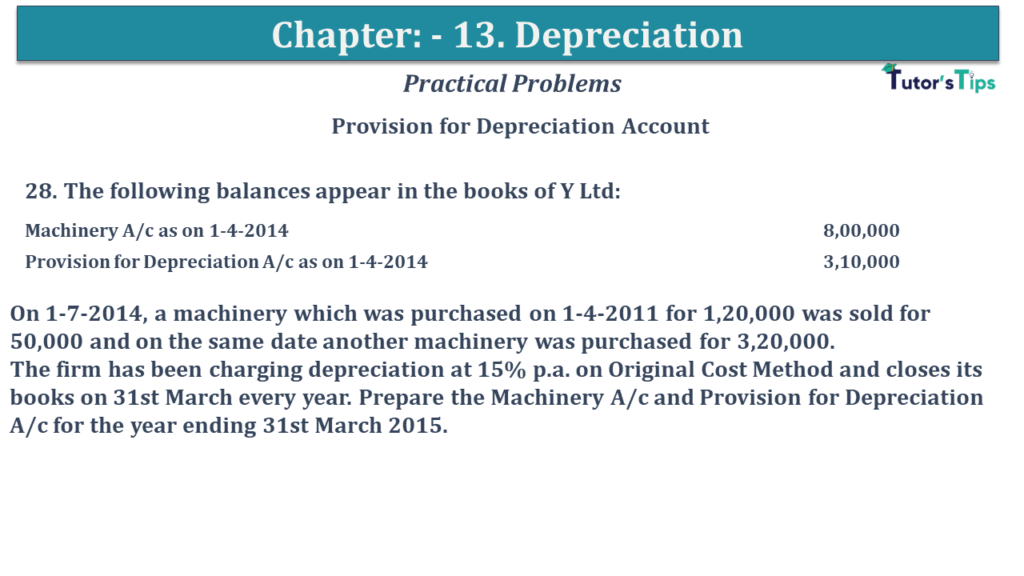

Question No 28 Chapter No 12 28. The following balances appear in the books of Y Ltd: Machinery A/c as on 1-4-2014 8,00,000 Provision for Depreciation A/c as on 1-4-2014 3,10,000 On 1-7-2014, machinery which was purchased on 1-4-2011 for Read More …

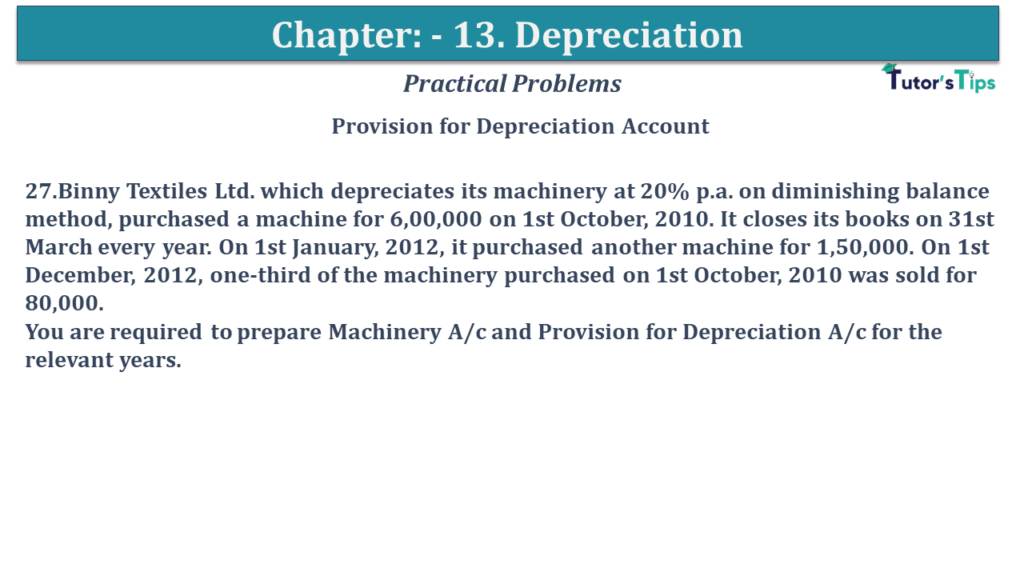

Question No 27 Chapter No 12 27.Binny Textiles Ltd. which depreciates its machinery at 20% p.a. on diminishing balance method, purchased a machine for 6,00,000 on 1st October, 2010. It closes its books on 31st March every year. On 1st Read More …

Question No 26 Chapter No 12 26. On 1st April 2012, Banglore Silk Ltd. purchased machinery for 20,00,000. It provides depreciation at 10% p.a. on the Written Down Value Method and closes its books on 31st March every year. On Read More …

Question No 25 Chapter No 12 25. On 1st August 2010, Hindustan Toys Ltd. purchased a plant for 12,00,000. The firm writes off depreciation at 10% p.a. on the diminishing balance and the books are closed on 31st March each Read More …

Question No 24 Chapter No 12 24. X Ltd. purchased a plant on 1st July 2010 costing 5,00,000. It purchased another plant on 1st September 2010 costing 3,00,000. On 31st December 2012, the plant purchased on 1st July 2010 got Read More …

Advertisement