Question No 05 Chapter No 13 05. B owed 20,400 to A. On 15th January, 2019, he accepted a bill for 20,000 for two months drawn by A in full settlement of his debt. On 18th January, 2019, A endorsed Read More …

Advertisement

Question No 05 Chapter No 13 05. B owed 20,400 to A. On 15th January, 2019, he accepted a bill for 20,000 for two months drawn by A in full settlement of his debt. On 18th January, 2019, A endorsed Read More …

Question No 04 Chapter No 13 04. On 15th February, 2019, X sold goods to Y for 60,000. On the same day, Y accepted a bill drawn upon him by X for three months for 60,000. X immediately discounted the Read More …

Question No 03 Chapter No 13 03. On 1st January 2019, Ajay sold goods to Bhushan for 50,000. Ajay draws a bill of exchange for two months for the amount due which Bhushan accepts and returns it to Ajay. Bhushan Read More …

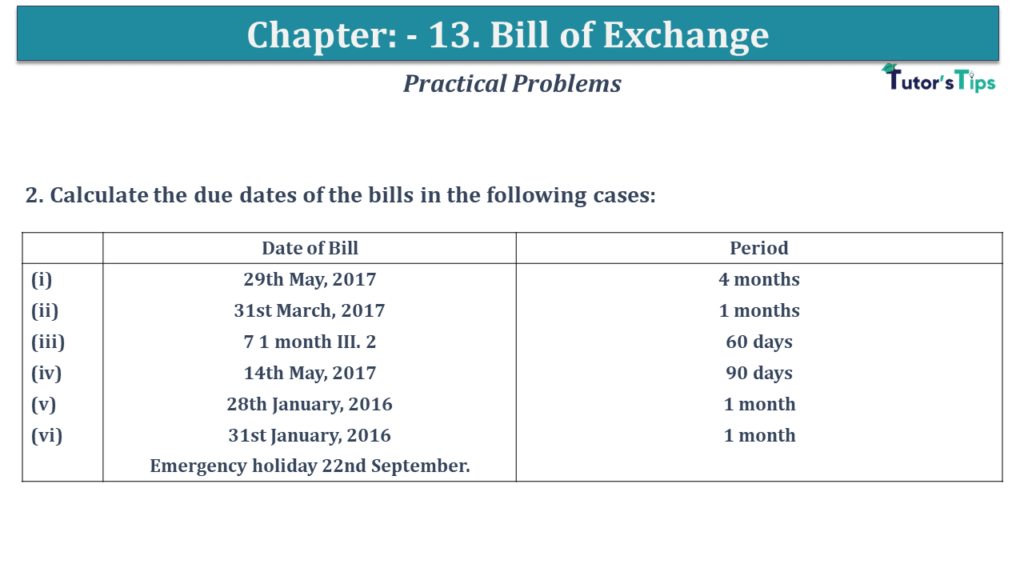

Question No 02 Chapter No 13 2. Calculate the due dates of the bills in the following cases: Date of Bill Period (i) 29th May 2017 4 months (ii) 31st March 2017 1 months (iii) 7 1 month III. Read More …

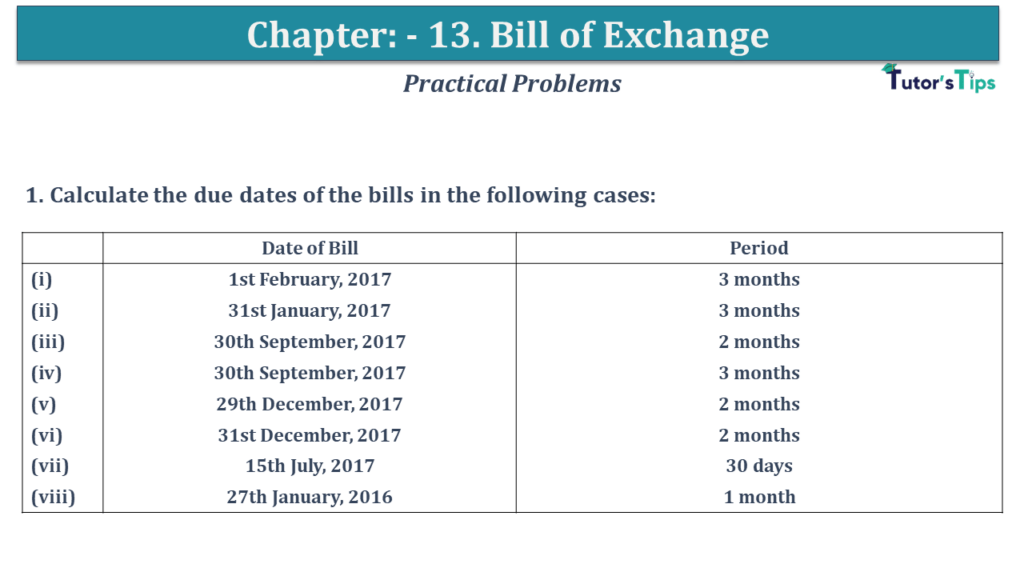

Question No 01 Chapter No 13 1. Calculate the due dates of the bills in the following cases: Date of Bill Period (i) 1st February 2017 3 months (ii) 31st January 2017 3 months (iii) 30th September 2017 2 Read More …

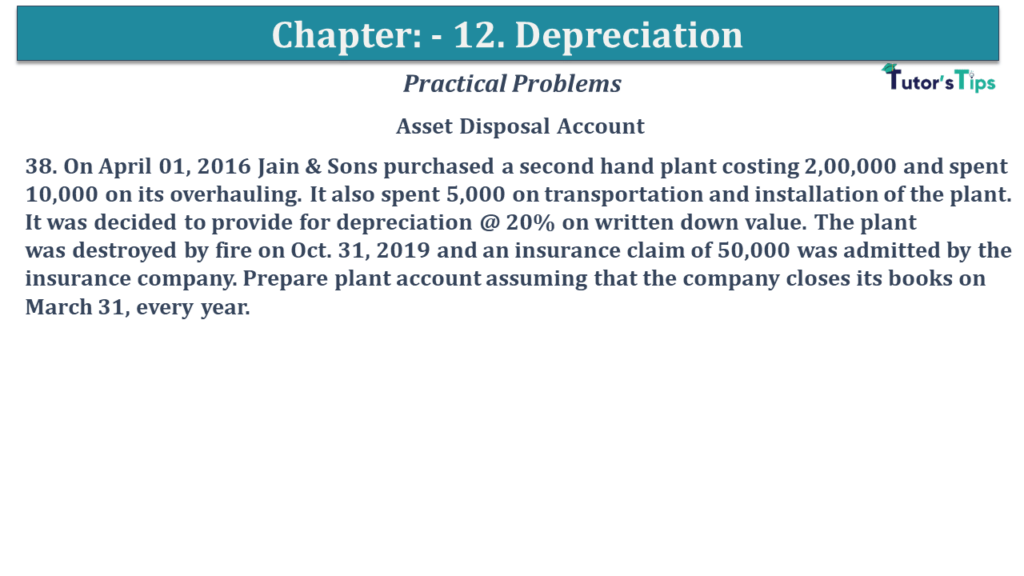

Question No 38 Chapter No 12 38. On April 01, 2016, Jain & Sons purchased a second-hand plant costing 2,00,000 and spent 10,000 on its overhauling. It also spent 5,000 on transportation and installation of the plant. It was decided Read More …

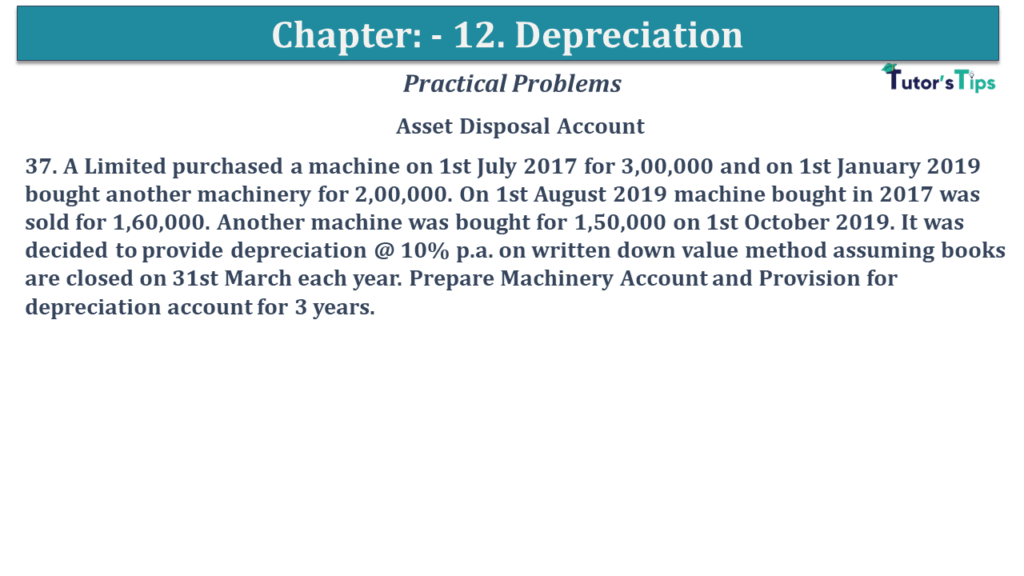

Question No 37 Chapter No 12 37. A Limited purchased a machine on 1st July 2017 for 3,00,000 and on 1st January 2019 bought another machinery for 2,00,000. On 1st August 2019 machine bought in 2017 was sold for 1,60,000. Read More …

Question No 36 Chapter No 12 36. A limited company purchased on 01-01-2017 a plant for 38,000 and spent 2,000 for carriage and brokerage. On 01-04-2018 it purchased additional plant costing 20,000. On 01-08-2019 the plant purchased on 01-01-2017 was Read More …

Question No 35 Chapter No 12 35. The following balances appear in the books of M/s Amrit: 1st April 2018 Machinery A/c 60,000 1st April 2018 Provision for depreciation A/c 36,000 On 1st April 2018, they decided to dispose of Read More …

Question No 34 Chapter No 12 34. On 1st Jan. 2017, Panjim Dryfruits Ltd. bought a plant for 15,00,000. The company writes off depreciation @ 20% p.a. on Written Down Value Method and closes its books on 31st March every Read More …

Advertisement