Question No 17 Chapter No 19

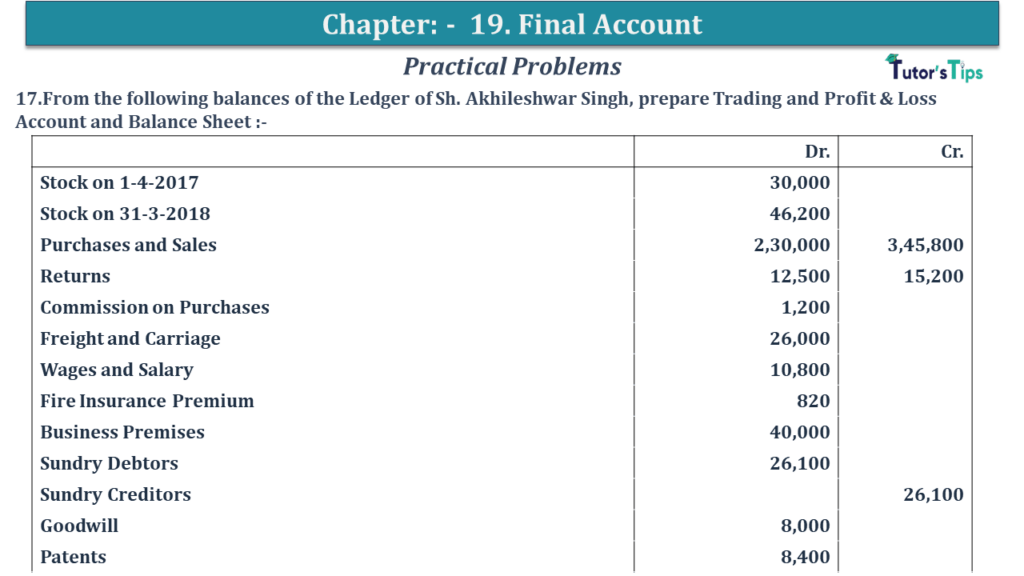

17.From the following balances of the Ledger of Sh. Akhileshwar Singh, prepare Trading and Profit & Loss Account and Balance Sheet :-

| Dr. | Cr. | |

| Stock on 1-4-2017 | 30,000 | |

| Stock on 31-3-2018 | 46,200 | |

| Purchases and Sales | 2,30,000 | 3,45,800 |

| Returns | 12,500 | 15,200 |

| Commission on Purchases | 1,200 | |

| Freight and Carriage | 26,000 | |

| Wages and Salary | 10,800 | |

| Fire Insurance Premium | 820 | |

| Business Premises | 40,000 | |

| Sundry Debtors | 26,100 | |

| Sundry Creditors | 26,100 | |

| Goodwill | 8,000 | |

| Patents | 8,400 | |

| Coal, Gas and Power | 12,100 | |

| Printing and Stationery | 2,100 | |

| Postage | 710 | |

| Travelling Expenses | 4,250 | |

| Drawings | 7,200 | |

| Depreciation | 1,000 | |

| General Expenses | 8,350 | |

| Capital | 89,760 | |

| Investments | 8,000 | |

| Interest on Investments | 800 | |

| Cash in Hand | 2,570 | |

| Banker’s Account | 5,200 | |

| Commission | 4,600 | 4,400 |

| Loan on Mortgage | 30,000 | |

| Interest on Loan | 3,000 | |

| B/P | 2,280 | |

| B/R | 4,540 | |

| Income Tax | 3,000 | |

| Horses and Carts | 20,300 | |

| Discount on Purchases | 1,600 | |

| 5,21,740 | 5,21,740 |

The solution of Question No 17 Chapter No 19: –

| Trading Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Opening Stock A/c | 30,000 | By Sales | 3,45,800 | ||

| To Purchases A/c | 2,30,000 | Less: return | 12,500 | 3,33,300 | |

| Less: Return | 15,200 | 2,14,800 | |||

| To Freight and Carriage | 26,000 | ||||

| To Commission on Purchases | 1,200 | ||||

| To Wages & Salaries | 10,800 | ||||

| To Coal, Gas and Power | 12,100 | ||||

| To Gross Profit | 38,400 | ||||

| 3,33,300 | 3,33,300 | ||||

| Profit & Loss Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Fire Insurance Premium | 820 | By Gross Profit | 38,400 | ||

| To Printing & Stationer | 2,100 | By Interest on Investments | 800 | ||

| To Postage & Telegram | 710 | By Commission Received | 4,400 | ||

| To Travelling Expenses | 4,250 | By Discount Received | 1,600 | ||

| To Depreciation | 1,000 | ||||

| To General Expenses | 8,350 | ||||

| To Commission | 4,600 | ||||

| To Interest on Loan | 3,000 | ||||

| To Net Profit A/c | 20,370 | ||||

| 45,200 | 45,200 | ||||

| Balance Sheet |

|||||

| Liabilities |

Amount | Assets |

Amount | ||

| Capital | 89,760 | Goodwill | 8,000 | ||

| Add: Net Profit | 20,370 | Business Premises | 40,000 | ||

| Less: Income tax | 3,000 | Patents | 8,400 | ||

| Less: Drawings | 7,200 | 99,930 | Horses and Carts | 20,300 | |

| Loan on Mortgage | 30,000 | Closing Stock | 46,200 | ||

| Creditors | 26,700 | Debtors | 26,100 | ||

| Banker’s Account | 5,200 | Cash in Hand | 2,570 | ||

| Bills Payable | 2,280 | Bills Receivable | 4,540 | ||

| Investment | 8,000 | ||||

| 1,64,110 | 1,64,110 | ||||

https://tutorstips.com/trading-account/

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.