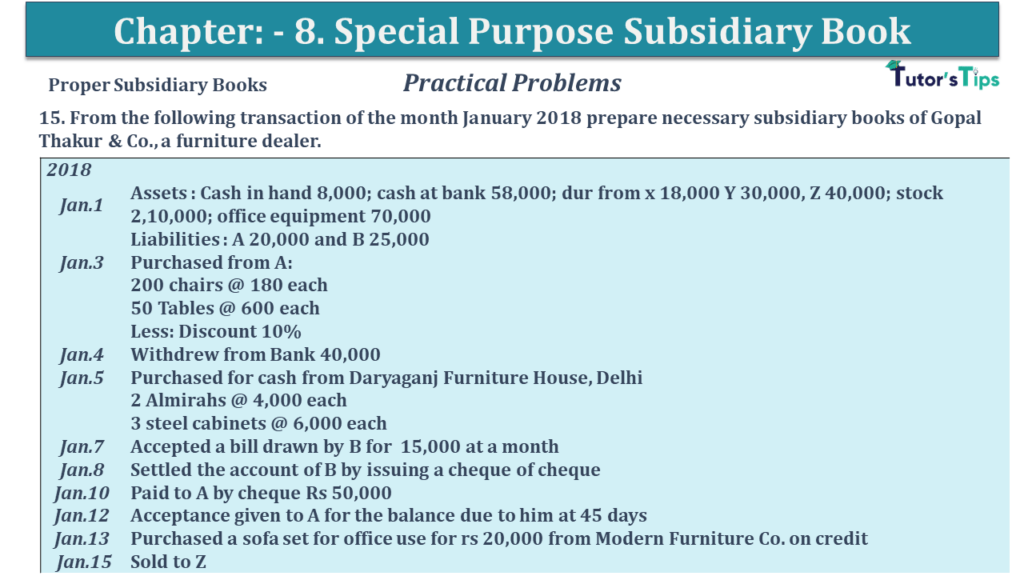

Question No 15 Chapter No 8

15. From the following transaction of the month January 2018 prepare necessary subsidiary books of Gopal Thakur & Co., a furniture dealer.

| 2018 | |

| Jan.1 | Assets : Cash in hand 8,000; cash at bank 58,000; dur from x 18,000 Y 30,000, Z 40,000; stock 2,10,000; office equipment 70,000 |

| Liabilities : A 20,000 and B 25,000 | |

| Jan.3 | Purchased from A: |

| 200 chairs @ 180 each | |

| 50 Tables @ 600 each | |

| Less: Discount 10% | |

| Jan.4 | Withdrew from Bank 40,000 |

| Jan.5 | Purchased for cash from Daryaganj Furniture House, Delhi |

| 2 Almirahs @ 4,000 each | |

| 3 steel cabinets @ 6,000 each | |

| Jan.7 | Accepted a bill drawn by B for 15,000 at a month |

| Jan.8 | Settled the account of B by issuing a cheque of cheque |

| Jan.10 | Paid to A by cheque Rs 50,000 |

| Jan.12 | Acceptance given to A for the balance due to him at 45 days |

| Jan.13 | Purchased a sofa set for office use for 20,000 from Modern Furniture Co. on credit |

| Jan.15 | Sold to Z |

| 100 chairs @ 250 each | |

| 80 Tables @ 1,000 each | |

| Jan.16 | Received a cheque from Z for 1,20,000. the cheque is immediately sent to the bank |

| Jan.17 | Y Settled his account through a cheque, after deducting 2% cash discount |

| Jan.18 | Sold to Asif Ali: |

| 150 chairs @ 300 each | |

| 5 steel cabinets @ 8,000 each | |

| Less: Discount 5% | |

| Jan.20 | Received a cheque from Z for 23,000 in full settlement of his account |

| Jan.21 | Asif Ali returned 1 steel cabinet |

| Jan.22 | Asif Ali Settled his account by cheque after deducting 2% cash discount |

| Jan.23 | Proprietor withdrew cash 6,000 for personal use |

| Jan.25 | Paid for newspapers 320, Salaries 6,000 and rent 3,000 |

| Jan.28 | Received from X a bill of exchange for Rs 10,000 for 30 days |

| Jan.30 | Interest allowed by bank 270 |

The solution of Question No 15 Chapter No 8: –

| Dr. | Cash Book | Cr. | |||||||||

| Date | Particulars |

L. F. |

Discount Allowed |

Cash | Bank | Date | Particulars |

L. F. |

Discount Received | Cash | Bank |

| 2020 | 2020 | ||||||||||

| Jan.1 | To Balance b/d | – | 8,000 | 58,000 | Jan.04 | By Cash A/c | – | – | 40,000 | ||

| Jan.4 | To Bank A/c | – | 40,000 | – | Jan.5 | By Furniture A/c | – | 24,700 | – | ||

| Jan.16 | To Z A/c | – | – | 1,20,000 | Jan.8 | By B A/c | 200 | – | 9,800 | ||

| Jan. 17 | To Y A/c | 600 | – | 29,400 | Jan.10 | By A A/c | – | – | 50,000 | ||

| Jan.20 | To Z A/c | 2,000 | – | 23,000 | Jan.23 | By Drawing A/c | 6,000 | – | |||

| Jan.22 | To Asif Ali A/c | 1,463 | – | 71,687 | Jan.25 | By Stationary A/c | – | 320 | – | ||

| Jan.25 | By Salaries A/c | – | 6,000 | – | |||||||

| Jan.25 | By Rent A/c | 3,000 | – | ||||||||

| Jan.30 | By Bank Interest A/c | 270 | |||||||||

| Jun.30 | To Balance c/d | 4,063 | – | Jun.30 | By Balance C/d | 400 |

7,980 | 1,34,930 | |||

| 4,063 | 48,000 | 3,02,087 | 400 | 48,000 | 3,02,087 | ||||||

| Purchases Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 3 | A | ||

| 200 chairs @ 180 each | 36,000 | ||

| 50 Table @600 each | 30,000 | ||

| Less: 10% Trade Discount | 6,600 | ||

| 59,400 | 59,400 | ||

| 59,400 | |||

| Sale Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 15 | Z | ||

| 100 chairs @ 250 each | 25,000 | ||

| 80 steel cabinets @ 1,000 each | 80,000 | ||

| 1,05,000 | 1,05,000 | ||

| 18 | Asif Ali | ||

| 150 chairs @ 300 each | 45,000 | ||

| 5 steel cabinets @ 8,000 each | 40,000 | ||

| Less: 5% Trade Discount | 4,250 | ||

| 80,750 | 80,750 | ||

| 1,85,750 | |||

| Sale Return Book | |||

| Date | Particular | Detail | Total |

| 2018 Jan. |

|||

| 21 | Asif Ali | ||

| 1 steel cabinets @ 8,000 each | 8,000 | ||

| Less: 5% Discount | 400 | ||

| 7,600 | 7,600 | ||

| 7,600 | |||

Advertisement

https://tutorstips.com/purchase-return-book/

Thanks, Please Like and share with your friends

Comment if you have any question.

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.

Advertisement