Question No 12 Chapter No 20

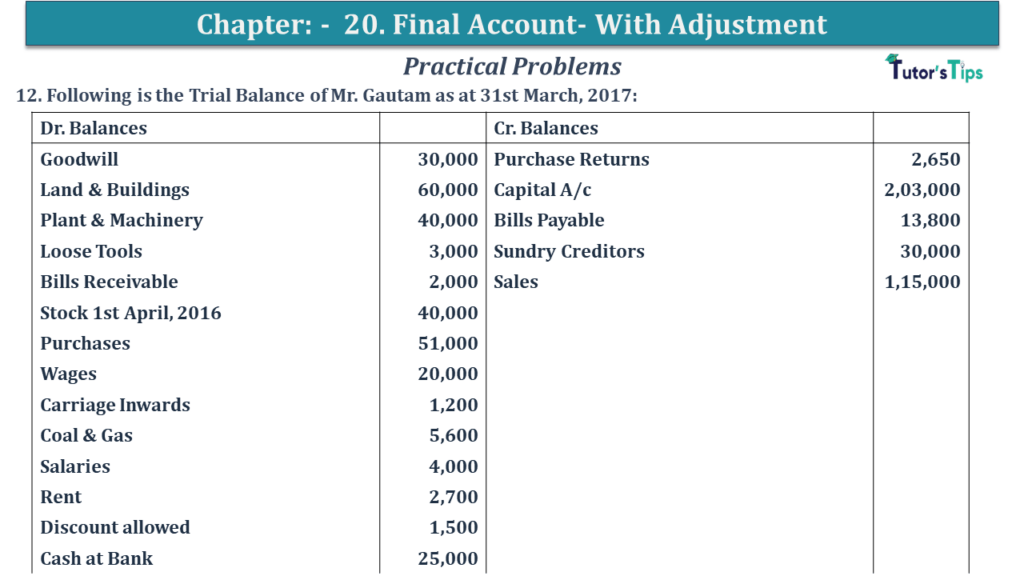

12. Following is the Trial Balance of Mr. Gautam as at 31st March, 2017:

| Dr. Balances | Cr. Balances | ||

| Goodwill | 30,000 | Purchase Returns | 2,650 |

| Land & Buildings | 60,000 | Capital A/c | 2,03,000 |

| Plant & Machinery | 40,000 | Bills Payable | 13,800 |

| Loose Tools | 3,000 | Sundry Creditors | 30,000 |

| Bills Receivable | 2,000 | Sales | 1,15,000 |

| Stock 1st April, 2016 | 40,000 | ||

| Purchases | 51,000 | ||

| Wages | 20,000 | ||

| Carriage Inwards | 1,200 | ||

| Coal & Gas | 5,600 | ||

| Salaries | 4,000 | ||

| Rent | 2,700 | ||

| Discount allowed | 1,500 | ||

| Cash at Bank | 25,000 | ||

| Cash in hand | 1,400 | ||

| Sundry Debtors | 45,000 | ||

| Repairs | 1,800 | ||

| Printing & Stationery | 600 | ||

| Bad-debts | 1,200 | ||

| Advertisements | 3,500 | ||

| Furniture and Fixtures | 1,200 | ||

| General Expenses | 250 | ||

| Investments | 5,000 | ||

| Drawings | 15,000 | ||

| Carriage Outwards | 1,500 | ||

| Sales Returns | 2,000 | ||

| 3,64,450 | 3,64,450 |

You are required to prepare Final Accounts after taking into account the following adjustments: a Closing Stock on 31st March, 2017 was 60,000. b Depreciate Plant and Machinery at 5%, Loose Tools at 15% and Furniture and fixtures at 5%. c Provide 2 1 2 % for discount on Sundry Debtors and also provide 5% for Bad and Doubtful Debts on Sundry Debtors. d Only three quarter’s rent has been paid, the last quarter’s rent being outstanding. e Interest earned but not received 600. f Write off 1 4th of Advertisement expenses.

The solution of Question No 12 Chapter No 20: –

| Trading Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Opening Stock A/c | 40,000 | By Sales | 1,15,000 | ||

| To Purchases A/c | 51,000 | Less: return | 2,000 | 1,13,000 | |

| Less: Purchases Return | 48,350 | 48,350 | |||

| To Wages | 20,000 | By Closing Stock | 60,000 | ||

| To Carriage Inwards | 1,200 | ||||

| To Coal and Gas | 5,600 | ||||

| To Gross Profit A/c | 57,850 | ||||

| 1,73,000 | 1,73,000 | ||||

| Profit & Loss Account |

|||||

| Particular |

Amount | Particular |

Amount | ||

| To Discount Allowed | 1,500 | By Gross Profit | 57,850 | ||

| To Salaries | 4,000 | By Accrued Interest | 600 | ||

| To Rent | 2,700 | ||||

| Add: Outstanding Rent (WN2) | 900 | 3,600 | |||

| To Bad Debts | 1,200 | ||||

| Add: New Provision (WN3) | 2,250 | 3,450 | |||

| To Depreciation: (WN1) | |||||

| Plant & Machinery | 2,000 | ||||

| Loose Tools | 450 | ||||

| Furniture | 60 | 2,510 | |||

| To Provision for Discount on Debtors |

1,069 |

||||

| To Repairs | 1,800 | ||||

| To Printing & Stationery | 600 | ||||

| To General Expenses | 10,000 | ||||

| To Carriage Outwards | 3,200 | ||||

| To Net Profit A/c | 37,296 | ||||

| 58,450 | 58,450 | ||||

| Balance Sheet |

|||||

| Liabilities |

Amount | Assets |

Amount | ||

| Capital | 2,03,000 | Plant & Machinery | 40,000 | ||

| Less: Net Loss | 37,296 | Less: Depreciation | 2,000 | 38,000 | |

| Less: Drawings 12, 000 +150 | 15,000 | 2,25,296 | Loose Tools | 3,000 | |

| Creditors | 30,000 | Less: Depreciation | 450 | 2,550 | |

| Bills Payable | 13,800 | Furniture & Fixtures | 1,200 | ||

| Outstanding Rent | 900 | Less: Depreciation | 60 | 1,140 | |

| Investments | 5,000 | ||||

| Land & Building | 60,000 | ||||

| Goodwill | 30,000 | ||||

| Closing Stock | 60,000 | ||||

| Accrued Interest | 600 | ||||

| Advertisement Expenditure | 2,625 | ||||

| Bills Receivable | 2,000 | ||||

| Cash at Bank | 25,000 | ||||

| Cash in Hand | 1,400 | ||||

| Debtors | 45,000 | ||||

| Less: Provision for Bad Debt | 2,250 | ||||

| Less: Provision for Discount | 1,069 | 41,681 | |||

| 2,69,996 | 2,69,996 | ||||

Working Note: –

Calculation of Depreciation

Advertisement

| Depreciation on Plant & Machinery | = | 5 | X | 40,000 |

| 100 | ||||

| = | Rs 2,000 |

| Depreciation on Furniture & Fixtures | = | 5 | X | 1,200 |

| 100 | ||||

| = | Rs 60 |

| Depreciation on Loose Tools | = | 15 | X | 3,000 |

| 100 | ||||

| = | Rs 450 |

Calculation of Outstanding Rent

| Prepaid Insurance | = | 9 | X | 1,200 |

| 12 | ||||

| = | Rs 900 |

Calculation of Outstanding Rent

Rent paid for 3 quarters = 2, 700

| Rent per quarte | = | 2,700 |

| 3 | ||

| = | Rs 900 Outstanding Rent |

Calculation of Provision for Doubtful Debts

Provision for Doubtful Debts = Sundry Debtors −Further Bad Debts × Rate 100

Advertisement

| Provision for Doubtful Debts | = | 5 | X | 45,000 |

| 100 | ||||

| = | Rs 2,250 |

Calculation of Provision for Discount on Debtors

Provision for Discount on Debtors = (Sundry Debtors −Provision for Bad Debts)× Rate 100

| Provision for Doubtful Debts | = | 2.5 | X | (45,000 – 2,000) |

| 100 | ||||

| = | Rs 1,069 |

Also, Check out the solved question of all Chapters: –

D K Goel – New ISC Accountancy -(Class 11 – ICSE)- Solution

- Chapter 1 Evolution of Accounting & Basic Accounting Terms

- Chapter 2 Accounting Equations

- Chapter 3 Meaning and Objectives of Accounting

- Chapter 4 Double Entry System

- Chapter 5 Books of Original Entry – Journal

- Chapter 6 Accounting for Goods and Service Tax (GST) (Coming soon)

- Chapter 7 Books of Original Entry – Cash Book (Coming soon)

- Chapter 8 Books of Original Entry – Special Purpose Subsidiary Books (Coming soon)

- Chapter 9 Ledger (Coming soon)

- Chapter 10 Trial Balance and Errors (Coming soon)

- Chapter 11 Bank Reconciliation Statement (Coming soon)

- Chapter 12 Depreciation (Coming soon)

- Chapter 13 Bills of Exchange (Coming soon)

- Chapter 14 Generally Accepted Accounting Principles(GAAP)

- Chapter 15 Bases of Accounting

- Chapter 16 Accounting Standards and International Financial Reporting Standard(IFRS) (Coming soon)

- Chapter 17 Capital and Revenue

- Chapter 18 Provisions and Reserves

- Chapter 19 Final Accounts (Coming soon)

- Chapter 20 Final Accounts – With Adjustments (Coming soon)

- Chapter 21 Errors and their Rectification (Coming soon)

- Chapter 22 Accounts from Incomplete Records – Single Entry System (Coming soon)

- Chapter 23 Accounts of Not-for-Profit Organisations (Coming soon)

- Chapter 24 Computerised Accounting System (Coming soon)

- Chapter 25 Introduction to Accounting Information System (Coming soon)

Check out the Accountancy Class +1 by D.K. Goal (Arya Publication) from their official Site.